Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 15, 2015

Sluggish tech sees bears circle

The tech manufacturing sector has struggled in recent weeks, seeing short interest climb in both PC and smartphone manufacturers.

- Markit Electronics PMI below 50 for the first time since March 2013

- PC manufacturers have seen investor sentiment turn bearish in recent weeks

- Tech ETFs have seen over $760m of outflows in July after underperforming the market

Technology is in a state of upheaval over the last few months, as gauged by the fact that global second quarter PC sales fell by 9.5% from the previous year according to industry analyst Gartner. This was partly driven by the upcoming release of Windows 10 as purchasers delay orders in anticipation of Microsoft's first update in nearly two years, but the dip will endure that the global PC industry will ship around 300 million units in the current year, 5% less than in 2014.

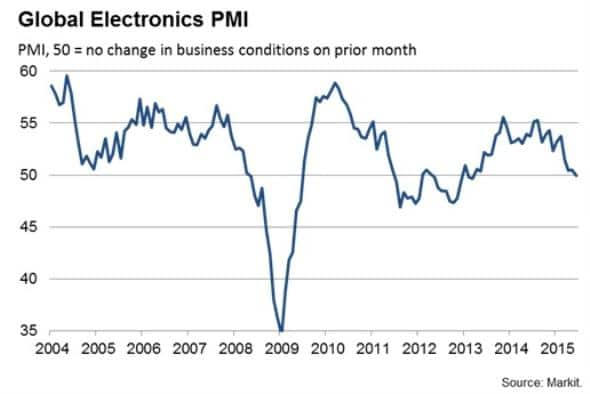

This recent slowdown in sales has been felt across the entire industry with the Markit Global Electronics PMI", a gauge of activity in the electronics industry, indicating the first industry-wide slowdown in output in over three years. The output gauge registered 49.9 in June, falling below the 50.0 "no change" level for the first time since the first quarter of 2013.

The industry slowdown is being driven by the weakness in the computing sector in particular. Computer and IT equipment manufacturers, which have been in contraction territory since March, registered their slowest quarter in terms of output growth since Q1 2009.

Manufacturers see bears circle

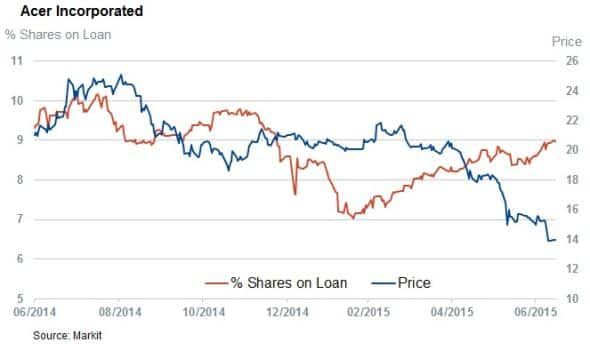

The recent sluggish industry growth has seen short sellers circle-in on five of the six publically-traded large computer manufacturers, who are collectively responsible for two thirds of global PC shipments. Acer, HP, ASUS and Lenovo have all seen short sellers increase their positions by 7% since the end of the first quarter

This demand to borrow was driven in large part by Acer in Taiwan, which has seen its short interest climb to 9% of shares outstanding in recent weeks in the wake of a 33% price fall in the year-to-date.

Dell, which was recently taken private in a $20bn leveraged buyout, has not been immune to the bearish sentiment as the firms has seen its credit risk surge in recent weeks. The company's credit default swap (CDS) spread now stands at 279 basis points, a new 12-month high and nearly twice the post-takeover lows seen in January.

No respite in mobile

Trading conditions are equally tough in the mobile space. A slowdown in tablet sales and slowing growth in mobile phones has seen short sellers increase across the last two listed pure-play cellphone manufacturers. The worrying state of competition in the sector is best demonstrated by a recent report by US research house Canaccord Genuity which estimated that Apple was responsible for over 90% of the industry's operating profits.

This reality has seen short sellers increase their positions in Blackberry and HTC to new recent highs.

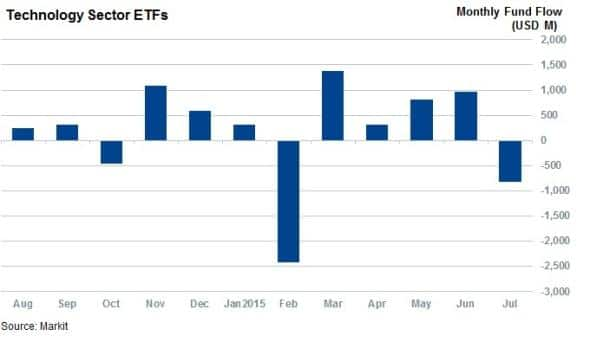

ETF investors head to the door

ETF investors seem equally weary of the sector's prospects given the fact that the 120 plus global technology ETFs have seen over $800m of outflows in the opening two weeks of the July.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-equities-sluggish-tech-sees-bears-circle.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-equities-sluggish-tech-sees-bears-circle.html&text=Sluggish+tech+sees+bears+circle","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-equities-sluggish-tech-sees-bears-circle.html","enabled":true},{"name":"email","url":"?subject=Sluggish tech sees bears circle&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-equities-sluggish-tech-sees-bears-circle.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sluggish+tech+sees+bears+circle http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-equities-sluggish-tech-sees-bears-circle.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}