Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 16, 2014

Euro sec lending revenues steady

Despite the fact that recent markets have not provided the most fertile ground for securities lending, we find that revenues generated across Europe have managed to stay level over the last 12 months.

- Revenues have stayed roughly flat in the first five months of the year as fees and balances remain stable

- Lendable growth has ensured that return to lendable posted new all-time lows in March

- Corporate actions driving the demand to borrow financial

In our look back at the year so far ahead of the upcoming ISLA conference, we find that European securities lending revenues have managed to stay relatively flat in the first five months of the year.

Aggregate revenues flat

Year to date, the aggregate revenues generated by lending European assets are roughly the same as they stood at last year.

This trend is driven by the fact that aggregate balances and fees have stayed roughly the same as figures seen 12 months ago. Again this should provide some solace as the current market environment offers pretty thin pickings for short sellers. Interestingly, the recent flat markets have seen the most shorted European shares underperform the rest of the market over the last two months.

As for the fees generated by lending European fixed income assets, which had been tipped as a potential growth driver, these have so far failed to grow materially. Year to date, fixed income has generated $220 million of revenues compared to $215 million over the same period a year ago.

All is not lost in that space however as much of the regulation tipped to drive fixed income revenue has yet to fully come on line. This is definitely a space to watch in the coming months.

Return to lendable falls on increased inventory

While equity fees and balances have stayed roughly flat, the same can’t be said for inventories which have managed to jump to all-time highs for the region. Currently, inventory stands at $2.25 trillion, a number that has increased by a third in the last 12 months.

This rise in new inventory has also raised complexities in the benchmark space as an ever increasing number of beneficial owners chase their share of a revenue pie that has failed to grow so far this year. To this end, Markit Securities Finance has launched a new benchmarking portal to answer the growing need for granular benchmarking across the industry.

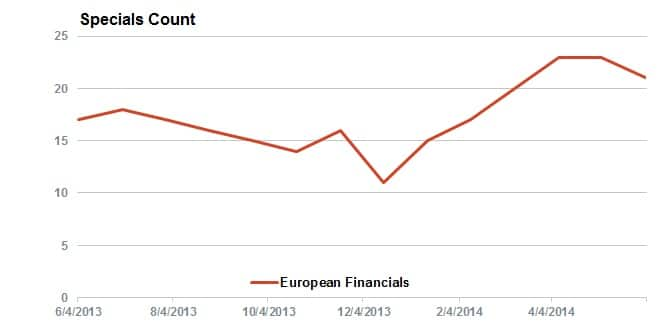

Special holding steady

While this rise in revenue has ensured that return to lendable and utilisation figures recently hit new lows in the run-up to dividend season, we’ve seen specials hold relatively steady in the face of this increased inventory. Specials have made up seven per cent of shares on average over the last 12 months; a number that has stayed roughly flat despite the all-time high inventory levels.

As for the fees charged for specials, they have also managed to hold steady around the 380bps mark.

Financial proves bright spot for specials

Although there has been little in the way of systemic shifts driving demand to borrow in the equities space, we’ve seen a resurgence in demand to borrow financials as European banks take advantage of the recent buoyant market conditions to shore up their capital base. The recent stream of rights issues from the likes of Banco Espirito Santo and Banca Monte dei Paschi has seen the number of specials trading European financials jump by a third over the last 12 months.

Benchmarking

To find out more about our new benchmarking portal, please reach out to your Markit representative.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062014120000Euro-sec-lending-revenues-steady.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062014120000Euro-sec-lending-revenues-steady.html&text=Euro+sec+lending+revenues+steady","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062014120000Euro-sec-lending-revenues-steady.html","enabled":true},{"name":"email","url":"?subject=Euro sec lending revenues steady&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062014120000Euro-sec-lending-revenues-steady.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Euro+sec+lending+revenues+steady http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062014120000Euro-sec-lending-revenues-steady.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}