Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 15, 2015

Short sellers wake up in Singapore

With its heavy exposure to China and the energy sector, Singapore's equities market has seen shorting activity rise as companies face renewed attention and scrutiny from activist investors.

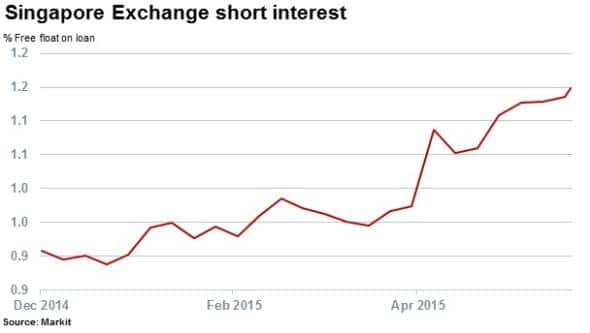

- Average short interest for the Singapore Stock Exchange is up 26% year to date

- Energy and commodity focused firms in the trading hub are among the most short sold

- Activist investors sounding alarms on Noble as S&P confirms negative outlook

Short levels rise

Singapore has never been a hotbed of short selling activity, but the country's exposure to China, weak commodities prices and a successful activist investor campaign has pushed average short interest up sharply from the levels seen at the start of the year.

Average short interest, as measured by the percentage of free float out on loan, has increased by over a quarter since the start of the year, currently reaching 1.2% for the Singapore Stock Exchange (SGX).

STI shares see higher short interest

In terms of average free float out on loan, the larger blue chip companies which make up the FTSE Straits Times Index (STI) have seen relatively more shorting activity than the wider market, with an average of 1.5% shares outstanding on loan.

This figure has also been rising at a faster pace than the SGX, as the current level represents an almost 50% jump from the 1.02% average seen at the start of the year.

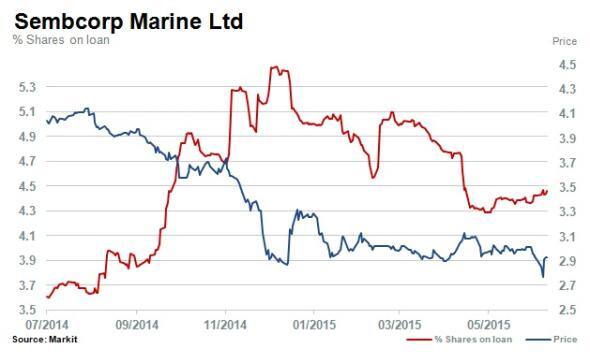

Short interest in the index has been heavily driven by energy and capital goods firms. Sembcorp Marine and Keppel Corporation are both involved in offshore and onshore infrastructure services that are heavily exposed to the energy and shipping sector. The current short interest in these companies currently represents 4.5% and 1.7% of shares outstanding.

Demand to borrow Sembcorp shares has steadily increased throughout the year, driving the cost to borrow above 8%. This makes Sembcorp the most expensive name to borrow in the STI.

Acting on Noble

The largest movement in shorting activity in the STI by far has been in commodities group Noble Corp, which became the target of activist investor Iceberg Research in February.

This has seen the shorting activity in Noble jump tenfold from the level seen on January 1st. Iceberg's research looks to have hit a nerve with investors as the shorting activity has jumped fivefold in the wake of the report, with over 7% of the firm's free float now out on loan.

The problems for Noble look set to continue as S&P has recently downgraded its outlook on the company to negative.

Outside of the STI, energy names have also been popular short targets. Offshore contractor and provider of integrated oil & gas services Ezra is the most shorted name on the SGX with 10% of shares outstanding on loan. The company has seen short sellers continue to gravitate towards the stock since the oil price started to collapse in 2014. The increase in shorting activity has been spurred on by a falling share price as the company's shares have slipped by 70% ytd.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com<</p>

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-equities-short-sellers-wake-up-in-singapore.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-equities-short-sellers-wake-up-in-singapore.html&text=Short+sellers+wake+up+in+Singapore","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-equities-short-sellers-wake-up-in-singapore.html","enabled":true},{"name":"email","url":"?subject=Short sellers wake up in Singapore&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-equities-short-sellers-wake-up-in-singapore.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+wake+up+in+Singapore http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062015-equities-short-sellers-wake-up-in-singapore.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}