Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 17, 2014

Lower US inflation rates provide leeway for loose policy

Inflation rates cooled around the globe in August, suggesting the global economic upturn remains too weak to generate price pressures to an extent that will worry policymakers into hiking interest rates. Instead, lower inflation rates may lead to further stimulus in some economies.

The annual rate of US inflation fell to a five-month low of 1.7% in August, down sharply from 2.0% in July. Inflation also fell in the UK, down to 1.5% and the joint-weakest seen over the past five years.

Inflation also cooled in China, down to a four-month low of 2.0%, and the latest data for Japan likewise showed a moderation to 3.4% in July. Inflation in the Eurozone is meanwhile stuck at just 0.4%.

Lack of inflationary pressures

Traditional leading indicators of inflation suggest there are few worries about inflation spiking higher in coming months.

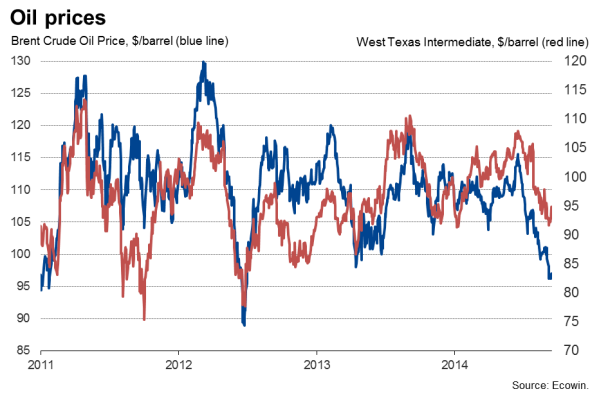

First, oil prices have fallen in recent months, with Brent Crude and West Texas Intermediate both down below $100 per barrel. The former is down some 16% since June. The markets have brushed off geopolitical concerns as new supplies from the US suggest there is sufficient energy capacity to meet global demand. Energy demand is widely expected to remain somewhat subdued as the pace of economic growth in the world's emerging markets, notably China, continues to disappoint.

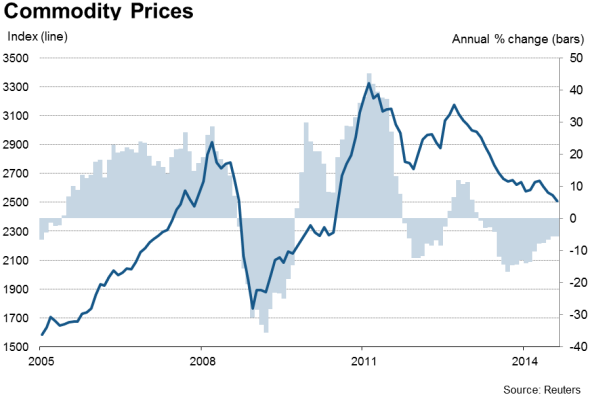

Second, commodity prices in general have softened in the face of the weakened global economic outlook. According to Reuters, commodity prices have fallen almost 25% from their early-2011 peak.

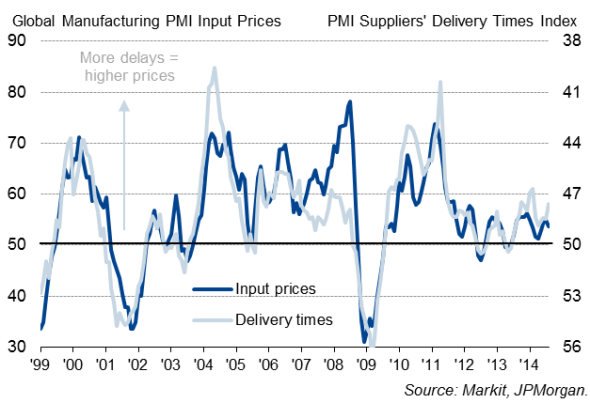

Third, Markit's global PMI data show prices charged by companies for goods and services having barely risen in August, continuing the trend of weak pricing power seen since early-2011.

Global PMI price pressures

The Global PMI Suppliers' Delivery Times Index - a key gauge of capacity constraints - meanwhile suggests that there are few price pressures building in the supply chain, with lead-times largely unchanged over the summer months as demand and supply have been broadly in balance.

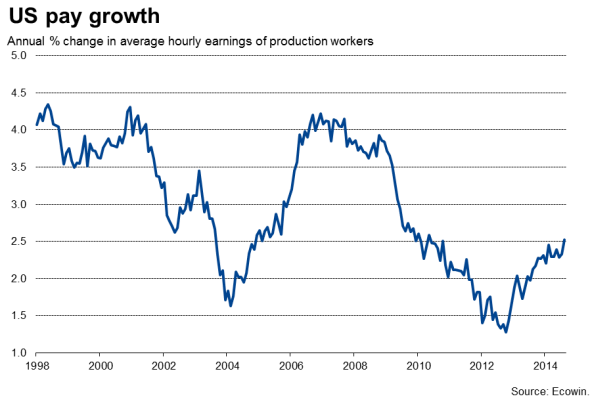

Finally, there have been few signs of wages picking up, even in fast-growing economies such as the US and UK, though the situation may start to change soon. The employment cost index for the US showed the largest gain for over five years in the second quarter, and more recent data on the production industries showed annual wage growth picking up to 2.5% in August, its highest since October 2010.

In the UK, there are no such signs of wages picking up, at least according to the official data. Regular pay rose just 0.7% on a year ago in the three months to July, a joint-record low. However, more up-to-date recruitment industry survey data point to strong increases in pay, which may start to feed through into the official data in the second half of 2014.

US and UK watching pay trends for policy guidance

Low rates of inflation are especially important in the UK and US, as both countries are seeing strong economic growth. Policymakers will be keen to hike rates as soon as inflation picks up to save having to tighten policy more aggressively at a later date. PMI survey data point to both countries growing strongly again in the third quarter. The downturn in price pressures therefore buys time before the majority of policymakers believe that rates might need to start rising, but both the Fed and Bank of England stress that pay trends will be a key determinant of the timing and speed of interest rate rises.

In contrast to the US and UK, the easing of inflationary pressures in China and Japan are seen as opening the door for further central bank stimulus, needed to prevent economic growth waning.

Asia stimulus

Recent data out of China showed a worrying slowdown in industrial production and retail sales, suggesting the government may miss its 7.5% growth target for the year. The People's Bank of China appears to have responded with measures to inject more liquidity into the banking system, following up on a mini-stimulus package earlier in the year, which included the bringing-forward of planned infrastructure spending.

In Japan, inflation is running at 3.4%, down for a second-successive month from 3.7% in May, a spike caused by a rise in the country's sales tax on April 1st. The government is still seeking to kill of the deflation that has plagued the country since the 1990s. More stimulus may therefore be needed to keep prices growing once the impact of the April tax hike falls out of the year-on-year comparisons next year, especially as recent business survey data point to the economy struggling to regain growth momentum in the aftermath of the tax rise.

Eurozone deflation

The biggest concerns about deflation are still found in the Eurozone. With inflation holding steady at a meagre 0.4% in August, expectations are mounting that the ECB may need to do more to boost the economy. PMI data showed growth likely to have rebounded in the third quarter, but nevertheless remained modest and certainly insufficient to have any meaningful impact in reducing the region's near-record rate of unemployment. The ECB has already announced two stimulus packages this year, and expectations have grown about the possibility of full-scale quantitative easing being announced as well, whereby the ECB buys government debt.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-Lower-US-inflation-rates-provide-leeway-for-loose-policy-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-Lower-US-inflation-rates-provide-leeway-for-loose-policy-.html&text=Lower+US+inflation+rates+provide+leeway+for+loose+policy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-Lower-US-inflation-rates-provide-leeway-for-loose-policy-.html","enabled":true},{"name":"email","url":"?subject=Lower US inflation rates provide leeway for loose policy&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-Lower-US-inflation-rates-provide-leeway-for-loose-policy-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Lower+US+inflation+rates+provide+leeway+for+loose+policy http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-Lower-US-inflation-rates-provide-leeway-for-loose-policy-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}