Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 17, 2016

Chinese financials lead country's dividends

Chinese financials are forecasted to boost their dividend payments to record levels, defying growing fears that the country may be about to face its own credit crisis.

- Aggregate dividends from Chinese financial services are set to grow by over 10% in fiscal 2016

- Falling share prices and dividends has seen bank yields jump by 80bps to 4.4%

- Short sellers have steered clear of financials as no firm sees any meaningful short interest

The news that China may be about to face its own debt crisis does not look to have reached the executive floor of the country's financial firms, as Chinese banks and the rest of the financial services universe are set to continue to grow their dividend payments in the coming fiscal year.

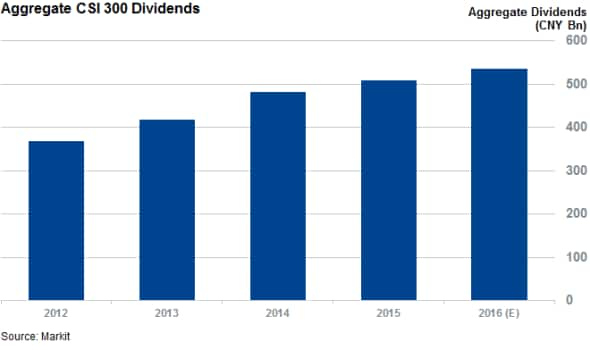

Markit's dividend forecasting service is expecting the financials which feature in the CSI 300 index to boost their aggregate dividends by over 10.3% in the coming fiscal year to reach an aggregate CNY 319bn. This is over twice the pace of growth seen by Chinese blue chip stocks as the aggregate dividend payments made by the index's constituents is only forecasted to grow by 5.3% over the same period of time.

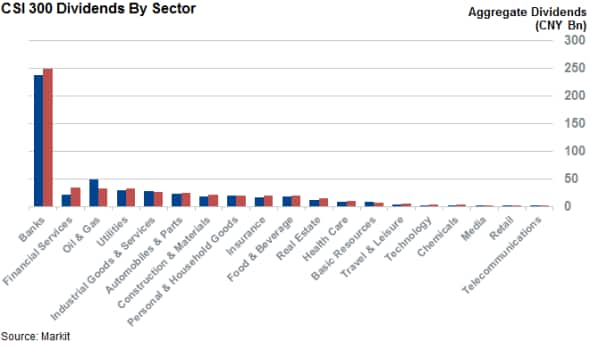

This strong performance from financials means that Chinese dividends will be even more dependent on the sector's performance, as these firms will make 60% of the total dividends payments across the index. That proportion has steadily crept up in the last four years; the sector only made 53% of all CSI 300's dividend payments in 2012.

Banks mainstay of dividends

Banks, which pay out the backbone of Chinese dividends, are set to see their aggregate payments trail the rest of Chinese large cap field somewhat in the coming year as their payments are set to grow by 4.3% over 2016. This is most likely driven by recent events as Chinese the four largest banks, Agricultural Bank of China, Industrial and Commercial Bank, China Construction Bank and Bank of China all cut their payout ratios to 33% last year, from 35%.

Despite this, the recent fall in share prices means that the banks are set to offer the most attractive dividend yield out of any sector. Average yields across the sector now stands at 4.4%; 80bps more than delivered last year.

Rest of the financials pick up slack

While bank dividends are set to have a relatively quiet year in 2016, the rest of the financial services firms are picking up the pace as real estate, insurance and financial services firms are all set to see their aggregate dividends jump by more than 20%.

Financial services firms, whose broker constituents are benefiting from China's newfound appetite for equity trading, are set to post the largest dividend growth of any sector, as payments made by the 24 firms which feature in the CSI 300 are set to grow by 62% in the coming year.

Short sellers staying clear

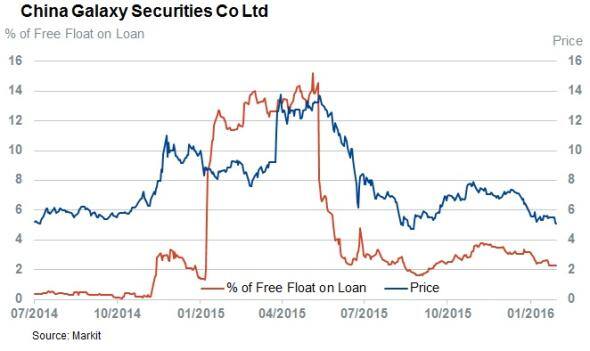

The bullish sentiment emanating from financials' dividend policies is also reflected in the fact that not one Chinese bank or financial services firm whose shares trade in the Hong Kong H Share market sees more than 3% of its free float on loan at present.

The only firm to see any significant demand to borrow is China Galaxy Securities which has 2.3% of its free float on loan. That number has come down by more than two thirds from the highs seen last year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-equities-chinese-financials-lead-country-s-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-equities-chinese-financials-lead-country-s-dividends.html&text=Chinese+financials+lead+country%27s+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-equities-chinese-financials-lead-country-s-dividends.html","enabled":true},{"name":"email","url":"?subject=Chinese financials lead country's dividends&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-equities-chinese-financials-lead-country-s-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+financials+lead+country%27s+dividends http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17022016-equities-chinese-financials-lead-country-s-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}