Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 17, 2016

Back to school bears surge

US short sellers have been covering their positions so far in Q3, but the apparel retail sector has seen short interest increase heading into the key back to school shopping period.

- US apparel retailers now 15% more shorted than the previous back to school shopping period

- Stage Store most shorted retailer with over 25% of its shares out on loan

- Nordstrom has seen the largest rise in shorting activity compared to last back to school

The US 'back to school' shopping period is second only to the December holiday shopping period in terms of contribution to retailers' yearly revenue totals. This year's back to school timeframe could prove doubly important for the US apparel and broad-line retail sector, which has experienced a marked jump in short interest from the same time a year ago.

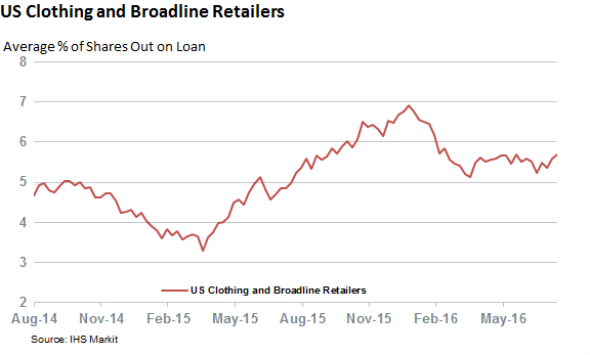

Despite the US retail federation's expectations for spending to rise by 10% from last year's levels, the ever growing threat of online competition and shifting consumer taste has made the sector a target of short sellers; now suffering twice the average short interest seen in the S&P 500. Its constituents now have 5.7% of shares shorted on average, a 15% increase from the same time last year. Bearish sentiment also shows no signs of slowing down heading into the back to school shopping period. Short interest in the sector has stayed roughly flat so far in the second quarter while the S&P 500 constituents have seen a 5% fall in average short interest.

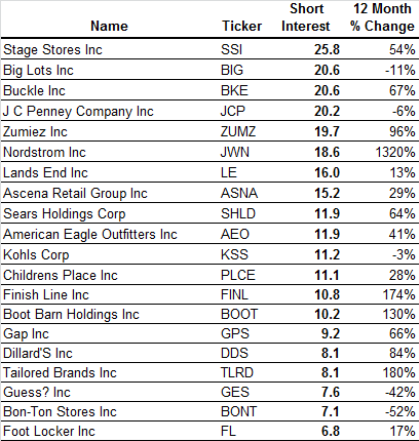

As ever in short selling, this bearish sentiment has disproportionally fallen on several short favorites. This year's favourite back to school short target is US regional department store operator Stage Stores, which has over a quarter of its shares shorted. Stage short sellers are no doubt honing in on the firm's large exposure to parts of the US that have disproportionately felt the slump in oil prices, given that a large number of its stores are situated in oil-focused states. The firm alluded to its last set of post-back to school earnings which saw it report a 3.5% fall in comp sales. Short sellers appear to be positioning for more trouble ahead.

Another notable department store short position is in upscale Nordstrom, whose current short interest is a massive 13 times higher than at the same time last year. Nordstrom reported relatively upbeat second earnings and raised its full year guidance last week which sent its shares sharply higher, but short sellers have shown no signs of capitulating with short interest remaining near its pre-earnings all-time high.

The only heavily shorted retailer which has seen any material amount of short covering over the last 12 months is US discount retailer Bog Lots whose current short interest stands a tenth lower than at the same time last year. Short sellers have added to their bets recently however, which have doubled from the recent yearly lows which indicates that short sellers are yet to be fully convinced by Big Lot's recent surging share price. Short sellers have also trimmed positions in JC Penney.

On the clothing side, short sellers are relatively more bearish towards Buckle, Zumiez and American Eagle compared to the last back to school run, and all three now have more than 12% of their shares shorted.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082016-Equities-Back-to-school-bears-surge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082016-Equities-Back-to-school-bears-surge.html&text=Back+to+school+bears+surge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082016-Equities-Back-to-school-bears-surge.html","enabled":true},{"name":"email","url":"?subject=Back to school bears surge&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082016-Equities-Back-to-school-bears-surge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Back+to+school+bears+surge http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17082016-Equities-Back-to-school-bears-surge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}