Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 13, 2016

United States Steel municipal bonds regain lost luster

US Steel's municipal bonds have been resurgent as the company's credit spread has returned from the brink.

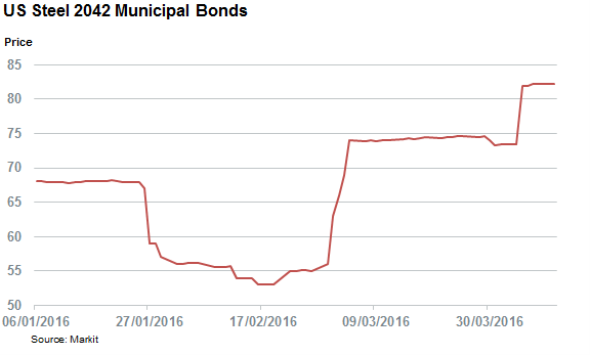

- US Steel 2042 muni listings have seen their price jump by 55% to 82 cents on the dollar

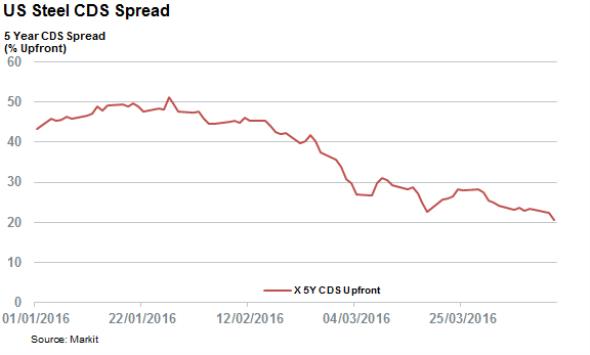

- US Steel's CDS spread has more than halved from January highs but still very high

- US Steel's municipal bond yields remain much lower than its long dated conventional bonds

The collapse in steel price threatened to hit the municipal bond market as some bonds issued by US Steel saw their price dip below 55 cents on the dollar in February but the recent rebound in commodities has lifted these bonds to new annual highs according to Markit's municipal bond pricing service.

These rather niche issuances, which are issued on behalf of corporates are on the riskier end of the municipal bond spectrum owing to the fact that the corporate borrower is responsible for payments with no recourse to the public issuing entity though they carry the tax exempt status of conventional municipal bonds.

The risk carried by these bonds were evidenced earlier in the year when $94m of US steel's corporate municipal bonds due in 2042 saw their price slump to a low of 53 cents on the dollar in February as steel prices hit their nadir. However, the last six weeks have seen steel rebound following steps taken by US legislators to address cheap Chinese competition, while an overall stabilisation in the global economy brightened the commodity's prospects.

Not surprisingly, the rebound was reflected in the market risk perception of US Steel's debt as seen by the fact that its CDS spread has more than halved in the six weeks since its year to date highs.

While US Steel is still not out of the woods, as shown by the fact that its conventional CDS spread is still over ten times that of the Markit CDX NA HY index, the fall in CDS spreads highlights that the recent actions taken by legislators have been well received by credit traders.

US Steel's municipal bonds have experienced a similar rebound as their value has surged by more than 50% from lows to 82 cents on the dollar. This rebound has taken these bond yields from a high 11.4% to 7.3% as of latest count.

While very high for municipal bonds, the current yield is much less than US Steel's long dated conventional bonds as the firm's 6.65% bond due 2037 is currently yielding 11.6%. The yield difference can be explained by the fact that holders of US Steel's municipal bonds are exempt from income tax something which has still proved popular with investors even in times of distress.

For more information regarding Markit's municipal pricing service please contact: NY-MunicipalPricingAnalystTeam@markit.com

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-credit-united-states-steel-municipal-bonds-regain-lost-luster.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-credit-united-states-steel-municipal-bonds-regain-lost-luster.html&text=United+States+Steel+municipal+bonds+regain+lost+luster","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-credit-united-states-steel-municipal-bonds-regain-lost-luster.html","enabled":true},{"name":"email","url":"?subject=United States Steel municipal bonds regain lost luster&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-credit-united-states-steel-municipal-bonds-regain-lost-luster.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=United+States+Steel+municipal+bonds+regain+lost+luster http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-credit-united-states-steel-municipal-bonds-regain-lost-luster.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}