Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 16, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

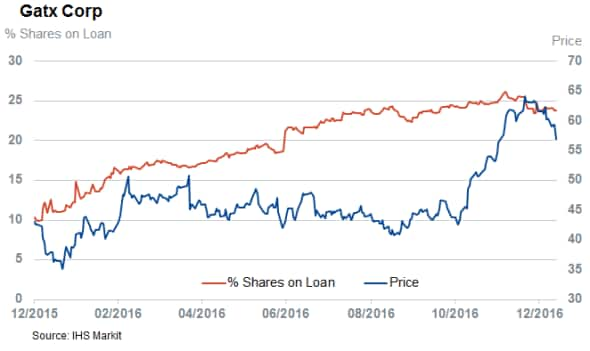

- Railcar leasing firm Gatx most shorted worldwide with 24% of its shares lent

- NCC sees record high short interest leading up to earnings

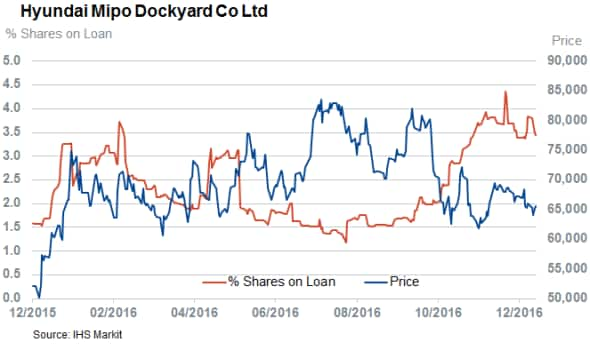

- Short sellers have been targeting shipbuilder Hyundai Mipo since US election

North America

Railcar leasing firm Gatx is the most shorted company announcing results next week with 24% of its shares out on loan. Gatx has been a painful play for short sellers as the company managed to beat earnings estimates for five straight quarters despite falling revenues. The last earnings update has proved particularly painful for Gatx bears as its shares have surged by over 30%. Short sellers have stood stoic in the face of the recent rally however as demand to borrow Gatx shares has remained steady near the all-time highs set in the closing weeks of last year.

Short sellers have been much less willing to ride the pain in the second most shorted firm announcing earnings this week; savings and loan holding company People's United. Demand to borrow its shares had fallen by over 20% since early November when the post-election has swept many of the market's least favorite stocks to new recent highs.

Banks, especially smaller regional institutions, have disproportionally felt this rally and we've witnessed large portions of short covering among many of the eight heavily shorted banks announcing earnings this week, all of whom are on the smaller end of the banking sector.

Another firm benefiting from the recent post-election rally is tool and building supplier Fastenal whose shares are up by over 20% since the first week of November. Unlike many stocks in the market however, the recent surge has nearly doubled in the last two and a half months.

Europe

In Europe, the only firm with significant shorting activity is cybersecurity firm NCC which has just over 8% of its shares outstanding on loan. Short sellers have had a good track record in NCC of late as the borrowed 6% of its share in October of last year. This was just before the firm announced a spate of contract cancelations which knocked 40% off its share price. NCC's shares have been trading sideways ever since, but this lack of momentum hasn't deterred short seller positions as evidenced by the fact that the demand to borrow these shares has increased by a third since the firm's most recent setback.

The only other firm to see any meaningful demand to borrow announcing earnings this week is Swedish bank Avanza Bank which has 3% of its shares on loan. However, short sellers have actively been covering their positions leading up to Avanza's earnings update next Thursday as demand to borrow its shares has fallen by 40% over the last three months.

Asia

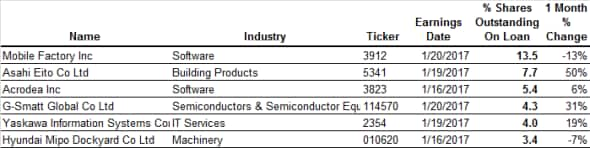

Asian short sellers as also face another calm week ahead as only six firms announcing earnings this week have more than 3% of their shares out on loan, although only one of these short targets has a market cap greater than $1bn.

This firm is shipbuilder Hyundai Mipo Dockyard which sees the least demand to borrow of this week's lot as only 3.4% of its shares are out on loan. Unlike US stocks which have generally seen covering in the last few months, demand to borrow Hyundai Mipo shares has increased significantly in the last couple month to the highest level in over a year which could indicate growing negative sentiment towards the volume of global trade which shipyards like Mipo are reliant on for demand.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16012017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}