Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 12, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Organic firms Hain Celestial and United Natural Food key short targets announcing earnings

- WM Morrison has 19% of shares shorted most of any company announcing earnings this week

- Japanese real estate developer Ardepro has seen short interest surge to a new alltime high

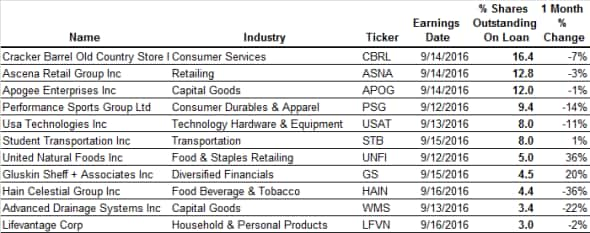

North America

The highest conviction North American short, announcing earnings this week, is casual dining operator Cracker Barrel which has 16.4% of its shares shorted. Cracker Barrel is no stranger to short sellers as it has seen more than 15% of its shares shorted for over a year. Short sellers have also shown tenacity in hanging on to their positions in recent months as the firm's shares jumped by over 20% from their lows.

Analysts are forecasting Cracker Barrel to post a 5% increase in revenue in its upcoming fourth quarter results which is in the lower bound of the company's guidance, but the elevated level of short interest indicates that there is plenty of scepticism around the company's ability to continue to grow revenues in a tough environment for casual dining.

Food is a key theme on this week's relatively small crop of firms seeing heavy short interest leading up to earnings as organic grocer United Natural Foods has seen its short interest jump by 36% in the month leading up to earnings to 5% of shares outstanding. Recent bear raids in United Natural have proved relatively successful as the alltime high short interest in July of last year preceded a 25% slide in its share price as investors soured on organic retail.

Hain Celestial is another organic short target of this week's crop of heavily shorted firms announcing earnings. Hain's shares have slumped by more than a quarter in recent weeks as the firms announced that it was undertaking an independent review of its financials which is threatening to see it delisted from the NASDAQ stock exchange. Short sellers aren't sticking around to see the results of this review as they have closed more than a third of their positions in the last month.

The other firm experiencing heavy covering in the leadup to earnings is Advanced Drainage Systems whose short interest has fallen by over a fifth in the last month to 3.4% of shares outstanding.

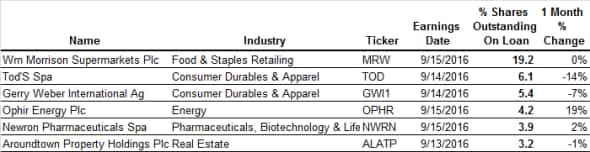

Europe

Retail also features prominently among the high conviction European short targets as the UK grocer has over 19% of its shares shorted. Morrison's shares have rebounded strongly in recent months, but short sellers are staying the course given as the firm's entire revenue stream comes from within the UK making it heavily exposed to the post Brexit uncertainty.

Fashion retailers Gerry Weber and Tod's round out the top three short targets for the coming week. Short sellers have borrowed more than 5% of both firm's shares on the eve of their earnings announcements but their resolve seems to be softening in recent weeks as both shares have seen covering in the month leading up to earnings.

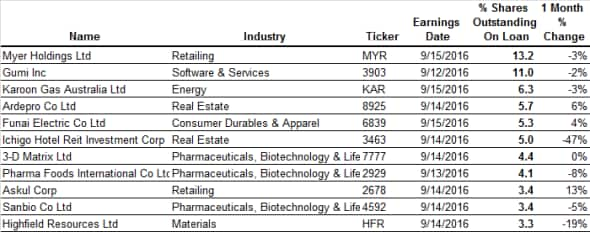

Apac

Myer Holdings and Askul round out the global retail short targets for this week with 13.2% and 3.4% of their shares out on loan respectively.

Myer is by far the most significant position as the value of its current short interest is twice that of its Japanese peer. Myer reported an improvement in sales in its May earnings update which saw short sellers halve their positions from the highs set in the middle of last year but short interest has since crept up to the current 13.2% of shares outstanding.

Askul has seen a much more severe rise in shorting activity leading up to earnings as its short interest has gone up six fold in the last three months.

Japanese real estate developer Ardepro is another firm seeing a large jump in short interest leading up to earnings. The 5.7% of Ardepro shares that are now out on loan, an all-time high for the firm are over twice the levels seen back in May.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}