Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 16, 2017

Scrip dividends boost European securities lending

European securities lending revenues are increasingly reliant on scrip dividends which have surged in popularity in the last ten years.

- Markit Dividend Forecasting expects 40 European firms to offer scrip options in 2017

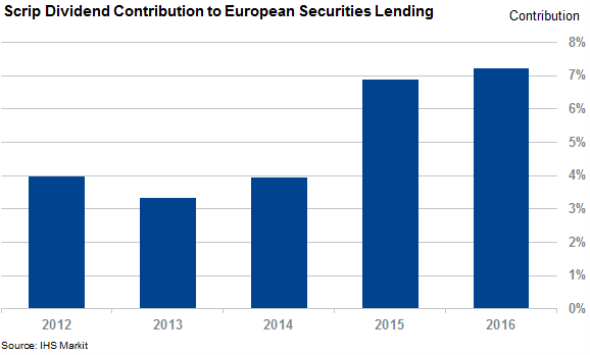

- Scrip dividends play a part in 7% of the European securities lending revenue

- Spanish banks are set to suspend their popular scrip payments

Please contact press@markit.com if you would like to receive a full copy of the Markit Dividend Forecasting 2017 Scrip Dividend report.

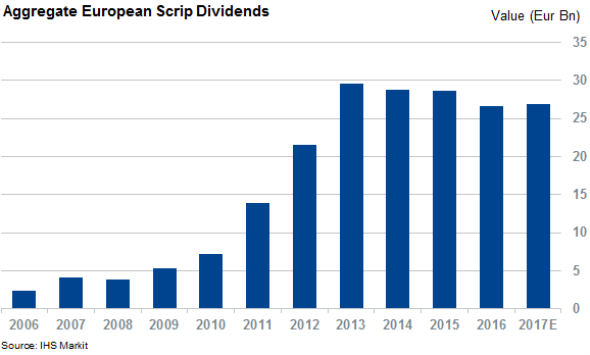

The total value of European scrip dividends has jumped ten-fold in over the last 10 years to reach "27bn in 2016. Economic headwinds in Europe have grown the cohort of cash conscious companies offering investors the option of receiving dividend payments in shares through scrip options. Unsurprisingly, financials and commodities companies have been some of the keenest scrip payers and have been responsible for two thirds of the "170bn of scrip payments in Europe paid out over the last decade.

The popularity of scrip dividends is showing no signs of slowing down anytime soon as Markit Dividend Forecasting is expecting 39 constituents of the Stoxx 600 index to pay at least one scrip dividend over 2017. This would see these firms issue "27bn of new shares, roughly the same as the 2016 total.

Securities lending market

While cash strapped companies benefit from offering scrip dividends, it's worth noting that scrip payments also offer advantages to shareholders. These advantages go beyond the discounted shares offered by some companies to entice investors to select shares over cash.

One key advantage is the optionality offered by scrip dividends as companies let investors make up their own minds on whether to receive payments in cash or in new shares. As both the share price and cash component of a scrip payment is set on the ex-date and investors generally have anything between one to four weeks to decide which type of payments to receive, scrips essentially offer an imbedded call option. Investors can strip this optionality by selling call options in secondary markets allowing them to receive more than the total cash value of the dividend on ex-date.

Shareholders who are mandated to only receive cash payments can still lock in this optionality through the securities lending market. The growing use of scrip dividends means that these payments are playing an increasingly large role in the European securities lending market. The numbers are significant as beneficial owners earned over $106m of securities lending revenues around the 85 scrip dividends paid by Stoxx 600 constituents last year. This represented 7.2% of the entire European securities lending revenue generated last year. This is significant given that revenues generated around scrip payments used to be responsible for less than 4% of the industry's total revenue as recently as 2014.

Optionality is most valuable among highly volatile companies so the fact that four of the firms which are forecast to make scrip payments in the coming 12 months are among the most volatile side of the market bodes well for securities lending revenues heading into 2017. These volatile scrip payers include utilities Aegon and EDF as well banks Barclays and Credit Suisse. The latter of the banks is especially significant as it is the third largest European scrip payer and the securities lending market generated $2.4m of revenues the last time it paid a dividend back in June of last year.

While significant, these numbers still pale in comparison to the $7.3m of securities lending earned by lending shares of largest scrip dividend payer, British bank HSBC. Its scrip optionality is doubly attractive as the bank pays its dividends in dollars, which allows investors to lock in from both forex and equity volatility.

Spain set to trim payments

While scrip dividends have enjoyed runaway success in the last decade there are indications that firms may look to start dialing back their payments in the coming years to avoid dilution of their earnings base. This is especially true for Spanish scrip dividends which also offered investors tax advantages up until last month. The change in tax circumstances means that BBVA and Santander will start to discontinue their scrip policies from 2017 onwards.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022017-equities-scrip-dividends-boost-european-securities-lending.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022017-equities-scrip-dividends-boost-european-securities-lending.html&text=Scrip+dividends+boost+European+securities+lending","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022017-equities-scrip-dividends-boost-european-securities-lending.html","enabled":true},{"name":"email","url":"?subject=Scrip dividends boost European securities lending&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022017-equities-scrip-dividends-boost-european-securities-lending.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Scrip+dividends+boost+European+securities+lending http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022017-equities-scrip-dividends-boost-european-securities-lending.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}