Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 08, 2024

Week Ahead Economic Preview: Week of 11 November 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US inflation and European GDP updates to help plot policy paths

The future paths of central bank interest rates have become blurred with the prospect of radically different US policy under Trump 2.0, but updates to US inflation and GDP growth in the eurozone and UK will help guide near-term market expectations of what scope central banks have to loosen policy further in the near-term.

October's PMI surveys indicated a sustained robust expansion of the US economy which contrasted with weak growth in Europe. This divergence will likely be further highlighted via official data releases for GDP in the US and eurozone in the coming week, alongside updated monthly industrial production and retail sales in the US.

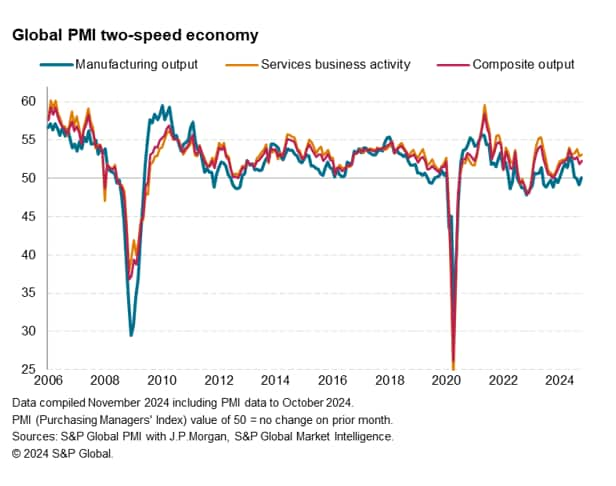

Growth in both the US and Europe is currently skewed towards services and the consumer, according to the PMIs, which portray a global expansion that is unusually lop-sided. A strong service sector contrasts with a stalled global manufacturing economy, the latter notably weak in Europe.

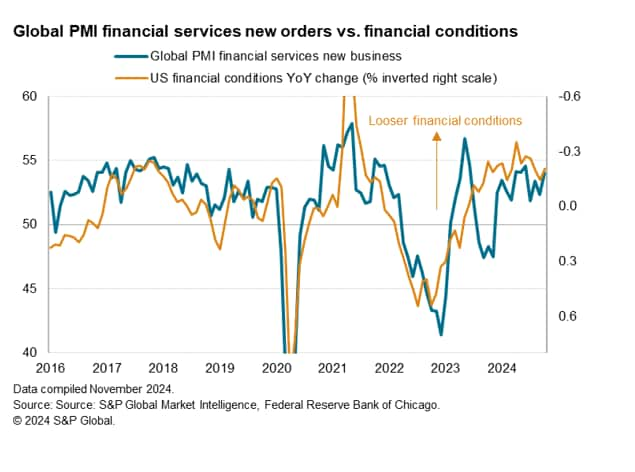

In the absence of a healthy manufacturing economy, growth in the services economy is instead being supported by rising demand for financial services. This is in turn a reflection of looser financial conditions which, alongside elevated markets, includes lower interest rates. Further cuts to policy rates in the US and the UK in early November will have added more stimulus. Hence, guidance on the Fed's next move will be sought from the updated consumer price data from the US, due on Wednesday.

The question remains as to whether lower interest rates can stimulate other components of healthy economic growth worldwide, notably business investment, in an uncertain climate. Business confidence remains in the doldrums, as proxied by PMI data on new orders for capital equipment. Capex spending is being subdued by heightened economic uncertainty, particularly around protectionism. Any further clarity on US economic policy in the new Trump era will thus be eagerly assessed by markets in the coming week.

In the same vein, updated industrial production and retail sales data from mainland China will help gauge the impact of recent government stimulus announcements, with the PMI having already alluded to improved business conditions in October.

Key diary events

Monday 11 Nov

Japan BOJ Summary of Opinions (Oct)

Turkey Industrial Production (Sep)

Turkey Unemployment Rate (Sep)

Mexico Consumer Confidence (Oct)

Mexico Industrial Production (Sep)

Tuesday 12 Nov

Australia Westpac Consumer Confidence Change

Australia NAB Business Confidence (Oct)

Germany Inflation (Oct, final)

United Kingdom Labour Market Report (Sep)

Germany ZEW Economic Sentiment (Nov)

Brazil Retail Sales (Sep)

India Industrial Production (Sep)

India Inflation (Oct)

Brazil Business Confidence (Nov)

United Kingdom Regional Growth Tracker* (Oct)

Global GEP Supply Chain Volatility Index* (Oct)

S&P Global Investment Manager Index* (Nov)

Wednesday 13 Nov

South Korea Unemployment Rate (Oct)

France Unemployment Rate (Q3)

Eurozone Industrial Production (Sep)

United States Inflation (Oct)

China (Mainland) New Yuan Loans, M2, Loan Growth (Oct)

S&P Global Business Outlook* (Oct)

Thursday 14 Nov

Australia Employment (Oct)

Sweden Inflation (Oct, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Sep)

United Kingdom GDP (Q3, prelim)

Spain Inflation (Oct, final)

Eurozone GDP (Q3, 2nd est.)

Eurozone Employment Change (Q3, prelim)

United States PPI (Oct)

Friday 15 Nov

Brazil, India Market Holiday

Japan GDP (Q3, prelim)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset

Investment (Oct)

China (Mainland) House Price Index (Oct)

Indonesia Trade (Oct)

Malaysia GDP (Q3)

Germany Wholesale Prices (Oct)

France Inflation (Oct, final)

Hong Kong SAR GDP (Q3, final)

Italy Inflation (Oct, final)

United States Retail Sales (Oct)

United States Industrial Production (Oct)

United States Business Inventories (Sep)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US inflation, retail sales, industrial production data, Fed comments

Following the Federal Open Market Committee (FOMC) meeting this week, US CPI data will be due Wednesday, 13 November, for insights into inflation developments and the path forward for the Fed. According to the consensus, US core inflation is expected to hover just above 3.0% going into the fourth quarter, and may ease further in the coming months in accordance with the signals from the US PMI. Additionally, US activity data including retail sales and industrial production will also be updated for October. Latest PMI data again alluded to the divergence in sector performance, with falling manufacturing production hinting at soft industrial production performance while a marked improvement in the service sector is often a good indication that robust growth has been sustained for retail sales. Fed comments will also be heard through the week, helping focus minds on the potential for another rate cut in December.

EMEA: UK GDP and jobs report, Eurozone GDP, employment and industrial production

The UK releases Q3 GDP on Thursday plus detailed sector output data for September. Official confirmation of the third quarter growth rate will be watched with more up-to-date October data having indicated that quarterly GDP growth in the UK has likely further slowed to 0.1% in October. UK employment data for September will also be keenly tracked after jobs growth was shown to have near-stalled according to PMI indications, before declining in October.

A revised Q3 eurozone GDP reading will be anticipated after a stronger than expected flash 0.4% estimate, in addition to employment and industrial production figures.

APAC: China industrial production, retail sales, Japan GDP, Australia employment

Mainland China's industrial production and retail sales numbers will be updated for October at the end of the week. Early signs of supportive policy measures lifting manufacturing production performance were observed from the latest Caixin China General Manufacturing PMI while services activity growth had also accelerated.

Separately, Japan's Q3 GDP will be due Friday.

S&P Global Business Outlooks, Investment Manager Index and Global Supply Chain Volatility Index

Business outlook surveys based on PMI findings in October will be released for insights into expectations surrounding growth, hiring, profitability, price and capex spending.

The new week also brings monthly S&P Global Investment Manager Index, tracked around the US election result release period, and the Supply Chain Volatility Index.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-november-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-november-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+11+November+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-november-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 11 November 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-november-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+11+November+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-11-november-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}