Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 14, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings this week

- Retail still the favorite topic of North American short sellers

- Meyer Burger shorts increase to the highest in over two years

- Australian short sellers target pizza firm Domino's

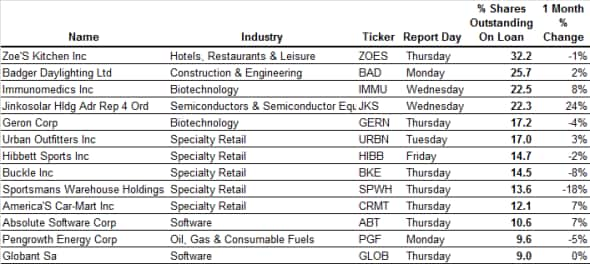

North America

Casual dining chain Zoe's Kitchen once again finds itself highly shorted in the run-up to earnings. The company has been a favorite target of short sellers for quite some time - over the last 12 months, more than a third of its shares have been out on loan. This commitment has rewarded bearish investors, as Zoe's shares have lost two thirds of their value following a string of poor earnings.

The second most heavily shorted stock is excavation firm Badger Daylighting. Since disappointing analysts with a weak sales announcement in Q2, short sellers have increased their positions in the firm by more than a quarter.

Retail continues to be high on the list of shorts this week, with eight specialty and general retail stocks targeted. These bets come on the heels of bad news from Macy's and Kohl's last Thursday; both shares lost significant value since announcing weak sales and gross margins.

The top retail focus this week is fashion retailer Urban Outfitters, which has 17% of its shares on loan. Sports firms Hibbett Sports and Sportsmans Warehouse are also worth watching. Both have around 14% of outstanding shares on loan.

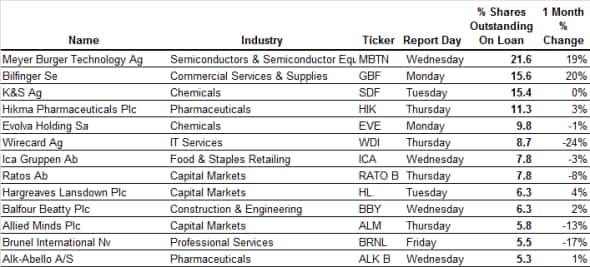

Europe

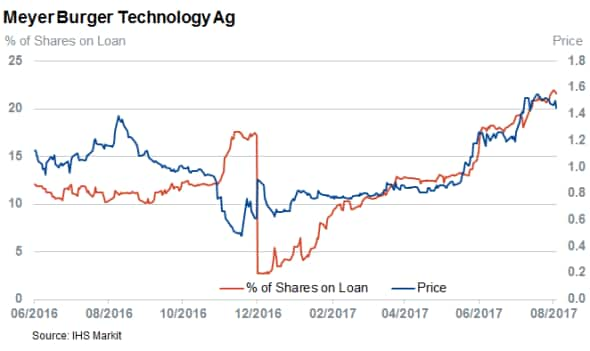

Solar panel manufacturer Meyer Burger is the most shorted European firm announcing earnings this week; it has more than 21% of shares out on loan. The German company's shares rallied heavily in the last few months based on expectations that it may break even next year. Short sellers are betting against this outcome, and the demand to borrow Meyer Burger increased by more than a fifth in the last month. This recent wave of bearish sentiment has pushed the firm's short interest to a 2.5 year peak.

One company which short sellers are unwilling to short is payment processor Wirecard. Payment processing is the darling of deep pocketed private equity companies of late, which has led to several takeover deals. To the chagrin of short sellers, Wirecard shares have been dragged to new highs by this takeover frenzy, and the demand to borrow its shares plummeted more than 50% in the last six months.

UK short sellers are keeping a close eye on Hikma Pharmaceutical. The demand to borrow its shares is at the highest level in more than three years.

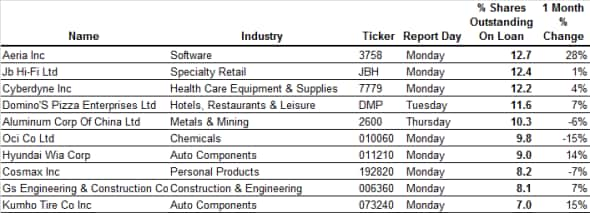

Asia

With just under 13% of its shares out on loan, Aeria is the most shorted Asian company announcing earnings this week. A large part of this borrow is unlikely to be directional; the software company is in the process of acquiring a peer through a stock swap, and the deal is expected to close in the coming weeks.

Directional short sellers are likely behind the demand to borrow speaker manufacturer Jb Hi-Fi. They started targeting the firm back in February, after it failed to live up to profit expectations. Since then, investor sentiment has significantly cooled, and the demand to borrow Jb Hi-Fi's shares surged by more than tenfold.

Australian short sellers are also increasingly bearish about Domino's Pizza Enterprises. The pizza firm's share price has fallen more than 14% YTD following disappointing revenues. Short sellers think that more pain is in the offing, and they have doubled their positions in the firm since the start of the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082017-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}