Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 16, 2015

Retailers struggle ahead of Black Friday

Last week's disappointing spending numbers and earnings updates took a chunk out of retail stocks; something which short sellers were well positioned to profit from.

- US retailers see the most shorting activity since 2012 after a 40% jump since April

- Mall stalwart Macy's and Nordstrom's saw increased short interest leading up to last week

- Investors fleeing retail ETFs with AUM down by nearly 50% in the last six months

Last week was a tough one for retail investors. Wednesday's disappointing Macy's earnings sent chills down the ranks of US retailers after the iconic retailer experienced its worst one day price decline since 2008. The bad news was echoed by fellow retailers Nordstrom's and JC Penney on Friday, which sent the sector's shares further into the red. The official consumer spending data released by the Commerce Department also added to the gloom felt by the sector as the October US retail sales number only grew by 0.1%, a third less than the number expected by analysts.

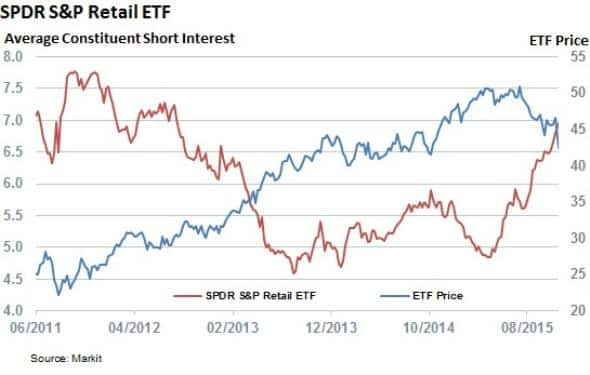

All this means that the retail shares as tracked by the SPDR S&P Retail ETF experienced their worst week since 2011 as the basket of shares which makes up the index fell by 8.4% last week. This strong pullback adds to the sector's recent woes as the ETF's shares are now trading over 15% lower than the all-time highs seen in July.

Short sellers invigorated

This pullback has not come unnoticed by short sellers as the average short interest across constituents has jumped by 40% since the ETF registered its summer highs. The current 7% of shares out on loan across the sector marks a level not seen since the middle of 2012 and highlights the uncertainty felt in retailers leading up to the start of the key holiday shopping season.

Perhaps equally important to the sector's investors, the recent surge in short interest has been pretty unanimous. Over 60% of the sector's constituents now see a greater demand to borrow than three months ago, demonstrating the across the board nature of the recent surge in short interest.

Multiline retail most shorted

Multiline retail has been the favourite target of short sellers of late as 12 constituents of the sub sector sees 8.3% of shares out on loan on average. Previously mentioned JC Penney, Nordstrom's and Macy's have all saw a significant rise in shorting activity in the last three months. The latter has seen shorts more than double over the period leading up to last week's collapse in its share.

Another significant name seeing rising short interest in the last three months is Target, which has 3.3% of its shares now shorted, 140% more than during its summer's highs. Target, which is due to report earnings on Wednesday, joins the cohort of heavily shorted retail names announcing earnings this week.

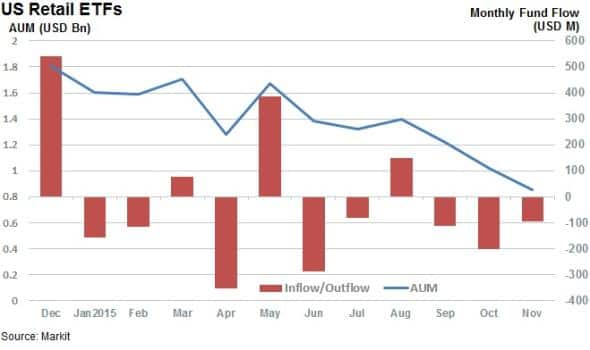

Investors rush to the door

There appears to be little appetite to buy the sector in the recent dip, and US exposed retail ETFs have seen significant outflows in the last three months. These outflows, $400m so far, mean that the three sector ETFs have seen their AUM atrophy by 49% since the end of summer.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-Equities-Retailers-struggle-ahead-of-Black-Friday.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-Equities-Retailers-struggle-ahead-of-Black-Friday.html&text=Retailers+struggle+ahead+of+Black+Friday","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-Equities-Retailers-struggle-ahead-of-Black-Friday.html","enabled":true},{"name":"email","url":"?subject=Retailers struggle ahead of Black Friday&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-Equities-Retailers-struggle-ahead-of-Black-Friday.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Retailers+struggle+ahead+of+Black+Friday http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112015-Equities-Retailers-struggle-ahead-of-Black-Friday.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}