Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 07, 2024

Global PMI selling price inflation at four-year low in October

The worldwide PMI surveys showed average prices charged for goods and services rising globally at the slowest rate recorded for four years in October. The further easing of price pressures hints at an ongoing moderation of global consumer price inflation in the months ahead, down to levels approaching long-run averages. Services inflation showed a notably welcome easing.

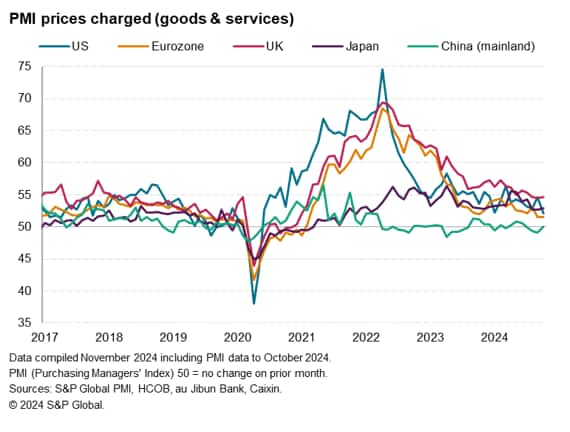

US selling price inflation cooled especially sharply in October, though particularly soft readings were also again seen in the eurozone and to a lesser extent the UK. Prices meanwhile stabilised in mainland China.

Global PMI selling price inflation at four-year low

Average prices charged for goods and services rose at the slowest rate for four years in October. At 52.0, down from 52.5 in September, the latest global PM Average Prices Charged Index was the lowest since October 2020.

Global consumer price inflation was meanwhile estimated at 3.6% in September, down from 4.0% in August, according to S&P Global Market Intelligence calculations from the latest available national sources. That put inflation at its lowest since July 2021, following the cooling trend that had been signalled in advance by the PMI. The PMI data - which tend to lead the official inflation data by around six months - hinted that the annual rate of increase will moderate to 3% in the coming months. That compares with a pre-pandemic decade average of 2.7%.

Particularly welcome news from an inflation-fighting perspective was a moderation the global PMI's gauge of service sector inflation to its lowest since October 2020. The Global Services PMI Prices Charged Index is now only just one index point above its pre-pandemic decade average, signalling a near 'normalisation' of inflationary pressures in a sector which has been the main cause of elevated inflation since late-2022.

Manufacturing selling price inflation meanwhile ticked higher but remained very modest, running in line with its pre-pandemic average and slightly below the average seen in the year-to-date.

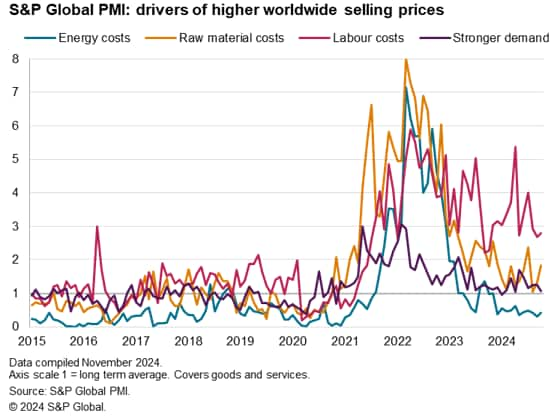

Stubborn wage pressures offset by weakened demand and lower energy prices

In both manufacturing and services, the principal driver of inflation was reportedly higher labour costs, according to analysis of the commentary provided by PMI survey respondents worldwide. However, these wage pressures were mainly felt in the services sector, having fallen to a 12-month low in manufacturing.

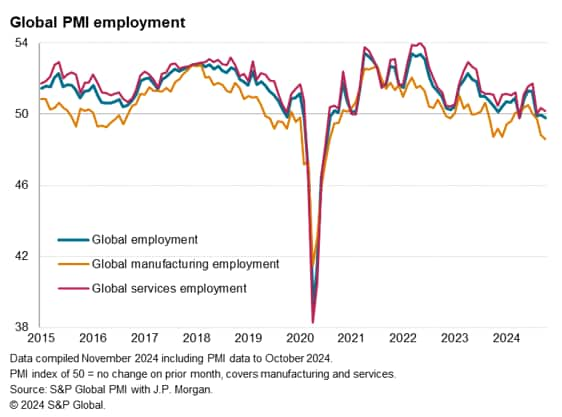

A key indicator to watch in terms of staffing costs is the PMI's employment index, which will provide insights into the demand for labour and therefore wage bargaining power. It is notable that global employment fell slightly for a second time in three months in October, dropping both in the US and Europe. An especially marked fall was seen in terms of manufacturing payrolls globally, but service sector jobs growth had also almost stalled.

Energy costs meanwhile remained the biggest deflationary factor acting on prices in October, while broader demand-pull forces were merely running at levels close to their long-run average, thereby hinting at no unusually strong demand-pull influence on pricing power.

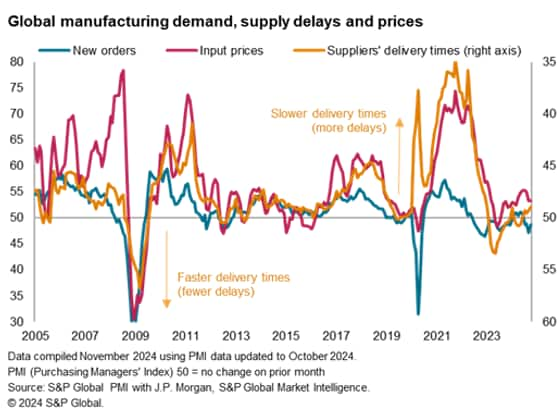

Despite raw material costs being seen as inflationary, the rate of increase signaled by the PMI survey remained muted by historical standards, even with supply chain disruptions from weather events, notably US hurricanes. And while supplier delivery times lengthened to the greatest extent for nearly two years in October, falling orders for manufactured goods had notably reduced suppliers' pricing power.

US prices rise at slowest rate since May 2020

Among the major economies, average prices charged for goods and services rose in US at the slowest rate since May 2020, while the rate of increase in the eurozone remained especially weak and among the softest seen since early-2021. A more elevated rate was seen in the UK, though even here the increase was also one of the smallest seen since early-2021.

In Asia, prices charged in mainland China were broadly unchanged after having fallen slightly in each of the prior three months, and the rate of price increase ticked higher in Japan thanks in part to imported inflation arising from the weakened yen.

Access the Global Composite PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-at-fouryear-low-in-october-Nov24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-at-fouryear-low-in-october-Nov24.html&text=Global+PMI+selling+price+inflation+at+four-year+low+in+October+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-at-fouryear-low-in-october-Nov24.html","enabled":true},{"name":"email","url":"?subject=Global PMI selling price inflation at four-year low in October | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-at-fouryear-low-in-october-Nov24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+selling+price+inflation+at+four-year+low+in+October+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-selling-price-inflation-at-fouryear-low-in-october-Nov24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}