Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 13, 2017

The Future of Loan Settlement

Predicting the future of loan settlement is like predicting the future of interest rates: challenging at best, and quite possibly highly risky. However, over the course of a 10-year career channeling the thousands of customers, colleagues, partners and industry leaders, like the LSTA, whose collective voices scream for improvement, we can create a road map, at the very least. We can start with a discussion about performance to establish a benchmark. After that, we can look into the future and determine what we need to do to get there.

Performance

Any conversation about settlement must start with performance, and no performance measure is more important than "T+", or the number of business days between the trade date and the settlement date. This metric is typically measured in two ways: as a median or as a mean (Fig. 1).

Each metric has its uses, and when combined, they help us to assess the status of settlement liquidity in the industry. However, even these measures, as they are aggregated today, have their challenges. When considering the future of settlement, we not only need to address the technological and operational aspects, but also our own established understanding of performance, including our historical biases.

There are two key challenges that are critical barriers in the path to transparency and progress. The first is a flaw in the very measure of T+, given the inconsistencies in delayed compensation rules. The second is the seemingly unfair way in which we have measured settlement success historically. Only the first is covered at a high level here.

Secondary Trades Are Not all the Same

Generally, there is no argument around how T+ is calculated. However, there is plenty of discussion related to delayed comp, which can have a notable impact on settlement performance. The discussion is typically specific to one of the four distinct categories of trades, including primary, secondary par, secondary distressed, and when-issued/early-day, on which delayed comp rules can affect performance.

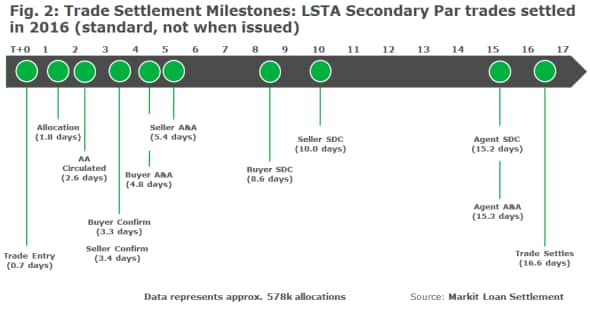

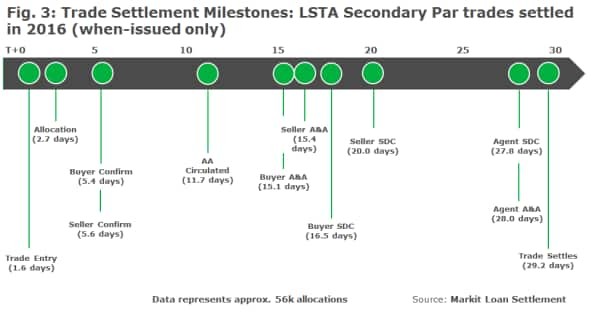

Few would argue that these trades are, in fact, different and warrant slightly different measures for delayed comp-at least for now. The problem arises most acutely with when-issued trades as they are grouped with secondary par trades, because…well…they are secondary par trades. However, they are held to a different standard when it comes to delayed comp given their dependence on upstream primary trades. This difference is the result of a need for an additional buffer given that primary trades settle unpredictably and, of course, do not currently accrue delayed comp. So, standard secondary par trades are held to a T+7 standard, and when-issued trades are held to a funding date +14 standard. Given that many firms plan for settlement based on delayed comp operational milestones, this makes them a bit incompatible when measuring T+ (Figs. 2 and 3).

How can we solve this incompatibility? We either measure when-issued trades separately, or we harmonize the rules so that they both utilize a 7-day offset. Either approach will ensure consistency, transparency, and simplicity going forward.

Are We too Hard on Ourselves?

Much is written about the standard acceptable seven-day settlement period for syndicated loan trades is notably greater than the three-day standard for equities and bonds. We all recognize the need to reduce the seven-day target, and many predict it will happen sooner rather than later, but in the meantime, we may need to re-examine the way in which we determine success.

When an equity trade settles, and does so by the prescribed goal of T+3, it does not matter if it did so at T+0, T+1, T+2, or T+3. It simply settled on time. That is the sole measure of success. We do not usually speak in these terms for loans. Instead, we always measure performance holistically, across all days, regardless of the fact that the first seven days in a trade's lifecycle are within that acceptable period, and they are not the same as those that come after.

For example, if a trade were to settle at T+10, our first instinct, and that of onlookers outside our market, is to say, "Wow, it took 10 days to settle that trade. That's a lot!" However, what if instead you were to read that it settled three days late? Does that feel different? The improvement required is three days in order to enter into the acceptable window of T+7. So what is the message? Until the day when market guidance is something other than T+7, T+7 is success. It is no different than T+3 on an equity trade. When we look at loan market performance, perhaps we could start thinking and communicating in terms that are specific to its successes and the improvement required for our failures to become successes. How many days to we need to improve to get our trades into the success category?

The market is hopeful that in the near future we will have simplified our delayed comp rules, created better transparency and consistency for when-issued trades, and begun to speak about our market performance in a different way. Now what's going to change...?

The Future

Let's take what we know today and see if we can make some educated predictions in three key areas.

For years, many have advocated consolidating or centralizing systems, reporting, operational teams, processes, and more. In the last two years, however, many have advocated for a model that is more distributed in nature, an idea led by the emerging distributed ledger technology (DLT) space, more commonly referred to as blockchain. Which model is going to win? Both. Some things will suit one and some will suit the other.

Connectivity will consolidate, but data will become distributed. Systems provisioned to operations personnel will become consolidated, but the inputs and outputs of their work will be more distributed. This is one of a few areas where I see DLT playing a notable role. Information will move faster than ever, translating into the automation of tasks or, at the very least, the faster turnaround of tasks.

Operational teams that are already distributed regionally will no longer be restricted functionally. Instead, they will be empowered to perform all tasks within the trade lifecycle. Some firms have already gone this way and, except for smaller players, most will adopt this model. Regional handoffs will become smarter and there will no longer be a need for specific individuals to own a trade or specific task from start to finish.

What Happened to Travel Agencies?

Remember travel agencies? With the democratizing effect of the internet, travel companies heavily consolidated, and most travel is now booked by individuals who have direct access to airline and hotel reservation systems. What's the parallel here?

If we've learned anything from the 2016 delayed comp changes, it is that the market has spent years working to make it easier for trade counterparties to book and collaborate to settle trades. This is one reason the changes seem like a non-event. However, the same effort has not been made historically to help agents execute their role in the settlement story. This is evident in the significant time, approximately 5 days, attributed to the tail-end of a trade when it is believed to be in the agent's hands.

So what's going to change? Just like travel agencies, there will be consolidation, not of the banks themselves, but of the agency function. Cost pressures have led many institutions to consider outsourcing at one point or another. This pressure will continue and ultimately the function will likely be handled by a small group of firms-a few large banks, service providers, and those industrious banks willing to expand their business lines. This will give lenders fewer touch points and make integration easier given the reduced number of connections in the market.

That being said, this whole challenge could be addressed by a system that could automate agent checks and reduce agent settlement to a few exceptions. If only that system existed…

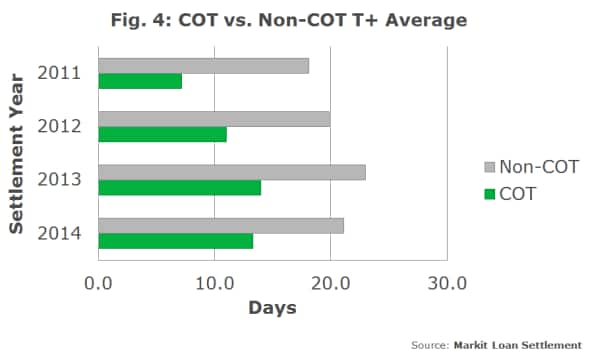

Cash Moves Everything Around Me

The delayed comp changes implemented in 2016 were all about cash, whether it's the need to satisfy redemptions or capital costs. In 2011, DTCC, partnering with Markit, led the initiative to develop cash on transfer (COT), a delivery versus payment-like solution, to ensure that the transfer of payment was linked to the execution of the transfer agreement. In fact, T+ times for COT trades were better than their non-COT counterparts (Fig. 4).

Fig. 4 is not exactly a smoking gun, given the sample size and the fact that it is possible that firms managed those trades more closely. Unfortunately, while the spirit of the idea was right, the timing and implementation were flawed. Some core institutions had not yet bought into the idea and had not prioritized the project. Additionally, market participants had to manage their trades in one place and their cash in another. It was not a strategically sound model.

This effort will undoubtedly come back soon as it is more relevant than ever. Loans will have a reimagining of COT and will potentially reevaluate its position on cash more broadly. The new version will be multi-currency, will be natively tied to trades, and will automate the remaining portion of the delayed comp rules that, currently, can take place only offline.

How Do We Get There?

If history has taught us anything in this market, it is that firms don't generally volunteer to make radical changes. Eventually, some force pushes, and the market reacts. As we saw with the 2016 delayed comp rule changes, a group of institutions within the LSTA wanted change and made it happen. Were there indirect pressures coming from other areas? Sure. But that doesn't take anything away from the firms who pushed for change.

If we are going to realize a future that is radically different from the present, we will need some force to propel us into new territory. Whether that force comes from within the market or not is yet to be seen. However, there is no question about whether it will come. It will. Let's lead the way on our own terms.

This article originally appeared in the LSTA 2017 Loan Market Chronicle.

John Olesky, Managing Director, Loan Settlement

Tel: +1 917 441 6420

john.olesky@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-In-My-Opinion-The-Future-of-Loan-Settlement.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-In-My-Opinion-The-Future-of-Loan-Settlement.html&text=The+Future+of+Loan+Settlement","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-In-My-Opinion-The-Future-of-Loan-Settlement.html","enabled":true},{"name":"email","url":"?subject=The Future of Loan Settlement&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-In-My-Opinion-The-Future-of-Loan-Settlement.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Future+of+Loan+Settlement http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13032017-In-My-Opinion-The-Future-of-Loan-Settlement.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}