Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 13, 2016

Portuguese bond returns lag eurozone peers

Falling government bond yields in Europe have been boosted returns in the region, but investors still remain cautious on Portugal's creditworthiness.

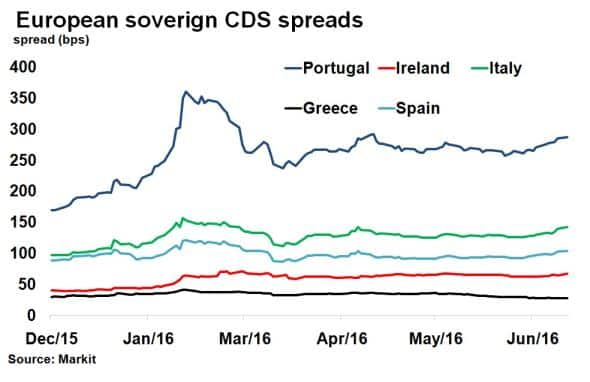

- Portugal's 5-yr CDS spread is 69% wider than at the start of the year

- Spanish and Italian government bonds have produced 70bps of extra return over Portugal so far this month

- Markit iBoxx " Portugal index has returned -1.68% this year, underperforming peers

Falling government bond yields across Europe have meant investors have been rewarded with impressive returns so far this year. One country however, continues to lag. Portugal has seen its credit risk hover at elevated levels and its government bonds have produced negative returns this year.

Elevated risk

Credit investors have been treating Portugal with increasing scepticism since the beginning of the year. Portugal's 5-yr CDS spread, a measure of perceived credit risk, is 69% wider than at the start of the year according to Markit's CDS pricing service. Compared to its European peers, Portugal's 5-yr CDS spread is 2.75 times wider than Spain's, after being less than double at the start of the year, and is also currently twice as wide as Italy's spread.

Having been bailed out by Europe and the IMF in 2011, Portugal has struggled to shrug off its reputation as one of the eurozone's weaker economies. A large debt overhang continues to be a burden; at 130% of GDP and one of the highest levels in the eurozone, while economic growth has remained slow. Problems surrounding Europe's banking sector this year have also impacted Portugal. An already fragile banking sector, the country's biggest bank, Caixa Geral de Depositos, is now in dire need of capitalisation.

Further credit deterioration could mean further downgrade pressure from rating agencies. It could also mean losing access to ECB QE, should DBRS (the only rating agency to have Portugal as investment grade) decide to downgrade the name. The consequences may well deepen any economic crisis, leaving Portugal susceptible to another bailout.

Returns lag

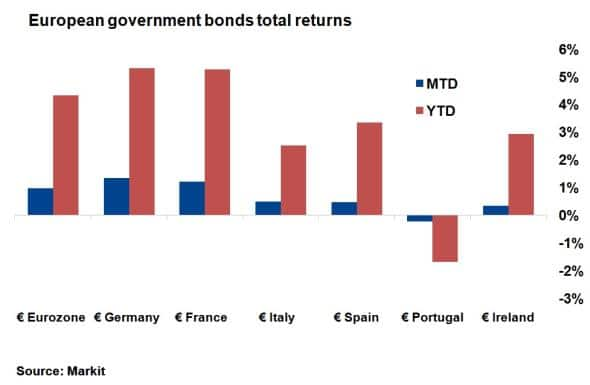

Portugal's troubles have meant government bond returns have underperformed European peers. The Markit iBoxx " Eurozone index has returned 0.97% so far this month, over 1% more than the Markit iBoxx " Portugal index, which has returned -0.21%. Spanish and Italian government bonds have returned 70bps and 71bps more than Portuguese government bonds in June.

Year to date returns paint a similar picture, with the gap between Portuguese government bond returns and their eurozone counterparts' exaggerated. Markit iBoxx " Portugal index has returned -1.68% so far this year on a total return basis, while broader Europe has seen returns in excess of 3%. While tumbling government bond yields help boost bond returns in Europe, Portugal continues to deal with its own creditability agenda.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062016-Credit-Portuguese-bond-returns-lag-eurozone-peers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062016-Credit-Portuguese-bond-returns-lag-eurozone-peers.html&text=Portuguese+bond+returns+lag+eurozone+peers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062016-Credit-Portuguese-bond-returns-lag-eurozone-peers.html","enabled":true},{"name":"email","url":"?subject=Portuguese bond returns lag eurozone peers&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062016-Credit-Portuguese-bond-returns-lag-eurozone-peers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Portuguese+bond+returns+lag+eurozone+peers http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13062016-Credit-Portuguese-bond-returns-lag-eurozone-peers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}