Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 16, 2016

UK households grow gloomier on finances amid expected inflation-squeeze

The first available indication of household well-being in November pointed to escalating worries about future finances. New survey data highlight how households are struggling to support existing spending due to weak income growth and rising prices, and how this negative trend is widely expected to intensify in coming months.

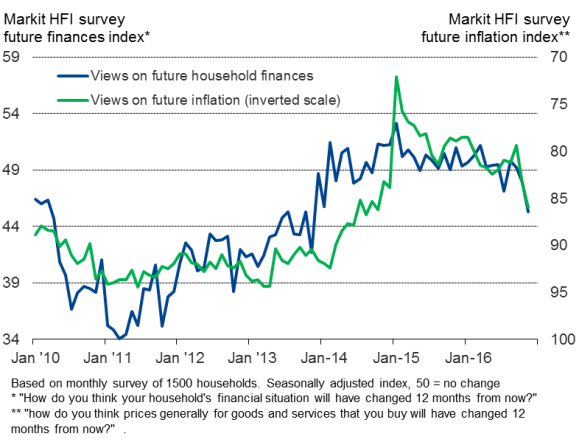

Households' expectations about finances and inflation

IHS Markit's Household Finance Index (HFI), a survey of 1,500 UK households, found the outlook for personal finances over the coming year to be the gloomiest for three years.

The darker mood stemmed mainly from fears of spending power being eroded by rising prices. The survey's gauge of expected inflation in the coming year rose to its highest since October 2014.

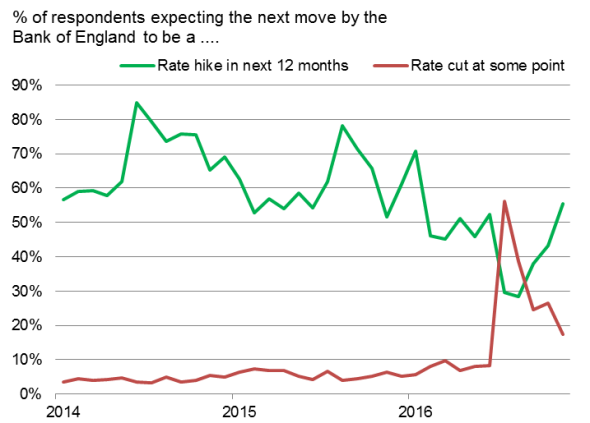

HFI survey interest rate expectations

Worries about higher interest rates, and therefore borrowing costs, also contributed to the downbeat view of the year ahead. For the first time since June's Brexit vote, more than half of survey participants (55%) expect the Bank of England to hike interest rates at some point during the next year.

The proportion of survey respondents expecting the next move from the Bank of England to be a rate cut has meanwhile fallen from 56% in July to just 17% in November.

Current finances also continued to be squeezed. Although overall spending continued to rise, the upturn was driven by households eating into their savings. The November survey recorded the biggest drop in savings for six months. This need to use savings to support additional spending was in part due to income from employment more or less stagnating.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-economics-uk-households-grow-gloomier-on-finances-amid-expected-inflation-squeeze.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-economics-uk-households-grow-gloomier-on-finances-amid-expected-inflation-squeeze.html&text=UK+households+grow+gloomier+on+finances+amid+expected+inflation-squeeze","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-economics-uk-households-grow-gloomier-on-finances-amid-expected-inflation-squeeze.html","enabled":true},{"name":"email","url":"?subject=UK households grow gloomier on finances amid expected inflation-squeeze&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-economics-uk-households-grow-gloomier-on-finances-amid-expected-inflation-squeeze.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+households+grow+gloomier+on+finances+amid+expected+inflation-squeeze http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16112016-economics-uk-households-grow-gloomier-on-finances-amid-expected-inflation-squeeze.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}