Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 16, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the week to come:

- Itt is the most shorted name ahead of earnings globally

In Europe, Burberry sees heavy short interest after disappointing results from its luxury goods peers

- Lenovo has seen a surge in short interest after announcing it was purchasing Motorola Mobility

North American earnings

This week sees first quarter earnings announcements start to tail off; there are only 20 companies announcing earnings with more than 10% of their shares out on loan.

Itt Educational Services is the most shorted company with over a third of total shares outstanding out on loan. Itt had seen shorts cover over much of last year as its shares tripled from their lows, but it has seen a resurgence in demand to borrow in the wake of a disappointing final quarter last year.

Shorts seem to have been justified in their recent activity, as Itt shares are down by 25% for the year. Retailers make up half of the heavily shorted companies announcing earnings this week as weak consumer confidence and poor weather have contributed to a disappointing quarter for the sector.

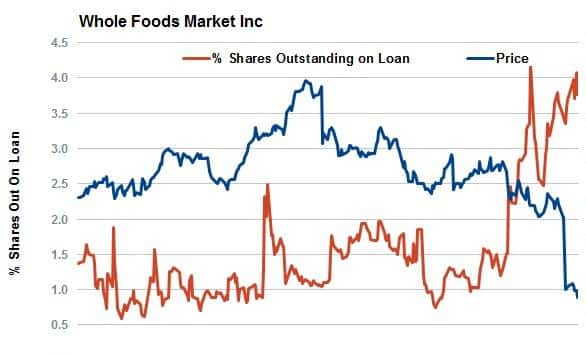

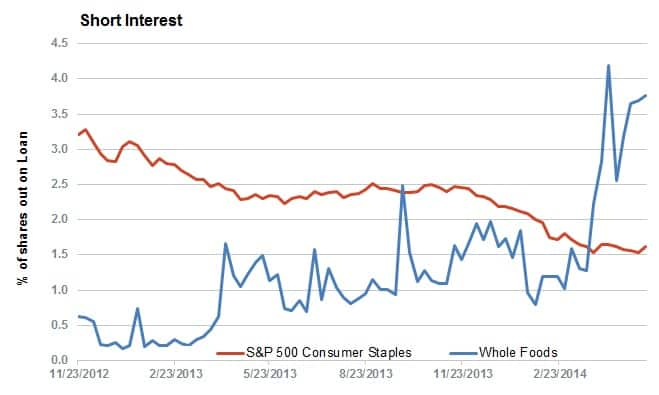

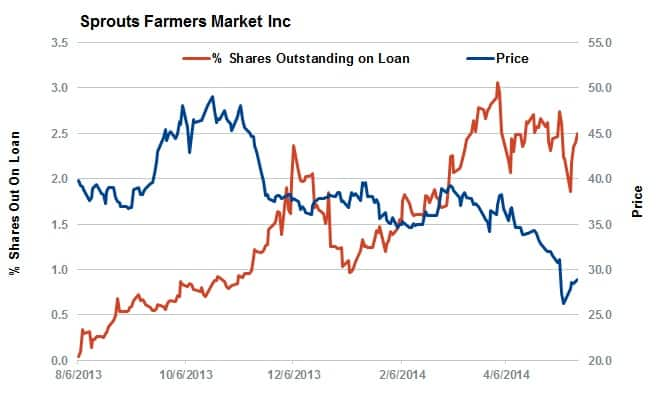

The one name that does stand out in the sector is Fresh Market which has seen short interest triple since the start of the year to an all-time high 15% of shares outstanding. Short interest surged most recently as competitor Whole Foods announced disappointing first quarter trading conditions which sent its shares down sharply. Shorts have been betting that Fresh Market will have faced the same headways as they have been increasing their positions by 13% in the month leading up to the company’s earnings announcement next Thursday.

More on this to follow later on in the week as we take an in depth look at short interest in the sector. On the short covering side, Chinese solar firm Trina Solar has seen shorts trim their positions by a fifth in the run-up to earnings. Shorts seem to be taking their cues from analysts, who are expecting the firm to post its first profit for the first quarter in over two years.

European earnings

Europe also sees relatively light earnings activity with four firms seeing more than 3% of shares out on loan ahead of announcements this week.

UK firms make up three of the four heavily shorted manes ahead of earnings led by APR Energy. APR, which specializes in turnkey power plants, currently has an all-time high demand to borrow after its share retreated by a quarter from their highs at the end of last year. While analysts are expecting results to show a strong improvement, the fact the Rolls Royce divested its energy generation unit and that rival Aggreco is the fourth most shorted name in the FTSE 100 will no doubt embolden short sellers in this niche market.

The company to see the largest surge in short interest is UK luxury firm Burberry Group which has seen demand to borrow jump by over 50% in the month leading up to earnings. Short sellers are no doubt taking their cues from disappointing results coming out of Italian firm Tod’s and falling sales from domestic rival Mulberry; both firms have seen shorts post new recent lows since the start of the year.

The largest short covering out of the four firms seeing high short interest comes from Golden Ocean which has seen an 18% reduction in short interest. This comes despite the fact that fellow shipping firm Eagle Bulk Shipping reported worse than expected earnings last week, pushing its shares to a new recent low.

Asian earnings

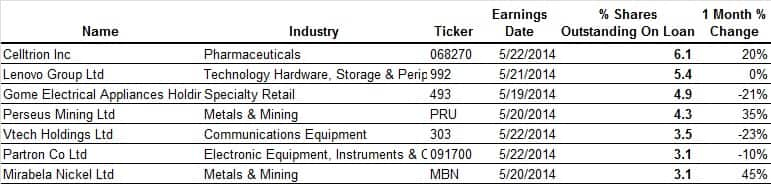

The Asian reporting season also starts to tail off this week with seven shares seeing more than 3% of shares shorted ahead of imminent earnings.

South Korean pharmaceutical firm Celltrion sees the most short interest with 6.1% of shares out on loan. The firm, which recently gained approval to market some of its products in Europe has seen shorts increase their positions by a fifth in the lead up to earnings.

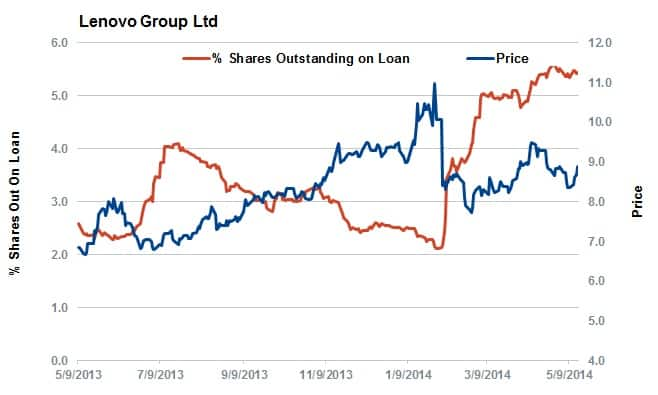

The second most shorted firm is computing firm Lenovo Group which has seen shorts increase their positions to a three year high after the company announced that it was purchasing Motorola Mobility from Google in January. Whether the acquisition proves to be a success remains to be seen, but analysts have been trimming their expectations for Lenovo’s final quarter of its fiscal year in the last three months.

Finally, Australian, mining firm Perseus Mining and Mirabela Nickel have seen large jumps in short interest in the run-up to earnings.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052014120000most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052014120000most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16052014120000most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}