Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 13, 2017

It pays to lend ETFs

ETFs are in higher demand than conventional equities which has enabled some investors to earn income above and beyond the cost of investing through these products

- ETFs have higher utilization rates and command a higher fee than equities

- Investors have offset over 40% of their ETF fees through securities lending

- ETF inventory levels are climbing, but representation still lags behind equities

This article features in the Markit Securities Finance quarterly review which is available in full here.

ETFs have two potential sources of revenue from securities lending activities: 'Inside' - Lending of underlying securities; ETF issuers lend underlying fund assets for the benefit of all fund investors. 'Outside' - Lending of the ETF units; ETF investors can potentially earn additional income by lending their ETF units through a lending agent.

The ETF securities lending debate has largely revolved around the former, "inside" lending, where ETF issuers lend out the assets purchased to replicate their chosen benchmark.

What investors have historically been less aware of are the increasing opportunities and benefits from lending out the ETF units themselves. In several cases revenues from "outside" lending, which is the prerogative of an ETF's ultimate beneficial owner, vastly outweighs those earned from the type of lending most commonly associated with the asset class. With investors now looking to squeeze every possible basis point from the market, we look to shed some light on the relatively niche practice of ETF Unit lending and the benefits it stands to deliver investors.

ETF borrow demand dynamics

The forces driving demand to borrow physical ETF units are numerous, but the most common reasons include: investors wishing to hedge assets tracked by an ETF, market making activity in the funds themselves, and the growing lists of derivatives that track them. Although ETFs have been around for over two decades now, the asset class is still relatively underrepresented in the securities lending market, which means that the growing pool of investors looking to borrow ETFs often struggle to get their hands on the most in-demand lines. In fact, a quarter of the 2,200 ETFs that feature inside lending programs have over half their inventory out on loan.

Enhanced Lending returns

US listed ETFs are the most widely traded in the securities lending market due to that market's relative maturity. Securities lending utilisation rates for these ETFs have been three times higher than those of conventional US equities in the first three months of the year. Notably, investors were also willing to pay a premium to borrow US ETFs, which have a cost of 55bps to borrow on average, a quarter more than the 46bps earned by conventional US equities.

The combination of the constant demand for ETFs, and the relatively high fees which can be drawn from this demand, means that global ETF investors earned over $167m from lending out ETFs over the last 12 months. This represents a return of 11.6 basis points on the ETF assets that are available in lending programs over this period.

ETF lending returns are not only restricted to the US market. There is a fast-developing European ETF lending market with increasing demand and supply, as we noted in our 2017 Q1 Securities Finance Quarterly Review highlights. In fact, European listed ETF lending revenue increased 15% year on year in Q1.

Reducing the cost of ETF ownership

Lending returns earned by investors have the potential to significantly offset the fees charged by ETF issuers. ETF price competition and the resulting fee cutting, combined with increasing lending revenue, has created the opportunity for investors to reduce their cost of ownership in the asset class. The total cost charged to hold the ETFs that sat in in lending programs over the last 12 months was $417m - which means that investors were able to recoup a substantial 40% of their costs simply by making their ETF assets available to lend.

Forming part of the investment decision?

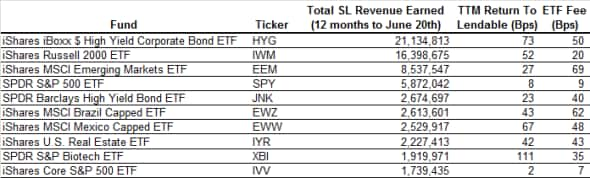

As with the rest of the securities lending market, the bounty earned from lending out ETFs is unevenly distributed, with the 10 largest revenue generating funds amassing one-third of all revenues.

Those ETFs which generated the most fees in the securities lending market over the last 12 months are very diverse in terms of their exposures. They include heavily traded mega-S&P500 funds, funds which track hard to short asset classes such as high yield bonds and emerging market equities, and those that track relatively volatile asset classes like small cap stocks and biotechs.

While asset class is a large determinant of an investment's performance in the securities lending market, not every fund is able to earn the same revenues for their underlying beneficial owners. Historical lending fees, whilst no guarantee of future returns, can potentially be one input into an investor's decision on how best to obtain a desired exposure.

One example of this disconnect is seen in the two high yield bonds funds which feature among the top ten largest revenue generating ETFs: the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the SPDR Barclays High Yield Bond ETF (JNK). Both funds track the same assets, yet investors who made their HYG shares available to lend were able to generate 73bps of total securities lending returns over the last 12 months, and those that did the same for JNK generated 23bps, or less than a third of the HYG haul. HYG costs 10bps more than JNK, yet the net cost of ownership when taking securities lending returns into account favors HYG. Investors who made their HYG shares available to lend were able to more than offset the cost of owning that ETF over the last 12 months, while earning a net 23bps by investing in high yield bonds through an in-demand ETF. Three other funds among the ten largest securities lending fee generating ETFs earned a net profit for investors willing to lend.

Such a feat isn't uncommon given that 151 global ETFs have earned more for their investors in securities lending programs than the costs incurred by these investors in ETF management fees over the last 12 months. The large majority of these instances occurred in North America - yet European ETF investors, who do not enjoy the type of developed trading and securities lending ecosystem as their North American peers, have still managed to more than recoup their costs in 17 ETFs through securities lending.

The largest net fee generator over this period was the iShares Core FTSE 100 UCITS ETF (IFS). IFS had an average of $300m of its shares in lending programs over the last 12 months, which cost investors $220,000 or 7 bps. These investors went on to earn over $750,000 (23 bps ) from this inventory, which translates into over $500,000 of net income.

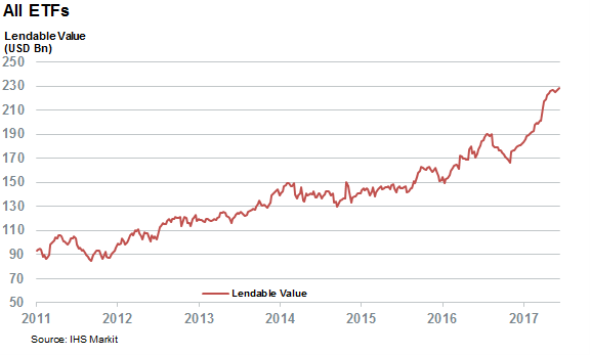

Lendable increasing, but still low compared to equities

There appears to be little sign of this revenue trend ending anytime soon, as ETFs are still relatively scarce in lending programs. The value of ETF assets in lending programs has surged by over 50% to an all-time high of $230bn in the last two years. In fact, only 5% of the total ETF AUM sits in lending programs; this is woefully behind conventional equities considering that over a quarter of the Russell 3000's market cap now sits in lending programs. This gap has been narrowing given the growth of ETF inventories in lending programs, but there still remains a massive availability gulf for the asset class.

ETF issuers would be well placed to encourage further growth in lendable inventory; a liquid ETF securities lending market, much like the conventional equities, helps foster the cash market by enabling market participants to quickly source ETFs without engaging in the creation process. We hope to play our part in this process by shining a light on the opportunities that ETF lending offers beneficial owners.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072017-equities-it-pays-to-lend-etfs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072017-equities-it-pays-to-lend-etfs.html&text=It+pays+to+lend+ETFs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072017-equities-it-pays-to-lend-etfs.html","enabled":true},{"name":"email","url":"?subject=It pays to lend ETFs&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072017-equities-it-pays-to-lend-etfs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=It+pays+to+lend+ETFs http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13072017-equities-it-pays-to-lend-etfs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}