Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 15, 2014

Scottish index performs in line with market

While investor sentiment has not been dented by the possibility of Scottish independence, we assess the performance of a hypothetical Scottish index comprising Scottish headquartered companies currently listed in the FTSE 350 index.

- The 12 Scottish headquartered companies have been more volatile than the UK market

- These companies account for 2% of the aggregate FTSE 350 dividend payments

- A few companies hold a disproportionate sway, especially SSE

- A hypothetical index of these stocks has performed in line with the broader FTSE 350 index

The two and a half year Scottish referendum campaign will come to a head on Thursday with the long awaited poll deciding whether or not the UK survives.

In a bid to gain some insight into what an independent Scotland would look like, Markit's custom index team has looked at FTSE 350 companies currently headquartered in Scotland to create a hypothetical Scottish share index.

This index doesn't take into consideration any potential re-domicile which may take place in the wake of an independence vote. However, it provides food for thought for any budding independence minded state.

Independence more volatile

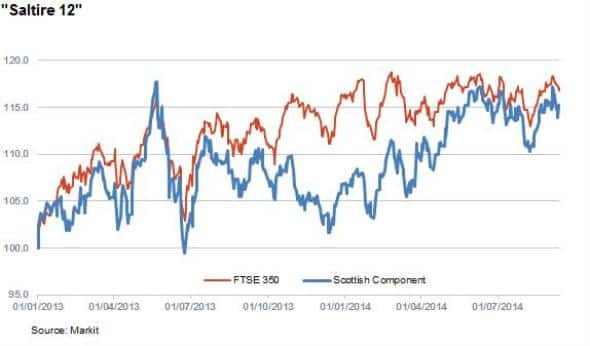

A free float weighted index consisting of the 12 companies FTSE 350 companies with corporate headquarters in Scotland would have seen performed roughly in line with the broader index since the start of 2013.

This index has returned 15.3% over this timeframe compared to 17% for the wider index of UK stocks.

While the raw return doesn't immediately seal the case for independence, an analysis of the returns sees that the Scottish index has proved much more volatile since 2013. The standard deviation of the daily returns has been a third higher than the FTSE 350 average.

At a constituent level, this index sees utility firm SSE as its largest constituent with over a quarter of the overall index weight.

Financials also look set to make up a disproportionate portion of the index with 40% of the index weight, with three sector constituents. However, one of these firms RBS has already stated its intention to move its domicile to England should the yes campaign prevail.

Concentrated dividends

Dividend investors should be reassured that the Scottish headquartered companies make up a relatively small proportion of the aggregate dividends set to be paid by FTSE 350 firms in the current fiscal year.

Aggregate payments across the Scottish firms are expected to amount to "1.8bn in the current fiscal year according to Markit's dividend forecasting group. This will represent roughly 2% of the index total payments.

It is noteworthy that SSE accounts for half of the aggregate total. Financials again punch above their weight, with over a third of the total forecast Scottish dividend payments coming from Standard Life and Aberdeen.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-scottish-index-performs-in-line-with-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-scottish-index-performs-in-line-with-market.html&text=Scottish+index+performs+in+line+with+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-scottish-index-performs-in-line-with-market.html","enabled":true},{"name":"email","url":"?subject=Scottish index performs in line with market&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-scottish-index-performs-in-line-with-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Scottish+index+performs+in+line+with+market http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-scottish-index-performs-in-line-with-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}