Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 16, 2017

Halcyon Days of the Markets

Research Signals

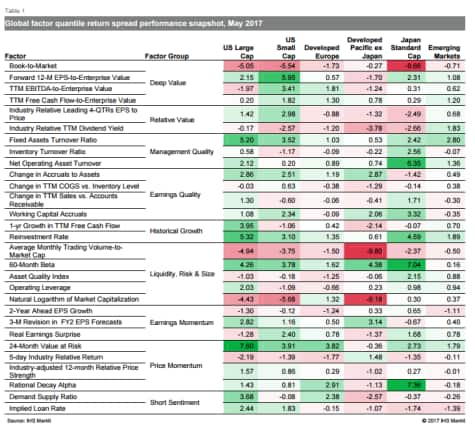

Whether artificial or natural, calm in the markets has persisted in spite of political and geopolitical risks, Moody's downgrade of China amid concerns that Chinese economic growth may slow and questions surrounding the impact of central bank policy tightening. Indeed, another small bout of volatility mid-May proved only temporary as global markets continued to push stock prices higher and momentum strategies benefited, while valuation saw mixed results between book value (negative) and earnings-based (positive) measures (Table 1). How much longer can markets sustain low volatility?

- US: 24-Month Value at Risk outpaced Book-to-Market by 13% and 9% among large and small cap stocks, respectively, while Forward 12-M EPS-to-Enterprise Value was a positive indicator, particularly for small caps, on strong earnings reports

- Developed Europe: Trend following captured by Rational Decay Alpha was a positively rewarded theme, though investors were cognizant of high short interest stocks according to Demand Supply Ratio

- Developed Pacific: Low beta was rewarded across developed Pacific markets, while Book-to-Market especially suffered in Japanese markets

- Emerging Markets: High quality stocks gauged by measures such as Fixed Assets Turnover Ratio were favored, though with less of a concern for valuation High quality stocks gauged by measures such as Fixed Assets Turnover Ratio were favored, though with less of a concern for valuation

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-Equities-Halcyon-Days-of-the-Markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-Equities-Halcyon-Days-of-the-Markets.html&text=Halcyon+Days+of+the+Markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-Equities-Halcyon-Days-of-the-Markets.html","enabled":true},{"name":"email","url":"?subject=Halcyon Days of the Markets&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-Equities-Halcyon-Days-of-the-Markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Halcyon+Days+of+the+Markets http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16062017-Equities-Halcyon-Days-of-the-Markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}