Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 15, 2017

Retail REITs singled out by short sellers

Bricks and mortar retailers have delivered consistent returns for short sellers, emboldening them to target the companies which own the real estate behind the stores.

- Retailers have lagged S&P 500 by 10% ytd, which has attracted short sellers

- Retail REITs see highest average short interest in over two years

- Favorite short targets include PREIT and Urban Edge

The momentum gathered by online retailers over the last decade has ensured that bricks and mortar stores have played a declining role in the overall retail experience. Over two thirds of US shoppers are now shopping online according and it's hard to see this trend reversing anytime soon given the omnipresence of mobile technology, offering online retailers near constant access to customers. In fact, a recent report by the Center for Retail Research, an industry consultancy, estimated that 13.9% of all US retail sales were made online in over 2016; over 1% more than the 2015 tally of 12.7%.

The growing popularity of online retailing has mainly come at the expense of bricks and mortar retailers which have seen their sales atrophy by 2.2% over the last year. Flagging sales in store has in turn made retailers one of the few successful short plays over the last few months as evidenced by the fact that the SPDR S&P Retail ETF, which track US retailers, has underperformed the S&P 500 by over 10% since the start of the year. Constituents of this ETF, which were heavily shorted heading into the year, have seen a continued deterioration in investor sentiment since the New Year as the average demand to borrow their shares has climbed by 15% ytd.

Retail REITs

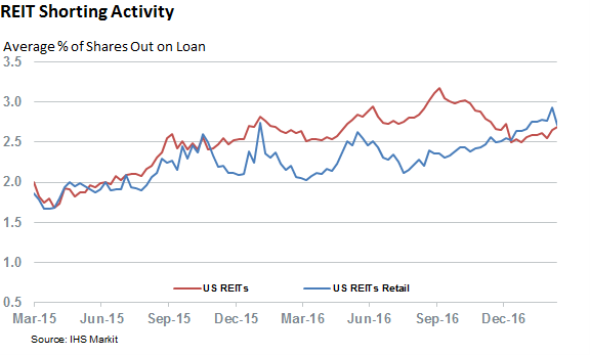

Short sellers aren't content with taking bearish views on just retailers as retail focused Real Estate Investment Trusts (REITs), which own many of the physical proprieties that retailers lease, have also seen a large increase in shorting activity over the last few months. Retail REITs which feature in the Vanguard REIT ETF used to be relatively less shorted than their peers, however the trend has inverted in the last three months after consistent short selling in the sector took its average short interest to a two year high of just under 3% of shares outstanding. This rising demand to short Retail REITs runs contrary to the recent wave of short covering in the REIT universe as the constituents of the Vanguard REIT ETF have seen their average demand to borrow shrink by over 15% from the recent high experienced in September of last year.

Bears are betting that the post-holiday wave of store closures, which saw US retailers close several hundred locations, will filter through to rental income garnered by these investment vehicles through a mixture of empty stores and lower yields as tenants gain pricing power a sluggish marker. Retail REIT troubles could be further compounded should the credit market, where bearish bets on retailers have also climbed, start to materially re-price loans made to retailers - which could shut the sector off from its greatest source of funding. Shorts have so far been vindicated as retail REITs have fallen by 7.2% on average ytd, which is over three times the decline seen in the rest of the REIT universe.

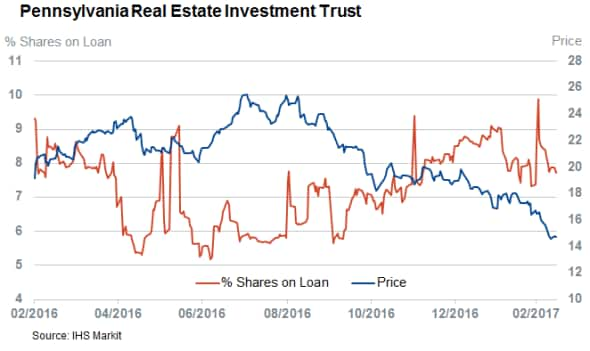

The current favorite short targets include the Pennsylvania Real Estate Investment Trust and Urban Edge Properties which have 8% and 5% of their shares out on loan respectively. Both these operators count Macy's and Sears among their tenants, two firms which have been among the most aggressive at reducing their footprint in the wake of the disappointing holiday shopping period.

Even the sector's largest players, such as GGP, have come under short sellers' scrutiny as evidenced by the fact that the firm saw short sellers increase their bets by over five fold in the last 12 months.

Not all the shorting activity in the sector is necessarily directional however as Cedar Realty Trust Inc, the Retail REIT which sees the greatest demand to borrow, only saw its borrow demand spike significantly after the firm announced that it was issuing some cash settled forward. The resulting rise in short interest is most likely driven from the deal's underwriters looking to hedge their exposure over the next 12 months.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032017-Equities-Retail-REITs-singled-out-by-short-sellers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032017-Equities-Retail-REITs-singled-out-by-short-sellers.html&text=Retail+REITs+singled+out+by+short+sellers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032017-Equities-Retail-REITs-singled-out-by-short-sellers.html","enabled":true},{"name":"email","url":"?subject=Retail REITs singled out by short sellers&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032017-Equities-Retail-REITs-singled-out-by-short-sellers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Retail+REITs+singled+out+by+short+sellers http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032017-Equities-Retail-REITs-singled-out-by-short-sellers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}