Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 15, 2016

Investors embrace HY ETFs as sentiment turns

High yield bonds have enjoyed a sustained rally led by Oil & Gas and Basic Materials, while the improved macroeconomic backdrop has seen investors use ETFs to express their views.

- High yield bond ETFs have seen five consecutive weeks of positive inflows

- The number of shares outstanding in $HYG has hit a new record high, illustrating demand

- Oil & Gas, Basic Materials, Utilities and Financials have all seen HY recovery

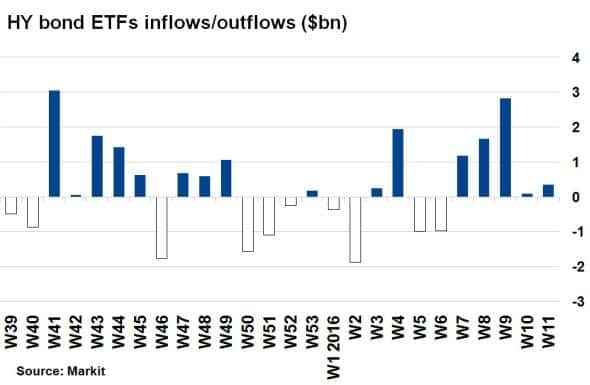

The recent rally in risky assets has seen investors continue to embrace high yield (HY) exchange traded funds (ETFs), with positive inflows into the funds now entering their fifth consecutive week.

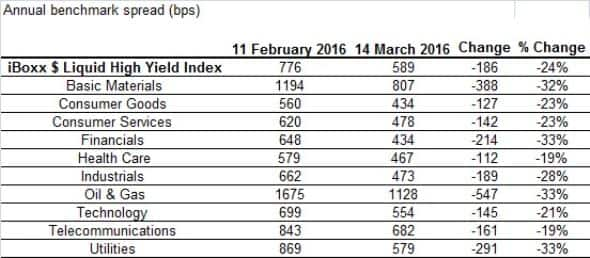

A rebound in commodity prices from February’s lows and stimulatory action from major central banks has improved global macroeconomic sentiment. As a result HY bond risk has fallen across the board, led by Basic Materials, Oil & Gas and Financials sectors.

Investors have been keen to take advantage of the improving macroeconomic backdrop by taking on risk through HY ETFs, due to their relative liquidity and ease to access. The last five weeks have seen consecutive inflows totalling $6.1bn, reminiscent of the inflows seen last October as global credit markets rallied on diminishing fears over a China/emerging markets slowdown.

Investors go to ETFs

ETFs have been increasingly gaining popularity amid volatile market conditions as a method for investors to express their macro view, due to their ease of access and liquidity.

This is particularly evident in credit markets, where underlying bonds are traded less often. As macroeconomic sentiment has improved, strong HY ETF inflows have followed.

According to Markit’s ETP service, the week starting February 29th saw inflows of $2.82bn, the largest since the second week of October last year. In total, $6.1bn of new money has entered over the past five weeks - over 10% of total AUM in the HY ETF space.

Blackrock’s iShares iBoxx $ High Yield Corporate Bond ETF ($HYG) saw inflows of $1.22bn the week starting February 22nd; the highest weekly inflow on record. Already the largest HY ETF by AUM, it also saw its number of shares outstanding top 200m for the first time ever, illustrating heavy investor demand.

Oil and Commodities lead

Corporate bonds in Europe were buoyed by the European Central Bank’s aggressive stimulus measure last week, with spreads tightening significantly. The Markit iTraxx Europe Crossover, for example, tightened 50bps to 316bps on the day of the announcement. Coupled with Japan’s aggressive central bank measures and the rebound in oil and commodity prices, the Markit iBoxx $ Liquid High Yield Index has seen its annual spread over US treasuries tighten 24% since February’s recent wide point (589bps, from 776bps).

According to Markit’s iBoxx indices, the sector leading the recent rally in US HY bonds has been Oil & Gas, which has seen spreads fall 547bps since February 11th. This comes as no surprise given crude oil’s rebound, but spreads remain above 1,000bps, indicating distressed levels. Basic Materials has seen a 388bps tightening and average spreads are back below 1,000bps. While these two sectors have led the tightening in absolute terms, both represent around a fall in spreads by around a third, similar to the Utilities and Financials sectors, implying a broad based tightening.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-credit-investors-em.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-credit-investors-em.html&text=Investors+embrace+HY+ETFs+as+sentiment+turns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-credit-investors-em.html","enabled":true},{"name":"email","url":"?subject=Investors embrace HY ETFs as sentiment turns&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-credit-investors-em.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+embrace+HY+ETFs+as+sentiment+turns http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-credit-investors-em.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}