Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 12, 2017

S&P shorting activity surges to pre-election level

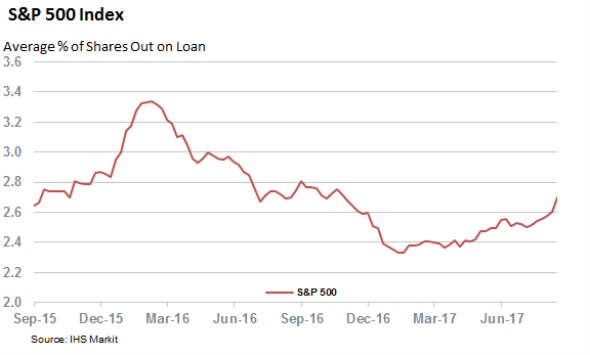

Short sellers are back in force in US large caps as demand to borrow shares of the constituents of the S&P 500 index is now back to levels last seen prior to the election last November

- Average shorting across S&P 500 constituents now at 2.7% of shares

- As Amazon makes waves, retail takes top billing as the most shorted sector

- Energy stocks also driving shorting activity higher

While the market was taking a deeper than usual summer slumber, short sellers added to their positions in US blue chip stocks. This steady buildup of short positions over the last few months means that the average borrow activity across S&P 500 constituents now stands at 2.7% of shares outstanding – a level not seen since last November’s presidential election.

Market commentators have been busy pointing fingers for the cause of this summer’s record breaking lack of volatility, but the recent surge in shorting activity over the last few weeks hints of a “lull before the storm”. The average short interest across the index is now 15% higher than the levels seen during recent lows in the closing days of January.

Time will tell whether or not this anticipated storm materializes, but short sellers are still not fully committing to the trade. Average short interest across the S&P is still way off the highs registered in the opening months of last year.

As is the norm with shorting activity, not every stock is equally targeted. In fact, more than half of the current S&P constituents now have a lower demand to borrow their shares than at the start of the year. Much of this shifting activity is directly attributable to sector rotations.

Amazon making waves

Retailers are at the forefront of shorting activity – the sector had a massive 40% increase in average short interest since the start of the year. On average, the sector is now more than twice as shorted than the rest of the S&P 500; short sellers are betting that the relentless rise of online retail will continue to negatively impact brick and mortar stores for the foreseeable future.

High conviction plays in the retail sector include Signet Jewelers, Autonation and Kohls, which all have at least 18% of their shares shorted.

Short sellers have also been busy taking bets on Amazon’s recent forays in industrial distribution. W.W. Grainger – which attributed its recent margin erosion to Amazon’s increasing momentum in its sector – is the hot short in the sector, and now has more than 14% of its shares out on loan.

Grainger peer Fastenal has also seen a significant amount of bearish sentiment in the last few months. The demand to borrow its shares doubled to 9%, the most in more than 12 months.

Telecommunication firms are slightly ahead of retailers in terms of the average demand to borrow shares, but this is mostly attributable to Centurylink. The company has seen shorts more than double their positions since January. The 21% of Centurylink shares which are out on loan place the firm in the sixth most-shorted spot on the S&P.

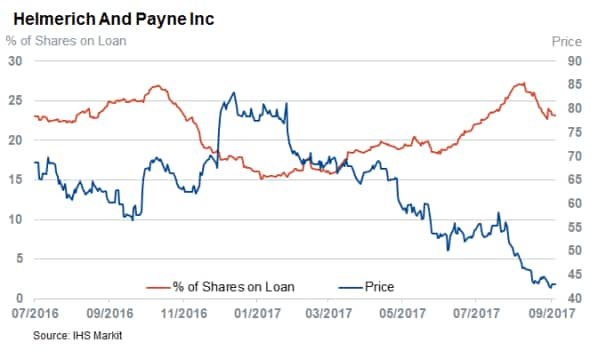

Energy also in focus

Energy shorts are also climbing back on short seller’s agenda over the last few months.

The two main focus manes are Helmerich & Payne and Transocean, which have 23 and 21% of their shares out on loan respectively.

Simon Colvin, Rsearch Analyst at IHS Markit

Posted 12 September 2017

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-equities-s-p-shorting-activity-surges-to-pre-election-level.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-equities-s-p-shorting-activity-surges-to-pre-election-level.html&text=S%26P+shorting+activity+surges+to+pre-election+level","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-equities-s-p-shorting-activity-surges-to-pre-election-level.html","enabled":true},{"name":"email","url":"?subject=S&P shorting activity surges to pre-election level&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-equities-s-p-shorting-activity-surges-to-pre-election-level.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+shorting+activity+surges+to+pre-election+level http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-equities-s-p-shorting-activity-surges-to-pre-election-level.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}