Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 11, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Shorts get a taste for US retailer and restaurant chain Cracker Barrel Old Country Store

- Oil, diamonds and real estate among the most shorted stocks in western Europe

- Post a sell off in equity markets, Japanese firms see short interest rise ahead of earnings

North America

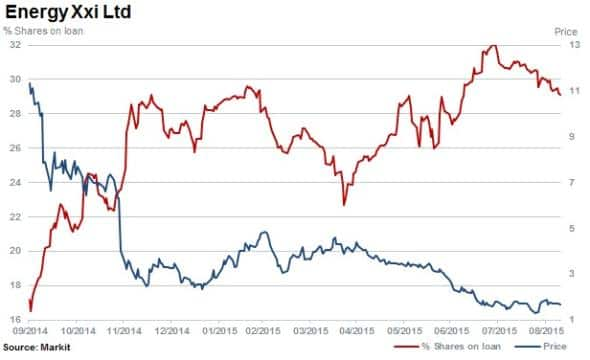

The most shorted company in North America this week is Energy Xxi with 29% of shares outstanding on loan. Short interest remains near a 52 week high for the company which originally listed on the LSE's AIM market in 2005.

Energy Xxi became the largest independent oil producer in the Gulf of Mexico in 2014 after acquiring EPL Oil & Gas for $2.3bn. The oil price rout has seen the company's stock plummet by 86% in the last 12 months.

Restaurant and retailer Cracker Barrel Old Country Store is the second most shorted in North America with 15.1% of shares outstanding on loan. Short sellers have been attracted to the name as the share price has continued to trend higher but has seen some weakness ahead of Q4 earnings. Shares have risen 46% over the last 12 months but have lost momentum year to date, rising only 6.3%.

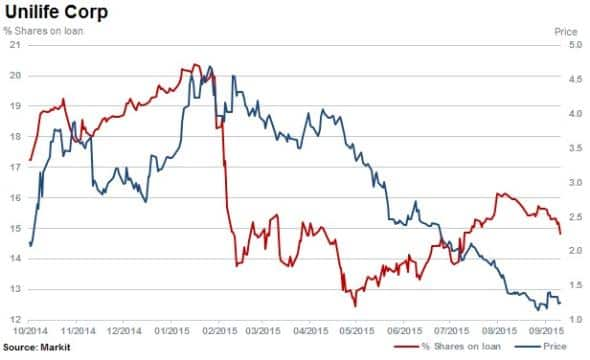

Third most shorted in North America is drug system designer and manufacturer Unilife, with shares outstanding on loan of 14.8%. Shorts have profited since the beginning of July 2015, as the stock has fallen by 40%.

Europe

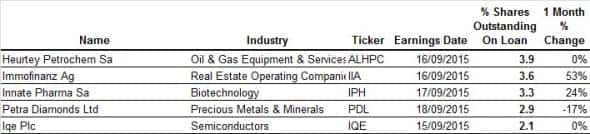

Most shorted ahead of earnings in Europe is French based Huertney Petrochem which has attracted short sellers recently with negligible short interest prior to June 2015. 3.9% of shares are currently outstanding on loan across a concentrated group of short sellers.

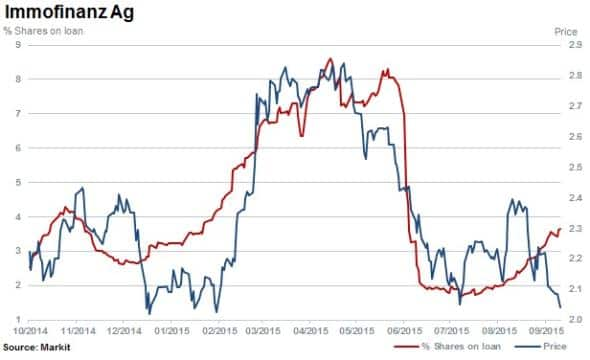

Austrian real estate investment and management services provider, Immofinanz has seen short selling increase in recent weeks with shares outstanding on loan increasing to 3.6%.

The company has a number of convertible bond issuances outstanding which may explain some the short selling behaviour seen in the stock as bond holders hedge their equity exposure of convertible bond options.

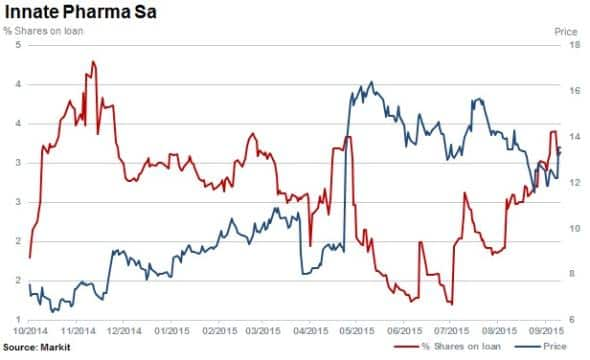

Developing drug treatments for cancer and inflammatory diseases, Innate Pharma has seen short sellers increase positions by 53% in the last three months. Despite the stock falling 8% in the last three months, it has rallied 65% year to date.

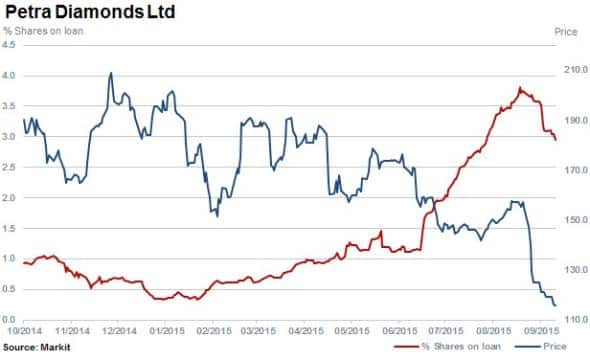

Shares in London listed diamond miner, Petra Diamonds have fallen by a third in the last three months as short sellers increased positions by 155%. The miner reported disappointing results in June after the company struggled to meet revenue targets.

Apac

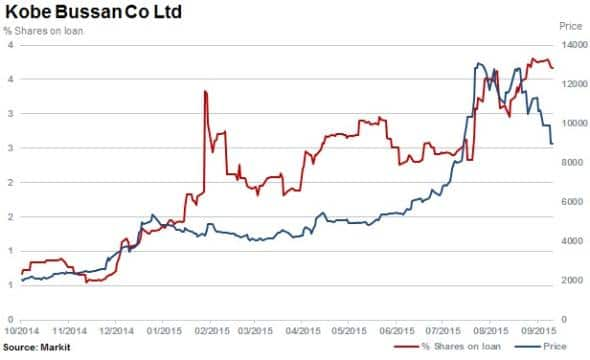

Most short sold in Apac is Japanese supermarket Kobe Bussan with 3.7% of shares outstanding on loan.

Shares in Kobe Bussan did not escape the recent sell off in Japanese equities, falling 31% from July highs. However, the stock is still trading some 350% higher over 12 months.

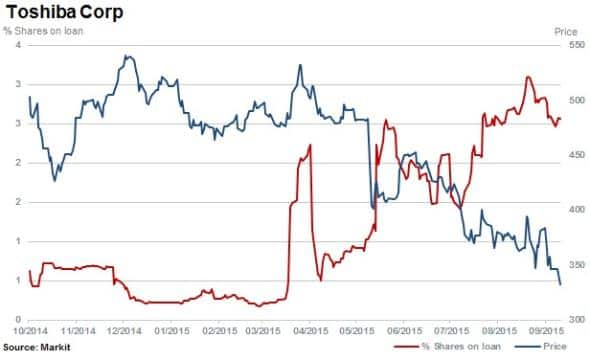

Japanese Electronic product maker, Toshiba is the second most shorted in Apac ahead of earnings with 2.6% of shares outstanding on loan. Toshiba joins other Japanese technology firms facing weaker demand for products in foreign markets.

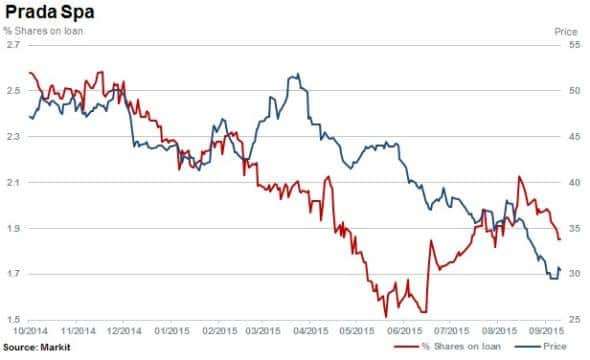

Short sellers have continued to target luxury goods firms exposed to Chinese demand. Hong Kong listed Prada has seen shares outstanding on loan increase to 2.1%, while the company's stock continues to fall, down 41% over the past six months.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}