Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 13, 2014

High fees, low expectations

Shares which command the highest fee to short have consistently underperformed in the US over the last two years. With this in mind, we highlight which stocks are currently the most expensive to short.

- The most expensive shorts have underperformed the US market by 18.06% over the last two years

- The Energy and Pharmaceuticals sectors dominate the most expensive to borrow decile

- RadioShack is the most expensive US stock within the Markit Total Cap Universe

The fee charged in order to short a specific security incorporates multiple sentiment indicators that may be considered esoteric to non-securities lending market participants.

It includes both the demand to borrow as well as the availability. This single number represents, as an annual percentage, what investors are willing to pay in order to gain short exposure to a security. Thus it is fair to say the most expensive stocks to borrow are often those with the most negative sentiment.

Expensive to short shares underperform

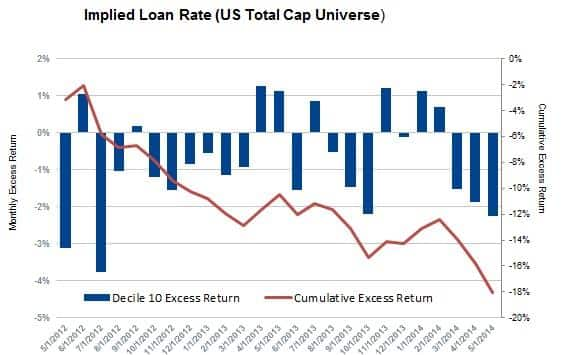

The top 10% most expensive shares to short in the Markit US Total Cap Universe have underperformed the market by a cumulative 18.06% in the 24 months leading to the end of April.

While the middle of 2013 and start of 2014 proved difficult for short sellers, the factor improved each month since February. Stocks in the most expensive to short group underperformed the market by 2.25% in April which is the worst (or best from a short seller’s perspective) performance since June 2012.

This underperformance is pretty consistent as the months when these shares underperformed the market outnumbered those when they outperformed by a factor of two to one.

This performance is only relative however, as the share prices of the stocks in the most expensive group increased by 76bp on average. This compares to an average return of 1.49 % for all deciles.

Energy and pharmaceuticals are most shorted

Two sectors are responsible for the majority of stocks included in the 10th decile. There are 129 companies in the energy and pharmaceuticals, biotechnology & life sciences sectors which account for almost 40% of the 10th decile’s composition.

Currently Organovo Holding, which is looking to develop a human tissue 3D printer, is ranked as the most expensive within the Pharmaceuticals, Biotechnology & Life Sciences sector.

Shorts have been increasing their positions since last November. The percentage of shares outstanding on loan has increased to 8.22% up from 6.5% at the beginning of the year.

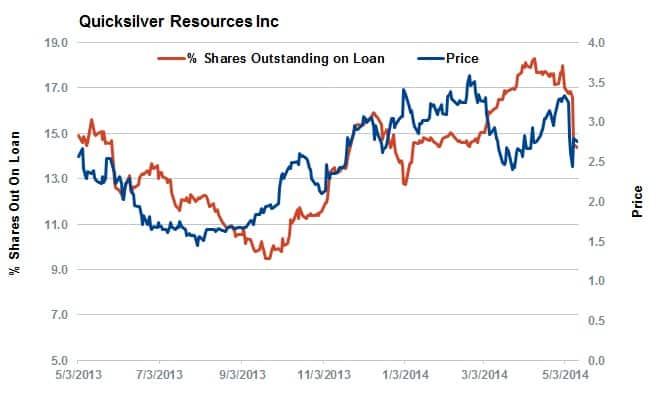

Oil and gas exploration company, Quicksilver Resources ranks among the most expensive energy stock to borrow. Despite the recent bout of short covering, the fee charged to borrow the company has picked up and is over twice that of the second most expensive to borrow firm, Diamond Offshore.

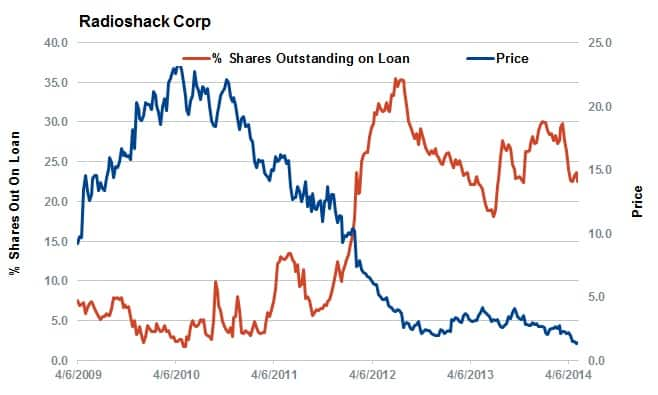

As of the end of April, Radioshack ranked the number one most expensive stock within the US Total Cap universe. Even with a decrease in percentage of shares out on loan there has been little correction in the cost to borrow.

This phenomenon has been driven by the fact that long only investors have been pulling their shares from lending programs as the current 19 million shares sitting in lending programs are an all-time low for the retailer.

Methodology

We compare the performance of 10% most heavily borrowed stocks against the broader Markit US Total Cap Universe, using Markit’s Implied Loan Rate factor. This is based on the Markit Securities Finance indicative loan fee which measures the cost charged to hedge funds to sell a share short.

Andrew Laird, Analyst, IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052014120000high-fees-low-expectations.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052014120000high-fees-low-expectations.html&text=High+fees%2c+low+expectations","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052014120000high-fees-low-expectations.html","enabled":true},{"name":"email","url":"?subject=High fees, low expectations&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052014120000high-fees-low-expectations.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High+fees%2c+low+expectations http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052014120000high-fees-low-expectations.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}