Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 17, 2016

Investors bet on long bonds in search for yield

The long maturity Treasury bond has proved fruitful as investors fret about volatile markets, stagnant growth and sliding inflation.

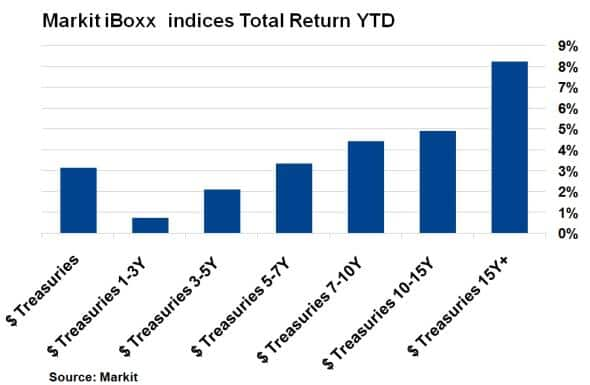

- The Markit iBoxx $ Treasuries 15+ index has returned 8.24% so far this year

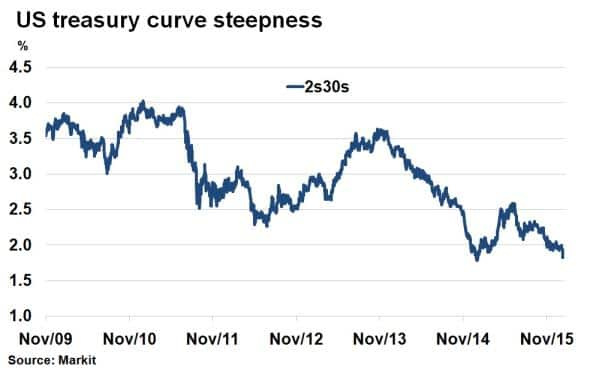

- The 2s30s US Treasury bond yield basis is close to tightest since the financial crisis of 2008

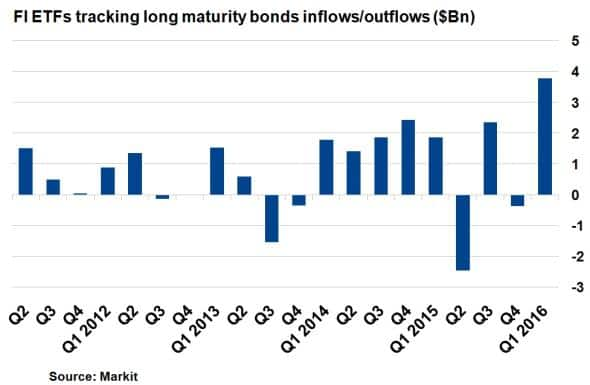

- FI ETFs tracking long maturity bonds have seen $3.8bn of inflows so far in Q1 2016

Market volatility and depressed inflation expectations have shifted fixed income investor sentiment towards long maturity high credit quality bonds in search for yield.

The Markit iBoxx $ Treasuries 15+ index has returned 8.24% so far this year as the 30-yr US treasury bond yield has fallen from 3.03% to 2.66% according to Markit's bond pricing service. In comparison, short term US treasury bonds, heavily influenced by the Fed funds rate, have seen paltry returns in comparison. The Markit iBoxx $ Treasuries 1-3+ index returned 0.75% so far this year, despite a fall in short term yields as further rate hike expectations faded into the future.

Investors favour long bonds

The returns have proved fruitful for investors who have been piling into longer maturity bonds via ETFs. According to Markit ETP there has been $3.6bn of new inflows into fixed income ETFs since 2016. This is set to be the biggest quarterly inflow on record.

With investors shunning the riskier, higher yielding side of the bond market, investors have turned their attention towards longer maturities in search for yield. Safe from inflation eating into returns (for now), US treasuries have been the first in line for investors, but high quality corporate issuers have also seen much demand. Apple, the AA rated tech giant, recently issued a 30-yr bond at around 215bps over treasuries to an oversubscribed order book.

US yield curve flattens

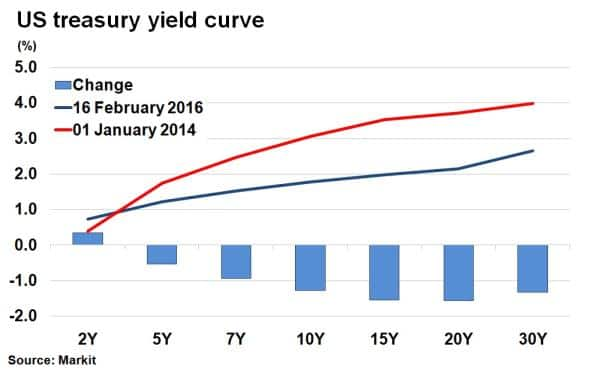

The demand for longer maturities has however not been a recent phenomenon. The past few years have seen a dramatic shift in the term structure of US interest rates.

Since the start of 2014, only the 2-yr maturity has seen a widening in yields, every other maturity cohort has seen a fall with 20-yr US treasuries experiencing the biggest with 156bps. No inflation, suppressed term premiums and the prospect of higher short term rates has pivoted the US treasury curve clockwise.

The result has been a much flatter US treasury curve, usually a sign of a slowing economy, and sometimes a pre cursor to economic recessions. The difference between 2-yr and 30-yr treasuries, sometimes referred to as the 2s30s basis, has fallen to 1.92%, a few bps off post financial crisis lows. Spurred on by talks of negative interest rates, the effects of a flatter US treasury curve have already been felt in the banking sector, where current and future lending margin expectations have been slashed.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-credit-investors-bet-on-long-bonds-in-search-for-yield.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-credit-investors-bet-on-long-bonds-in-search-for-yield.html&text=Investors+bet+on+long+bonds+in+search+for+yield","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-credit-investors-bet-on-long-bonds-in-search-for-yield.html","enabled":true},{"name":"email","url":"?subject=Investors bet on long bonds in search for yield&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-credit-investors-bet-on-long-bonds-in-search-for-yield.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+bet+on+long+bonds+in+search+for+yield http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-credit-investors-bet-on-long-bonds-in-search-for-yield.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}