Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 16, 2016

ECB corporate lifts all euro denominated debt

Fears that the ECB's decision to expand its quantitative easing program into the corporate bond space would amount to a back door subsidy for Eurozone corporates have not materialized.

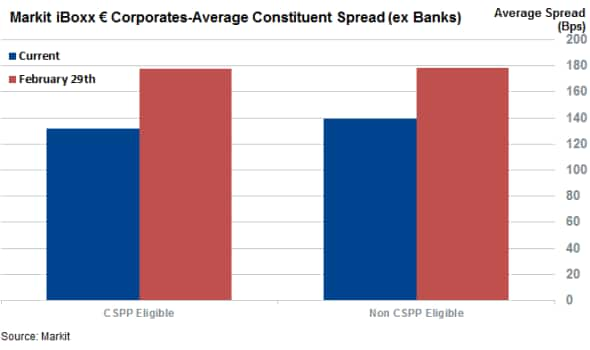

- CSPP has seen spreads from both non eligible and eligible euro IG bonds tighten by a fifth

- 98% of CSPP eligible bonds have seen spreads tighten since February vs 96% for non-eligible

- Euro denominated corporate bond ETFs have seen inflows taper off as yields fall to new lows

Despite only including debt issued by eurozone domiciled firms in the basket of investment grade corporate bonds eligible for purchase under the Corporate Sector Purchase Program (CSPP), the ECB's decision to include the asset class has benefited both eurozone and non-eurozone issuers evenly.

The extra yield demanded by investors to hold both by both eurozone and non-eurozone domiciled non-bank constituents of the Markit iBoxx " Corporates index has fallen roughly evenly since the announcement in late February, according to the latest analytics from Markit Bond Pricing.

The average spreads of CSPP eligible constituent bonds of the Markit iBoxx " Corporates index stood at 177bps in February 29th; that spread has since fallen by 46bps to 132bps, in a fall of roughly a quarter. Non CSPP eligible bonds have mirrored this trend nearly perfectly with average spreads across the 412 CSPP eligible constituents of the index falling by 22% over the same period of time.

The tightening is not driven by a minority of names on both sides of the eligibility divide given that 98% of CSPP eligible bonds are now trading with a tighter spread. The proportion of non eligible bonds that have seen spread tighten is lower at 96%, but the difference is hardly noticeable.

While some feared that the CSPP would essentially offer an implicit subsidy to eurozone corporates, the fact that the program has so far impacted the entire euro denominated bond field evenly indicates that this has yet to materialise one week after the program's implementation.

Investors continue to buy

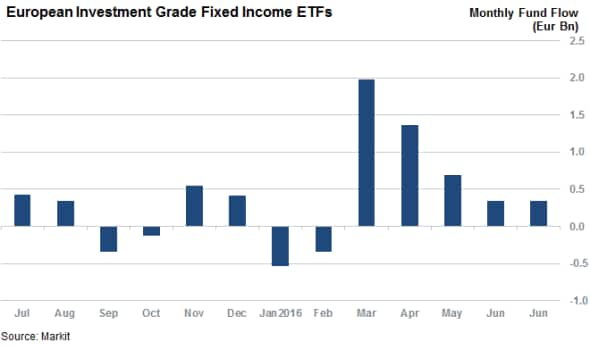

ETF investors seem to be keen to ride the improving investor sentiment seen in the asset class, as euro corporate bond exposed ETFs have seen large inflows in the four months since the CSPP was announced.

These inflows have stalled in recent weeks however as last month's inflow tally was one third of that seen in March. The recent collapse in yield seen in the asset class could be driving this tapering, given that investment grade euro denominated bonds now yield one quarter less than at the start of the CSPP program.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Credit-ECB-corporate-lifts-all-euro-denominated-debt.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Credit-ECB-corporate-lifts-all-euro-denominated-debt.html&text=ECB+corporate+lifts+all+euro+denominated+debt","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Credit-ECB-corporate-lifts-all-euro-denominated-debt.html","enabled":true},{"name":"email","url":"?subject=ECB corporate lifts all euro denominated debt&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Credit-ECB-corporate-lifts-all-euro-denominated-debt.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+corporate+lifts+all+euro+denominated+debt http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062016-Credit-ECB-corporate-lifts-all-euro-denominated-debt.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}