Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 13, 2015

Iran deal and the impact on US high yield

With an Iran nuclear deal apparently imminent, the prospects of a flood of new oil hitting the global market has put downward pressure on oil prices and consequently the US high yield market.

- The Markit iBoxx USD Liquid High Yield Oil & Gas Index has widened 38bps this month

- Oil & Gas represents around 13% of US high yield liquid bond market

- Investment grade Oil & Gas bond spreads have remained stable; flat this month

After countless missed deadlines, a deal between Iran and six world powers seems to be in the offing. Led by the US, the agreement sets out the technicalities regarding limiting Iran's nuclear ambitions in exchange for an end to sanctions that have been plaguing the Islamic Republic. While progress has been made, a comprehensive deal will have to overcome heavy resistance from both sides.

Oil markets have reacted to the news with the price of WTI falling 1.5% to $52 per barrel; a three month low. In terms of proven oil reserves, Iran ranks fourth behind Venezuela, Saudi Arabia and Canada. Needless to say, any sanctions relief would open up Iranian oil channels back into world markets. Resultant oversupply in the market has the potential to trigger another downward trend in the price of crude oil.

High yield oil & gas

In credit markets, oil's impact is most evident in highly leveraged Oil & Gas producers, many of whom came to prominenceamid the US shale boom of recent years.

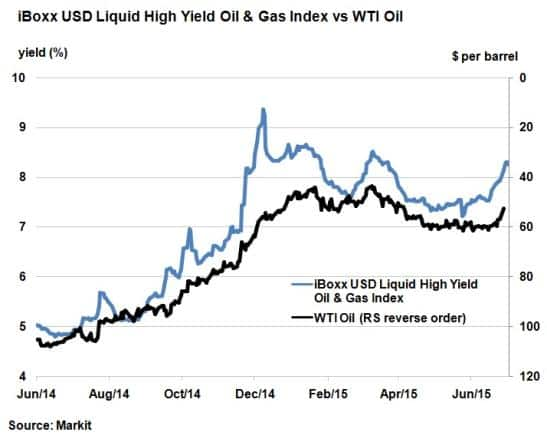

High yield names in the US Oil & Gas sector have sold off amid the recent drop in crude oil prices. July has seen WTI oil prices drop around $8, negatively impacting high yield Oil & Gas credits. The Markit iBoxx USD Liquid High Yield Oil & Gas Index has widened 38bps this month owing to its strong negative correlation with the price of WTI oil.

The last time the Markit iBoxx USD Liquid High Yield Oil & Gas Index touched 8.3% was on March 30th, when the price of WTI stood at $47. Interestingly, the current price for WTI oil is actually $5 higher than this figure, suggesting that either the state of the US high yield oil and gas sector is weaker now from a credit quality standpoint, or that prices are expected to drop further with an Iran deal looking imminent.

Wider credit market

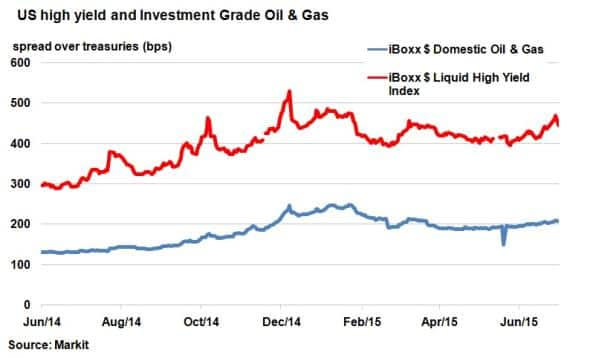

Looking at the broader credit markets, high yield spreads have also been widening. The iBoxx $ Liquid High Yield Index (HYG) has seen its benchmark spread widen 50bps since June 3rd as investors have shunned high yield amid global geopolitical uncertainties.

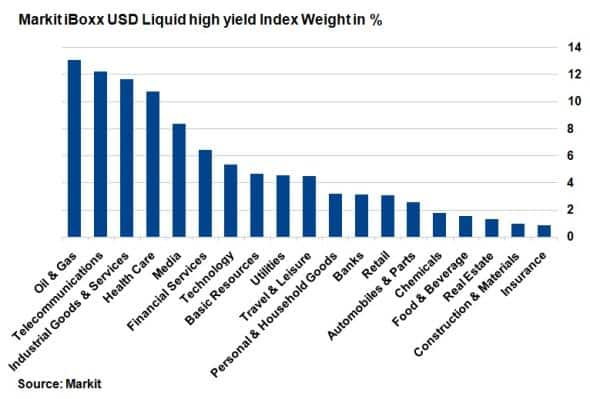

This month's oil slump has coincided with an 11bps widening of the HYG index, and oil's impact must not go unnoticed since over 13% of the Markit iBoxx $ Liquid High Yield Index is made up of Oil & Gas names; the largest representative sector. It was also no coincidence that HYG's 52 week high spread over benchmark was during oil's sharp selloff in December last year.

On the investment grade front, larger Oil & Gas firms appear much better equipped to handle another downturn in oil prices. The current spread for the Markit iBoxx $ Domestic Oil & Gas index is 207bps over treasuries, performing flat for this month and a far cry from the 247bps seen during December 2014.

These larger firms also have the capabilities and capital that could see them partner up with Iran to help them extract and market their oil which could benefit these larger firms in the end. These developments seem to be already in the works, with Shell's ceo reportedly meeting with Iranian officials in recent weeks.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-credit-iran-deal-and-the-impact-on-us-high-yield.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-credit-iran-deal-and-the-impact-on-us-high-yield.html&text=Iran+deal+and+the+impact+on+US+high+yield","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-credit-iran-deal-and-the-impact-on-us-high-yield.html","enabled":true},{"name":"email","url":"?subject=Iran deal and the impact on US high yield&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-credit-iran-deal-and-the-impact-on-us-high-yield.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Iran+deal+and+the+impact+on+US+high+yield http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072015-credit-iran-deal-and-the-impact-on-us-high-yield.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}