Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 13, 2014

Sportswear running out of steam

- Short sellers have increased their positions in Adidas by a quarter in the last month

- Puma and Geox have also seen sustained short selling in recent months as their share prices hover at new yearly lows

- US firms are more buoyant, although Lululemon continues to see heavy demand to borrow

Last week saw Adidas shares fall by more than 16% after the firm issued a profits warning which it blamed on surging marketing spend to fend off Nike, and weakness in its Russian business. This comes only weeks after the frim jubilantly announced a five year $1.3bn deal to supply Manchester United’s kit, displacing arch rival Nike.

While the company was keen to highlight that the setback was driven by short term events in its business model, the increasingly bearish mood seen in Adidas’ shares, along with that in its peers seems to indicate otherwise. With this in mind, we recap investor sentiment in the sector. Adidas among most shorted

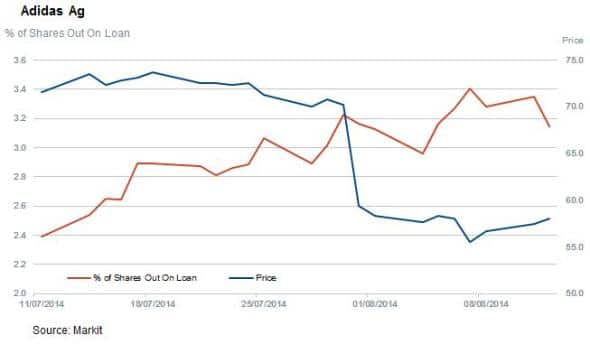

Adidas had over 3% of its shares out on loan the day before its recent profits warning, a number that had climbed over previous weeks as investors no doubt saw cause for concern in the firm’s 1000 plus Russian stores. Investors’ sentiment in the world’s second largest sportswear firm has only darkened in the following days and there are now 3.15% of Adidas shares out on loan, taking the month on month surge in short interest to 25%. This now makes Adidas the third most shorted Dax constituent, behind only K&S and Lufthansa.

With short sellers piling in and analysts trimming their full year profit forecast to match the company’s revised expectations, Adidas’ shares will definitely be ones to watch in the coming months.

Puma also targeted

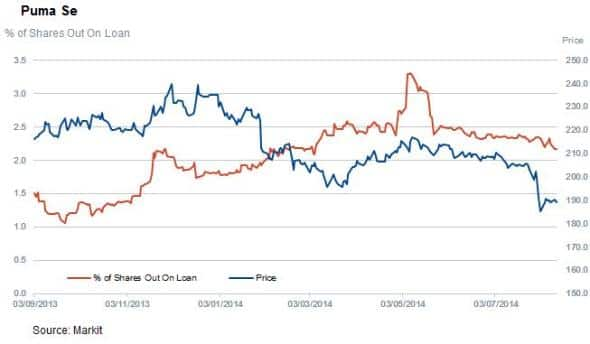

Adidas’ recent struggles look to have rippled their way onto the wider European sector, as peer Puma also saw its shares tumble in the wake of its larger rival company’s profits warning. Puma shares are now down by over 6% in the last month despite the fact that the company recently reiterated its full year forecast.

While short interest in Puma has remained relatively flat over the last couple of months, demand to borrow is still over a third higher than at the start of the year. The current demand to borrow represents 2.3% of shares outstanding, but the company’s low float means that over 16% of freely traded shares are out on loan.

Europe firms also shorted

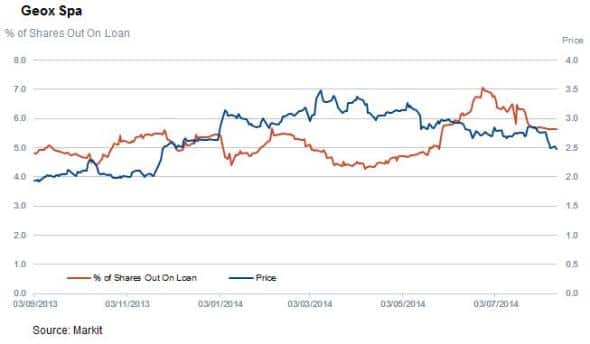

Further afield in Europe, sports shoemaker Geox has also seen its shares tumble to new annual lows. The firm, which is not unknown to short sellers, has seen its demand to borrow rise by a quarter in the last three months despite the fact that its first half results came in above analyst estimates.

Another sportswear company seeing increased demand to borrow is Amer Sports which has seen demand to borrow tick past the 2% of shares outstanding mark for the first time in over 18 months. Its shares also tumbled in recent weeks after second quarter revenues came in below analyst expectations.

US share more buoyant

European sportswear woes seem to be isolated to the region as North American firms Nike and Under Armour have seen buoyant share prices over the last few months. Under Armor, which used to be heavily targeted by short sellers has seen shorts cover over a third of their positions over the last six months.

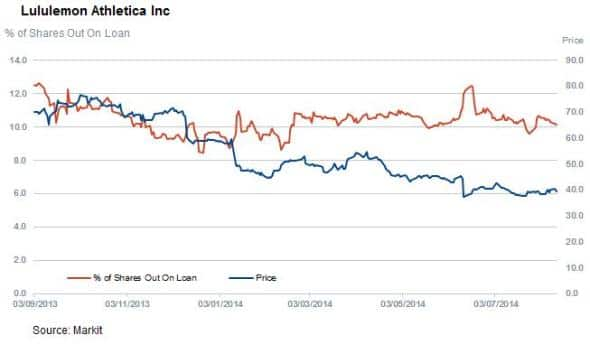

But Yoga apparel firm Lululemon seems to be an exception as its shares have continued to fall despite the recent ousting of their founder and ceo in order to give the company a freer hand at turning itself around. Shorts have stayed the course in this name with over 10% of LULU shares now out on loan.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082014Sportswear-running-out-of-steam.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082014Sportswear-running-out-of-steam.html&text=Sportswear+running+out+of+steam","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082014Sportswear-running-out-of-steam.html","enabled":true},{"name":"email","url":"?subject=Sportswear running out of steam&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082014Sportswear-running-out-of-steam.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sportswear+running+out+of+steam http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13082014Sportswear-running-out-of-steam.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}