Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 13, 2015

Investors add UK retailers to shopping bags

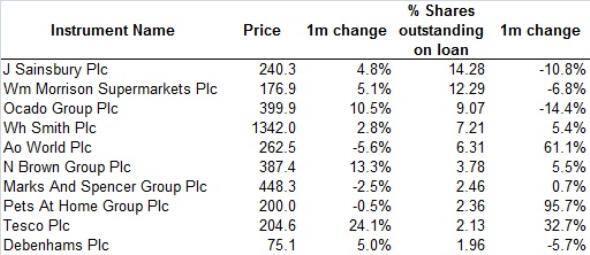

Weak price inflation, a hyper competitive atmosphere and price conscious customers have plagued retailers in the UK, particularly the supermarket chains which saw a tough trading market in 2014. But recent willingness to face these demons has seen the sector rebound in early 2015.

- Big three retail stocks down 33% over 2014, but bounced 11% in the last month

- Tesco's shares jump 24% as new ceo drives strategy

- Sainsbury sees highest short interest, but has seen short sellers cover by 10.8%

Tough times for retailers ahead

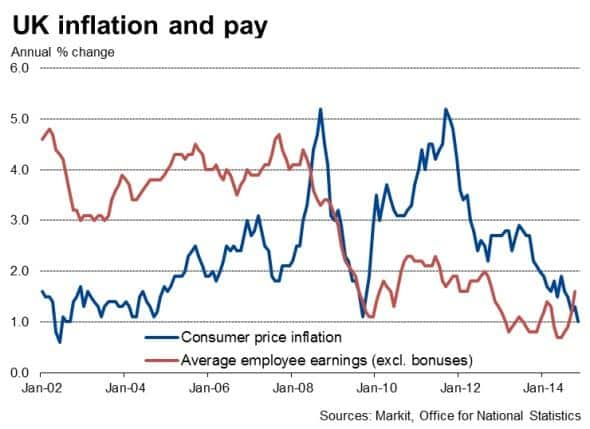

UK inflation has fallen to its lowest level in almost 15 years as consumer price growth weakened to 0.5% in November, below analyst expectations of 0.7%. The 1.9% decline in December food prices year on year means that retailers are already on the back foot and in for another difficult year as they attempt to grow sales volumes.

Perhaps most worrying for supermarkets is the suggestion that some of these struggles might be self-inflicted, as exemplified by the major players spending much of last year trying to aggressively grab market share in a falling market.

Fresh ceos and refined strategies

The share prices of the three largest listed "pure play" UK retailers; Sainsbury's, Tesco and Morrisons bore the brunt of the retail headwinds over the last year, falling by a third, but the firms have shown recent willingness to face some of their competitive demons. Store closures and restructuring are already underway at Morrisons and Tesco as retailers slim down and refine strategies in order to stay competitive in light of recent changes.

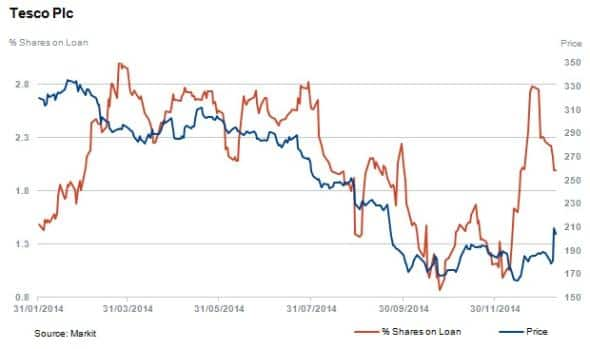

Top three send short sellers packing

Investors have responded well to recent changes being made. This has seen shares in the big three retailers trade 11% higher over the last month, with the most aggressive swing seen by embattled Tesco. The firm had a tumultuous 2014, which saw its shares fall by 43%, but the market has reacted positively to Dave Lewis's recent announcement to close historic Cheshunt headquarters, dramatically reduce capital expenditure, carry out store closures and focus on Tesco's core grocery business - all while reducing overheads by 30%. Tesco's share price is up by 24% over the last month.

Short sellers have reacted to the recent bullish mood, with shares outstanding on loan decreasing by 14% in light of the recent restructuring.

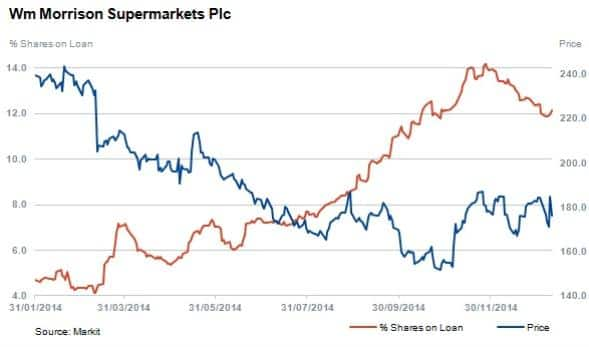

Morrisons, the second most shorted retailer in the UK has proven less fertile for short sellers since they doubled their positions in June of last year to a high of 14.2% of shares outstanding in November. The recent price rebound (5% in the last month) has continued to see short sellers close out their positions which now stand at 12.1% of shares outstanding on loan.

The market reacted positively to news on the 13th January 2014 that Morrisons ceo Dalton Philips is to step down in March after the company released disappointing sales figures for the festive period which fell 3.1%.

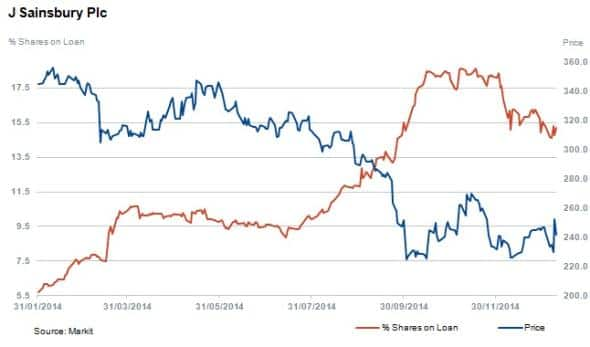

Sainsbury's share price increased 4.8%, and shares outstanding on loan simultaneously decreased by 10.8% in the last month to 14.3% of shares outstanding on loan.

Other notable retailer's movements

The Ocado Group felt the 2015 retail lift as shares rose 10.5% during the month. Short sellers covered positions by 14%. The company is currently the third most shorted in retail with 9% of shares outstanding on loan. Posting a 15% increase in quarterly sales this December despite the recent price wars, Ocado benefited from online adoption and Morrisons partnership.

WHSmith's shares marginally rose by 2.8% but contrasting to others, the share price is up 31% this past year. A previous favourite among short sellers, the stock currently has 7.2% of shares outstanding on loan. The UK's largest card retailer is facing competition from discounters and recently listed Card Factory.

Newly listed Pets At Home, the UK's dominant pet care retailer, has seen its share price decrease 18% since listing and has attracted increasing levels of short interest recently, up 96% to hit 2.4% of shares outstanding on loan. This came as positive results fell short of analyst expectations.

Newly listed AO World, an online retailer of white goods, reported a surge in Black Friday sales this week. The company's stock is down 28% since listing and there has been significant growth in short interest with shares outstanding on loan increasing by 61% to 6.3% over the last month.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012015-equities-investors-add-uk-retailers-to-shopping-bags.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012015-equities-investors-add-uk-retailers-to-shopping-bags.html&text=Investors+add+UK+retailers+to+shopping+bags","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012015-equities-investors-add-uk-retailers-to-shopping-bags.html","enabled":true},{"name":"email","url":"?subject=Investors add UK retailers to shopping bags&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012015-equities-investors-add-uk-retailers-to-shopping-bags.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+add+UK+retailers+to+shopping+bags http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012015-equities-investors-add-uk-retailers-to-shopping-bags.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}