Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 12, 2015

Noble's troubles seep into its bonds

Accusations of accounting irregularities and the continuing global commodities slump has seen the credit markets turn bearish on Singapore-listed commodities trader Noble.

- Noble's CDS spread have more than tripled in the last 12 months to reach 714bps

- Noble's bonds have widened by 200bps across the maturity curve in the last year

- Glencore also caught up in the commodities slump; CDS spread doubles year to date

Singapore-listed commodities trading house Noble is going through a rough patch of late which has sent its shares slide down to seven year lows. Operationally, the commodities slump stemming from weakening Chinese demand and low energy prices has seen analysts trim their profit forecasts for the company's current year by a quarter in the last six months. The company is also facing accusations of accounting irregularities from activist short seller Iceberg Research, which is accusing the firm of manipulating the value of its contractual assets; something which Noble has fervently denied.

These two factors have combined to see the firm lose over 50% of its share price year to date, spurring short selling to a new all-time high.

While most of the recent coverage concerning Noble has been centred on its equities and the increasing short interest, the trading house's credit has also shown signs of severe deterioration in light of the recent situation.

CDS market turns bearish

Noble's CDS spread has tripled in the last 12 months. The latest 5 year CDS spread stands at 714bps, the highest level since 2009.

This jump came in two waves which occurred in March, when Iceberg's allegations first came to light, and July when the commodities slump started in earnest.

Bonds also feel the strain

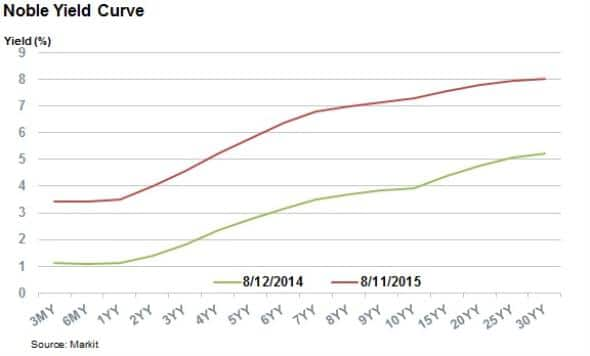

The bearish sentiment seen by Noble's CDS spread has also been felt by Noble's bonds, which have seen their yields shoot up in recent weeks. The entirety of the firm's yield curve has widened in the last 12 months, according to Markit's evaluated bond service.

This widening has been most extreme at the long end, where the 30 year yield recently jumped above the 8% mark for the first time ever in the closing week of July. This means that Noble's longest dated bond, the 6.95% 2045 issue, is now yielding 8.3% after having seen its price fall to 85 cents on the dollar since listing in March.

This increased bearish sentiment towards Noble's bonds could limit the firm's strategic options going forward as both the equity and debt portion of its balance sheet have come under pressure.

Glencore also targeted

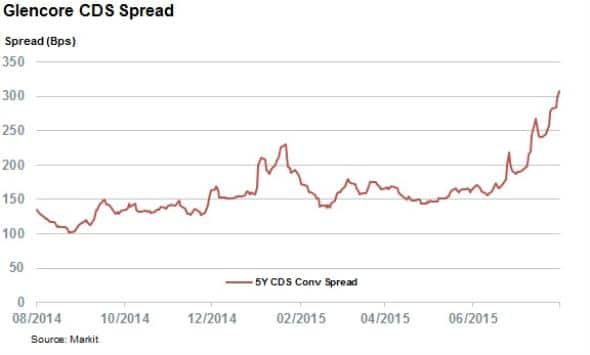

The credit market has also turned bearish towards fellow commodities trading house Glencore over the last few weeks. Glencore's 5 year CDS spreads now stand at 283bps; the widest in two and a half years.

Unlike Noble, the entirety of the recent widening was linked to the commodities slump in the last few weeks, which saw Glencore's CDS spread double in from its April level.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-credit-noble-s-troubles-seep-into-its-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-credit-noble-s-troubles-seep-into-its-bonds.html&text=Noble%27s+troubles+seep+into+its+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-credit-noble-s-troubles-seep-into-its-bonds.html","enabled":true},{"name":"email","url":"?subject=Noble's troubles seep into its bonds&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-credit-noble-s-troubles-seep-into-its-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Noble%27s+troubles+seep+into+its+bonds http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082015-credit-noble-s-troubles-seep-into-its-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}