Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 13, 2016

US investors u-turn on currency hedges

Once lured by currency hedged exposure to foreign equity markets, US ETF investors are withdrawing funds as the recovery in equities loses steam and dollar weakness erodes hedging incentives.

- ETF investors withdraw $6.5bn from currency hedged ETFs

- Biggest hedged outflows emanating from Japanese and European ETFs

- Largest inflows going into bonds, gold, and UK funds hedged against Sterling movements

US investors exposed to equities in Japan and Europe have withdrawn over $6bn from currency hedged ETFs thus far this year.

In 2015 currency hedged ETFs recorded significant fund inflows totalling almost $60bn as investors made use of hedging features designed to mitigate currency risk, while maintaining exposure to foreign equity markets.

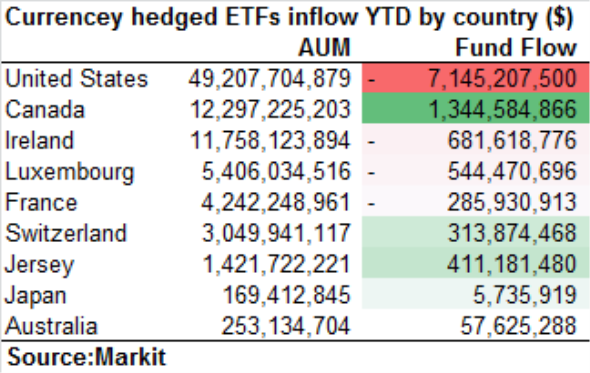

However, this trend seems to be unwinding fast and reveals investors efficient use of ETFs when faced with trend reversals. Strong outflows have occurred from US domiciled funds specifically, which have seen $7.1bn of outflows thus far this year.

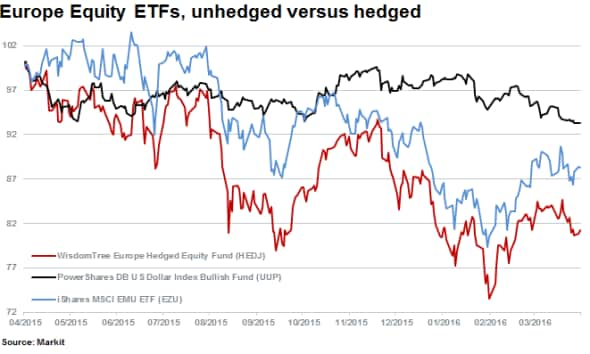

Analysing return differentials of hedged versus unhedged ETFs, investors can be forgiven for not staying the course. On a total return basis, the weaker relative underperformance of the Wisdom Tree Europe Hedged Fund (HEDJ) compared to the unhedged iShares MSCI EMU ETF (EZU) over the past 12 months is 7%. The underperformance is almost perfectly explained by the total returns of the Powershares USD index bullish fund (UUP) which shows a decline of 6.9% over the same time period.

Although hedged products have served their mandate well they do attract higher management fees. A recent stint of dollar weakness has meant investors in hedged products have reduced currency downside which also means sacrificing the upside. Paying for this pleasure has seen investors start to unwind positions as currency movements go against them.

Losing out on dollar weakness seems to be too much to swallow for a swathe of US ETF investors as outflows indicate investors are concerned around future dollar weakness than the strength.

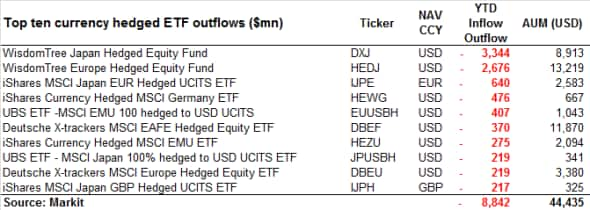

With the majority of currency ETFs domiciled within the US and $50bn in AUM, USD funds represents the majority of hedged withdrawals. The biggest USD withdrawals have flowed out of European and Japanese equity funds totalling $3.3bn and $2,7bn respectively. However, the euro denominated iShares MSCI Japan fund has also tallied a significant $640m of outflows thus far this year.

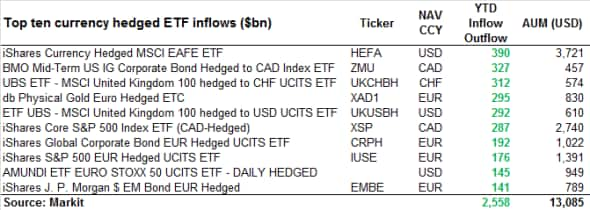

Some of the largest inflows year to date has been captured by smaller funds measured by AUM which provide hedged exposure to Bonds, UK large Caps, Gold and the S&P500.

Canadians are using hedged ETFs to protect against the Loonie with $1.3bn of inflows seen year to date. The currency and country has battled lower oil prices however, recent strength in the currency could cause similar reversals seen above with USD based investors.

Top ten inflows into hedged ETFs total over $2.5bn in aggregate with some interesting funds attracting significant inflows relative to AUM.

CHF and USD investors have hedged exposure to UK equities which could indicate concerns regarding possible Brexit scenarios and European ETF investors have increased their investments into hedged dollar exposure to gold.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-equities-us-investors-u-turn-on-currency-hedges.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-equities-us-investors-u-turn-on-currency-hedges.html&text=US+investors+u-turn+on+currency+hedges","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-equities-us-investors-u-turn-on-currency-hedges.html","enabled":true},{"name":"email","url":"?subject=US investors u-turn on currency hedges&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-equities-us-investors-u-turn-on-currency-hedges.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+investors+u-turn+on+currency+hedges http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-equities-us-investors-u-turn-on-currency-hedges.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}