Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 17, 2015

UK home construction paying dividends

The relentless increase in house prices in the UK and subsequent earnings growth of UK homebuilders has filtered down into strong share price growth and attractive forward dividend yields.

- More than half of UK homebuilders' shares exhibit strong positive earnings momentum

- Average 12-month forward dividend yield of 3.7% expected for UK

- Large capital distributions indicate lack of investment opportunities for homebuilders

Post-election momentum building

The UK housing market continues to reach new heights as average selling prices continue to inch higher amid a shortage of supply and insatiable demand. Record low interest rates and indications of a pickup in wage growth has also created a supportive environment for rising home prices.

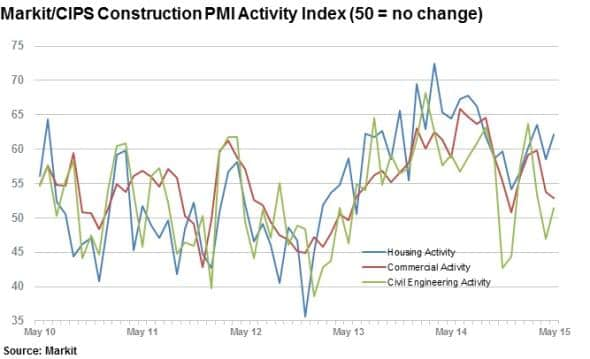

This has boded well for homebuilders as homebuilding activity has been the standout growth story construction sector, according to the Markit/CIPS Construction PMI data.

Housing activity levels have hovered around the 60 mark in 2015; a positive level for the industry. With 50 indicating 'no change' in activity, housing activity is well above that of commercial and civil engineering which has hovered around the 50 level.

Ranking the builders

These buoyant trading conditions are translating into strong returns as well as increasingly bullish analyst sentiment, according to Markit Research Signals. UK homebuilders, which make up the Markit Developed Europe Universe; a universe of 1,300 European equities representing over 90% of European shares by market cap, currently rank amongst the best European shares for price momentum and price revision.

The 1-year Price Momentum factor, which ranks stocks by underlying price trends adjusted for volatility, shows that UK construction firms are currently ranked highly. Four of the seven UK home building firms in the Markit Developed Europe universe currently sit in the top 10% of shares with the most attractive price momentum. Barratt, Bellway, Persimmon and Taylor Wimpey all have managed to outpace the wider field of European equities, despite the recent strong run in continental shares.

These rankings should not be surprising as the seven UK home builders represented in the Developed Europe Universe have seen their shares increase by 63% on average over the last 12 months.

Analyst expectations are also proving resilient as UK homebuilders rank in the top quartile of firms according to the Time Weighted Earnings Revision Dispersion factor. This positive average factor ranking implies that on average, earnings growth forecasts have increased by more for UK homebuilders. Earnings growth in the region has in a large part been influenced by house price growth.

An example of the stellar house price increases seen in the UK is shown in the annual results for premium home builder Berkeley. While the company sold almost 200 fewer homes during the year ending April 2015, the average selling price per home rose from "423,000 to "575,000.

Paying dividends

The return of capital to investors through special dividends indicates the potential lack of investment opportunity for homebuilders that would provide sufficient rates of return. This should ensure the continued undersupply of houses in the market, higher prices and thus continued expectations of strong dividend growth in the future.

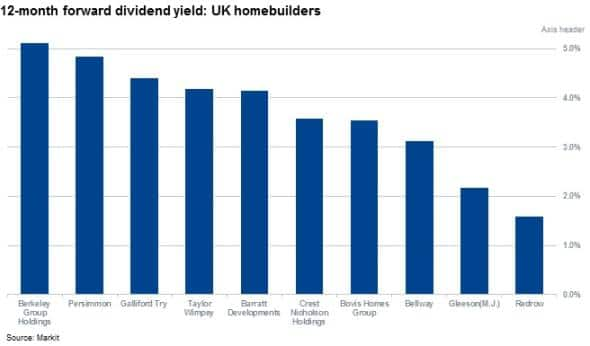

Investors in homebuilders look set to be rewarded in 2015 and beyond through bumper special dividend pay-outs and increased future dividend yields.

According to Markit Dividend Forecasting, aggregate total dividend payouts for the sector are expected to grow by 64% in 2015 to "1329. This represents underlying growth of 26% in ordinary dividends which is less than half of the previous year's growth of 58%.

Berkley currently has the highest expected forward 12 month dividend yield at 5.1%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Equities-UK-home-construction-paying-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Equities-UK-home-construction-paying-dividends.html&text=UK+home+construction+paying+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Equities-UK-home-construction-paying-dividends.html","enabled":true},{"name":"email","url":"?subject=UK home construction paying dividends&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Equities-UK-home-construction-paying-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+home+construction+paying+dividends http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17062015-Equities-UK-home-construction-paying-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}