Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 11, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week and names at risk of a short squeeze.

- Sanderson Farms most shorted in North America and at risk of squeeze ahead of earnings

- Mining downturn puts Joy Global's dividend at risk

- Shorts hold on to Scandinavian Airlines ahead of earnings even as shares take off

North America

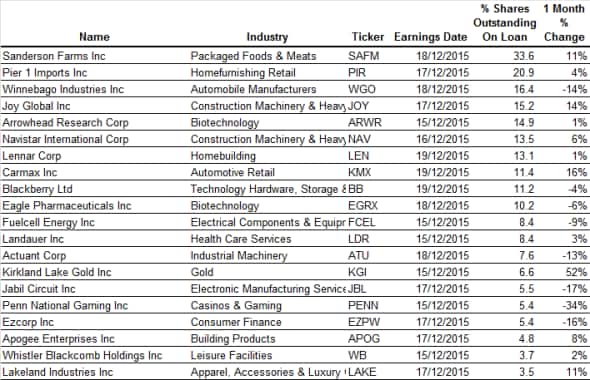

Most shorted ahead of earnings in North America this week is Sanderson Farms with 33% of shares outstanding on loan.

The poultry producer has been targeted by short sellers for over 12 months. The recent rise in share price has seen the stock rank in the top percentage of names at risk of suffering a squeeze by Markit Research Signals' Short Squeeze model.

Second most shorted is Pier 1 Imports with 20.9% of shares outstanding on loan. Short sellers who increased positions in Pier 1 the previous quarter will have been rewarded as the stock has slid some 28% since.

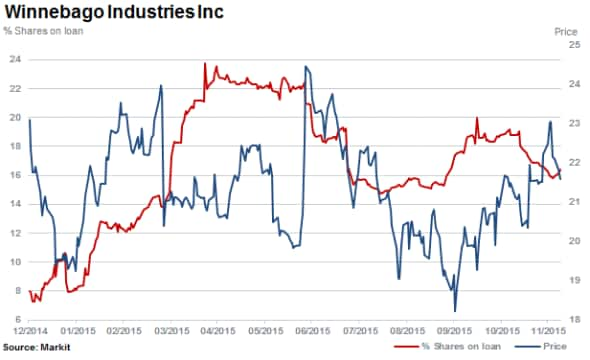

Winnebago Industries with 16.4% of shares outstanding on loan has seen shares rally almost 20% since October 2015 when the firm reported improved full year earnings for its 2015 fiscal year.

Short sellers have however covered positions only marginally by 6% in Winnebago since October 2015.

Joy Global, a manufacturer of heavy machinery used in the mining of commodities is the fourth most shorted stock ahead of earnings in North America with 15.2% of shares outstanding on loan. Shares in the firm have fallen 70% in the last six months alone as basic resources and commodities prices continue to hover at seven year lows.

Markit Dividend Forecastingis expecting Joy to cut its quarterly dividend by 50% to $0.1 per share. Last quarter the company posted a 10% drop in sales and diluted earnings per share fell 35% compared with the same quarter last year. Management has commented that it is likely to consider reducing its dividend rate due to the expected step down in sales and earnings for 2016.

Europe

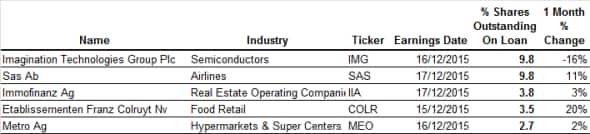

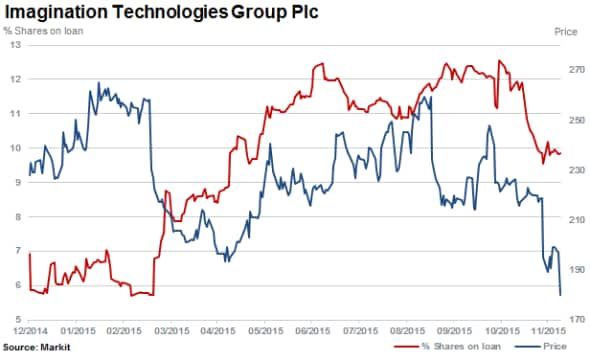

Most shorted in Europe ahead of earnings once again, with 9.8% of shares outstanding on loan is mobile chip maker Imagination Technologies. Short sellers have covered positions by 15% in the last three months during which the stock price has declined 30%.

Scandinavian passenger airline Sas is tied for the top position as most shorted in Europe ahead of earnings with short sellers steadily increasing positions since early 2015 to 9.8% of shares outstanding on loan currently. Shorts have continued to increase positions even while Sas shares have rallied by 32% in the last three months.

Austrian real estate and investment services provider Immofinanz continues to see relatively high levels of short interest at 3.9% of shares outstanding on loan. The firm has a number of convertible bond issuances outstanding which may explain why short interest movements track movements in the share price as bond holders hedge their exposures.

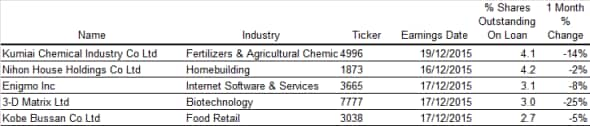

Apac

Most shorted in Apac is Kumiai Chemical Industry with 4.1% of shares outstanding on loan. Short sellers in the Japanese agricultural chemical firm covered almost 20% of positions in November and December as shares have remained buoyant since September, rising some 35%.

Second most shorted ahead of earnings in Apac is Japanese housing and construction firm Nihon House Holdings. Short interest has increased fivefold in the last three months to reach 4.2% of shares outstanding on loan currently.

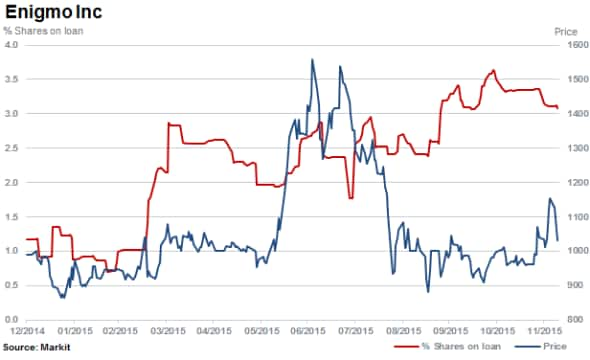

Short sellers have increased stakes in Enigmo whose volatile shares rose and then subsequently fell by a third during the middle of the year. The company operates an online social shopping site "BUYMA" and has seen shares outstanding on loan increase to 3.1%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}