Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 14, 2016

Short sellers return to UK property

UK homebuilders have seen their first bear raid in nearly five years as luxury London property prices stall.

- Berkeley has over 5% of its shares shorted, first UK homebuilder to hit this level since 2010

- Negative sentiment isolated to Berkeley, unlike previous periods of bearish sentiment

- Markit/CIPS UK Construction PMI saw housing activity soften to two year lows

The appetite for prime London property, which was so strong in the last five years that flats in areas such as Chelsea and Knightsbridge were likened to a reserve currency, has started to wane in recent months. In response, investors have begun to pile on bearish bets in Berkeley Group, whose fortunes are largely tied to the London market.

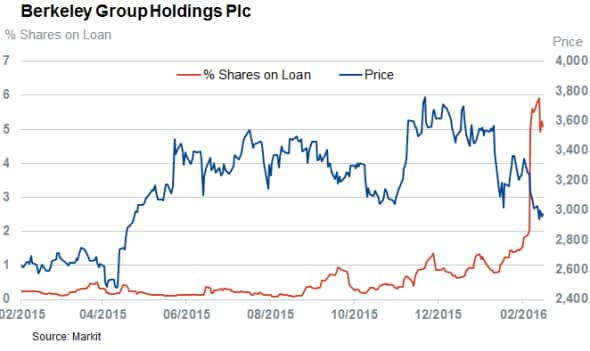

Berkeley Group, whose developments are nearly exclusively located within London and its commuter belt, has seen short sellers borrow as much as 6% of its shares in recent weeks. Short interest in Berkeley has since settled slightly to hit 5.2% of shares outstanding, but the pace of the reversal is rather stunning given that the current short interest is five times that seen at the start of the year.

This bear raid, which comes at the heels of a 20% retreat in Berkeley's shares, represents the first time in over five years that short sellers took a position of more than 5% of shares outstanding in a UK listed homebuilder.

Rest of the sector immune

The rest of the UK homebuilder sector, which includes such names as Persimmon and Barratt, appears to be relatively immune to the recent bear raid as only one firm, Redrow, sees more than 2% of its shares out on loan. In fact the average short positions in across Berkeley's 14 UK listed homebuilder peers stands at 0.6% of shares outstanding, less than third of the average shorting activity seen in constituents of the FTSE 350 index.

Short sellers were much less discriminating the last time a UK listed homebuilder had more than 5% of its shares out on loan back in 2010. At that point, the average short interest across the rest of the sector stood a 1.5%; nearly three times the level seen currently in the sector.

Sector activity slows down

Despite the fact that the recent bearish sentiment towards the UK home building sector has been isolated to one London-centric developer, indications are that the overall sector is slowing. The February Markit/CIPS UK Construction PMI Housing Activity Index showed that the sector registered the slowest rate of growth in nearly three years.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-Equities-Short-sellers-return-to-UK-property.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-Equities-Short-sellers-return-to-UK-property.html&text=Short+sellers+return+to+UK+property","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-Equities-Short-sellers-return-to-UK-property.html","enabled":true},{"name":"email","url":"?subject=Short sellers return to UK property&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-Equities-Short-sellers-return-to-UK-property.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+return+to+UK+property http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-Equities-Short-sellers-return-to-UK-property.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}