Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 15, 2016

Italian banks rebound while US peers idle

Italian banks saw their CDS spreads retreat, while US bank bonds spreads remain largely unmoved after a mixed bag of earnings.

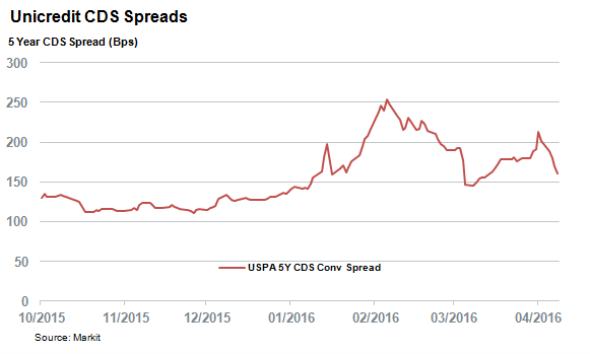

- Unicredit CDS spread falls by a fifth but still higher year to data

- US bank bond spreads flat on the week after earnings announcement

- In sovereigns Brazil's CDS spread falls to nine month lows as impeachment progresses

Italian banks dominated the headlines this week as news broke that a "5.5bn fund would be set up in order to buy non performing bank loans which have multiplied after years of economic woes. While some have posted that the fund is far too little to properly address the "360bn of bad loans currently sitting on Italian bank balance sheets, the credit market have warmed up to the news as CDS spreads across the country's banking system fell significantly.

Unicredit saw its five year spread fall by a fifth over the week to 160bps. This tightening was echoed by the three next largest publicly traded banks Intesa Sanpaolo, Medibanca and Banco Popolare which all saw their spreads retreat after a recent spike.

While the market's renewed confidence in the credit worthiness of Italian banks, as gauged by the tightening CDS spreads, shows that the steps taken have been well received by the market. All four of Italy's largest bank CDS spreads are still wider for the year to date which shows that the current steps taken may not be enough to address the issue.

US Banks

On the other side of the Atlantic, tier 1 US banks reported a mixed bag of earnings this week, as the oil slum and market volatility continue to cloud on results. Large US banks saw bearish signals in the credit market in the weeks leading up to this week's earnings in the CDS market.

The cash bond market has also shown little signs of warming towards the US banks as spread over interest free rates in dollar denominated investment grade bank bonds which make up the Markit $ Banks have continued to trade above the levels seen in January. Investors are now demanding 184bps of extra yield over benchmark rates to hold banking bonds, 20bps more than at the start of the year. This measure of credit risk is roughly flat on the week which shows the underwhelming market reaction to the sector's most recent earnings.

Brazil

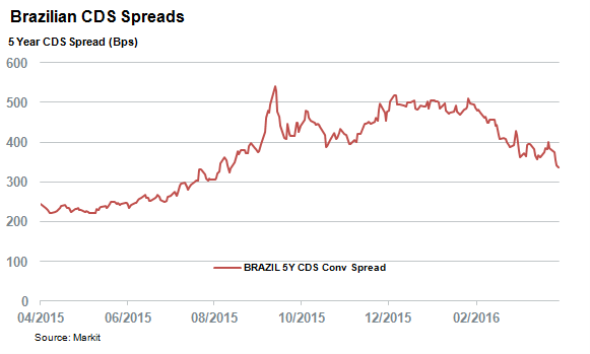

In the sovereign space, Brazil's CDS spread continued to fall from its recent highs this week after its legislature moved closer to impeaching its president Dilma Rousseff. The market has been hopeful that a successful impeachment proceeding would herald a new legislature which would be better suited to address the country's fiscal woes. The latest five year CDS spread stands at 337bps, the lowest level since August of last year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Credit-Italian-banks-rebound-while-US-peers-idle.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Credit-Italian-banks-rebound-while-US-peers-idle.html&text=Italian+banks+rebound+while+US+peers+idle","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Credit-Italian-banks-rebound-while-US-peers-idle.html","enabled":true},{"name":"email","url":"?subject=Italian banks rebound while US peers idle&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Credit-Italian-banks-rebound-while-US-peers-idle.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Italian+banks+rebound+while+US+peers+idle http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042016-Credit-Italian-banks-rebound-while-US-peers-idle.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}