Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 12, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the week to come.

- Factset is the most shorted North American company reporting results next week

- UK tech companies account for three of the most shorted European companies

- Mining firms make up three of the five most shorted companies in Asia

North America

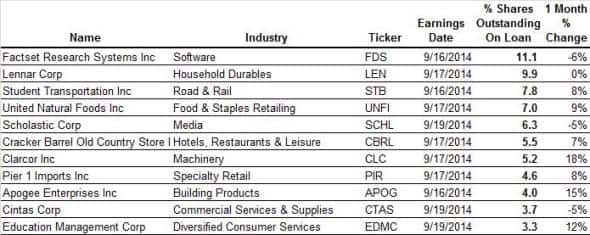

The second quarter earnings has passed its peak, with only 152 companies announcing results across North America. Of these, there are 11 companies announcing earnings with more than 3% of their shares out on loan.

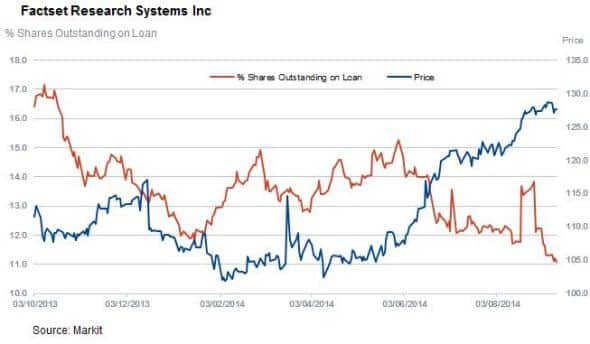

Financial information company Factset Research is the most shorted company with 11% of its shares out on loan. The company has seen heavy short interest over the last couple of years, though shorts have covered of late as the firm posted a streak of better than expected quarterly results. In fact, the proportion of Factset shares out on loan has fallen to its lowest level in over 18 months ahead of this results announcement.

Another firm seeing short covering in the run-up to results is homebuilder Lennar Corp, which has seen short interest dip to 10% of shares outstanding from 12% at the start of the year. This follows another strong run of better than expected results.

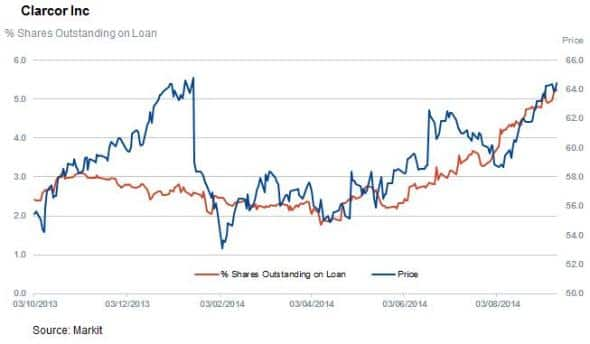

While the two most shorted companies have seen shorts cover in the run-up to results announcements, the same can't be said for air filtration firm Clarcor which has seen shorts increase positions by 18% in the month leading up to earnings. This demand to borrow the stock could be tied to heavy short interest in industrial machinery firms Caterpillar and Deere, which have both seen stock on loan surge after forecasting weaker than expected guidance.

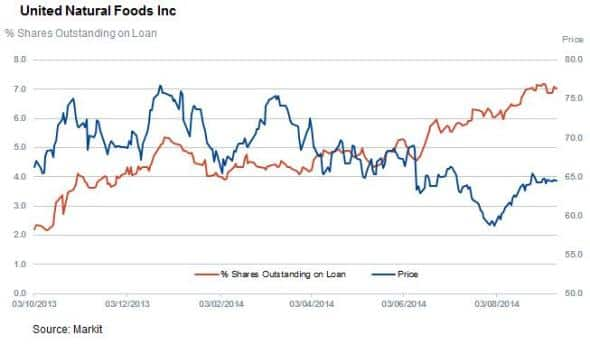

Another sector seeing surging demand to borrow is the health food sector with industry leader Whole Foods seeing shorts circle in the face of competitive headwinds. On this theme, short sellers have targeted United Natural Foods which sees 7% of its shares out on loan - the highest level in over three years.

Europe

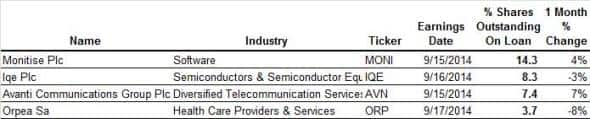

Europe sees light earnings activity with only four firms seeing 3% or more of their shares out on loan ahead of results.

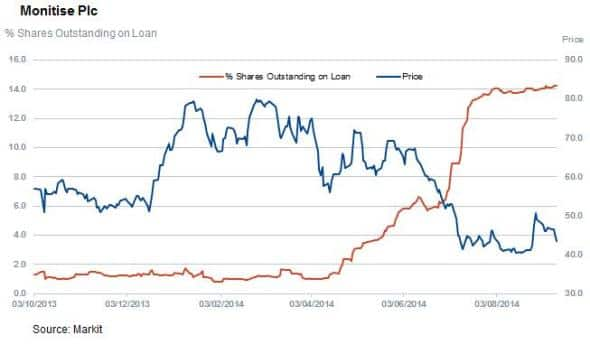

UK technology firms make up the three most shorted companies in the region led by mobile banking firm Monitise which has 14.3% of its shares out on loan.

The company, which is yet to turn an operating profit in over six years, has seen short interest surge in the wake of its last earnings announcement when it cut full year revenue forecasts. With the shares tumbling by 30% in the last three months, short interest in the company has risen to an all-time high.

The other two firms seeing heavy demand to borrow are Iqe and Avanti Communications which have 8.3% and 7.4% of their shares out on loan respectively.

The only non UK firm making this week's heavily shorted list is French care home company Orpea which has 3.7% of its shares out on loan. This could be driven by the fact that it has three convertible bond issues outstanding and borrowing demand may not be driven by directional short selling.

Asia

Asia also sees relatively low earnings activity with five firms seeing more than 3% of shares out on loan ahead of earnings.

Mining firms make up three of the most shorted companies announcing results in the region next week.

Lynas is the most shorted with the rare earth mining firm seeing 8% of its shares out on loan. The continuing headwinds have seen Lynas shares tumble by over 90% from their highs in 2011 as fears about China's dominance in the rare earth's space tumbled.

The other two firms seeing heavy demand to borrow in the mining space are gold miners Regis and Liongold, both of whom have seen their shares tumble in the wake of the rout in gold prices last year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092014-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}