Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 13, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- Tiffany short sellers cover after the firm strikes deal with activist investor

- Aryzta sees a large jump in short interest leading up to earnings

- South Korean travel firms targeted as tensions with China escalate

North America

Canadian media conglomerate Quebecor sees the greatest demand to borrow its shares among North American firms announcing earnings this week as there are now just under 23% of Quebecor shares on loan. While high, Quebecor's short interest has remained relatively flat over much of the last couple of years.

This contrasts with the large increase in demand to borrow Neophotonics shares over the last few weeks. The company has seen the proportion of its shares out on loan surge by a fifth in the last month to take the overall demand to borrow to an all-time high of just shy of 15% of all issued shares. Neophotonic's bear raid was initially triggered by issues with its Asian distribution network which caused the firm to miss its last earnings target. Short sellers were further emboldened in the closing days of last year when the firm announced that it would lower its guidance, citing oversupply in some of its key end markets.

On the opposite side of the sentiment scale, we've seen Tiffany sceptics trim their bets heading into earnings as the demand to borrow its shares has fallen by nearly a fifth in the last month. The recent improvement in investor sentiment came after the firm caved in to demands from activist investor JANA partners which was demanding board representation after acquiring a 5% stake in the jeweler. Tiffany's current short interest stands at a the lowest level in over six months and indicates that a growing number of investors are starting to get behind the firm's rally which has seen Tiffany shares surge by over 50% from the lows registered last June.

Short sellers continue to be heavily active in the healthcare/biotech sector this earnings season and this week is no exception as seven of the sectors' firms make the list of firms seeing heavy short interest in the run-up to earnings. The high conviction short in the sector this week is Inovio Pharmaceutical which has over 14% of its shares out on loan.

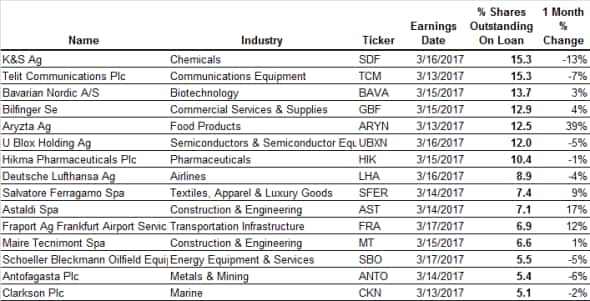

Europe

German chemical firm and perennial short K&S once again finds itself at the top of the list of heavily shorted shares announcing earnings as it has over 15% of its shares out on loan. K&S short sellers have targeted the firm owing to the vagrancies of the potash market, which represents half of K&S's revenues. The current year long slump in the commodity's price is showing no signs of easing which has ensured that K&S, as well as its peers in the potash market; continue to see high short interest.

Swiss listed baker Aryzta has registered the largest surge in shorting activity in the last few weeks as short sellers have increased their borrow in the firm by 40% in the last month to take the borrow to 12.5% the company's shares outstanding. This most recent spike comes in the wake of a turbulent couple of months for the struggling baker which saw it issue another profits warning as well as experience the departure of several key executives. Some investors have raised questions as to whether the firm will be able to continue on its current path without raising additional capital and the increase in short interest could indicate that investors are starting to take this possibility seriously.

Asia

Australian firms Myer Holdings and Syrah Resources are the two most heavily shorted Asian firms announcing earnings this week as they have 14% and 13% of their shares out on loan respectively.

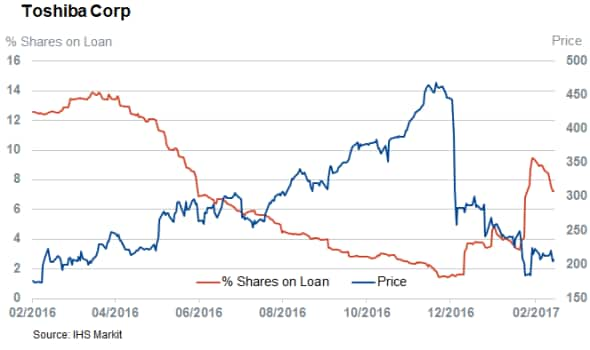

Japanese industrial conglomerate Toshiba is by far the largest short play in terms of capital required to borrow the current 7.3% of Toshiba shares which are currently out on loan. The demand to borrow Toshiba shares has jumped significantly in the last few weeks as the firm revealed troubles in its recently acquired Westinghouse division which could potentially wipe out the firm's equity value according to some estimates.

Another key themes expressed by short sellers over the last few weeks has been the growing tension between China and South Korea regarding the basing of a US missile defence shield in the country. China has been looking to prevent this happening as it threats that the US could use the system's radar capabilities to monitor Chinese airspace which lies beyond North Korea. Chinese tourists, which make up the bulk of overseas visitors the South Korean, have been used to exert leverage on the country to reverse its decision which has in turn hit Korean hotel and tourism related stocks. Short sellers have been keen to take advantage of the headwinds faced by these firms as Hanatour and Paradise Co both make the list of firms seeing high short interest in the lead-up to earnings.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}