Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 07, 2024

Global trade remains in contraction at start of fourth quarter

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

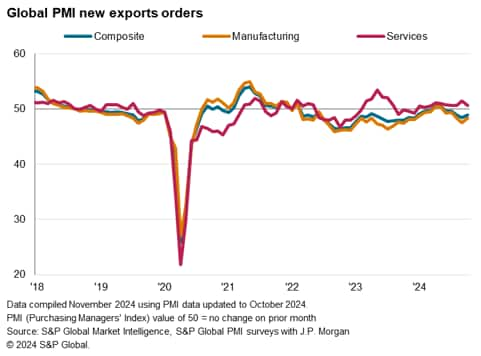

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade in goods and services remained in deterioration at the start of the final quarter of the year.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, posted 48.9 in October, up from 48.4 in September. Posting below the 50.0 neutral mark for a fifth consecutive month, the latest reading signalled that trade conditions deteriorated again albeit at a less pronounced pace compared to September. The downturn in trade activity was confined to the goods producing sector, though convergence in performance by sector was observed in the latest survey period as services trade growth slowed.

Goods trade declines for fifth straight month while growth in services trade slows

Manufacturing new export orders remained in contraction globally for a fifth successive month in October. The rate of decline eased from the 11-month high in September, but reflected the persistent weakness in the manufacturing sector, with the J.P. Morgan and compiled by S&P Global Market Intelligence, posting below the 50.0 no change level for a fourth straight month. Overall goods new orders have now declined for four successive months, albeit dropping in October to a smaller extent compared with September.

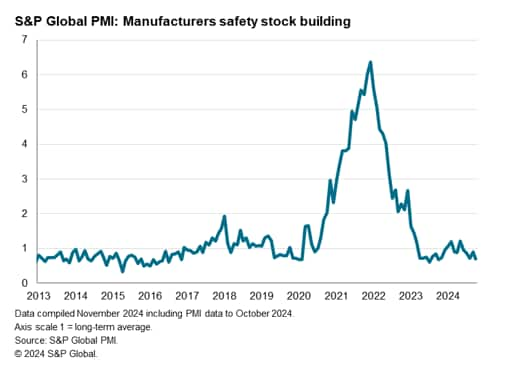

The downturn in global goods trade was partially driven by a sustained inventory reduction among manufacturers. According to data compiled from panel comments, instances of global manufacturers seeking safety stock building dipped further below the long-term average at the start of the fourth quarter, suggesting that since the early post-pandemic period, goods producers have scarcely felt the need to reaccumulate safety stocks.

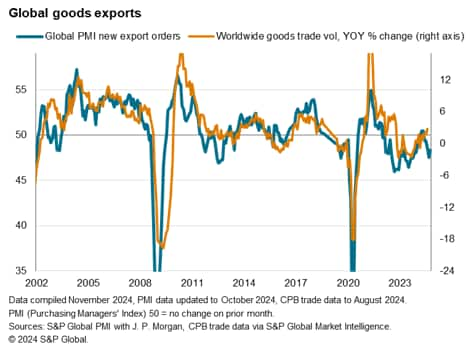

The latest fall in manufacturing export orders continued to correspond to global trade volumes falling approximately 3-4% in year-on-year terms into the start of the fourth quarter of 2024.

While services export business continued to expand in October, growth slowed to only a marginal pace in the latest survey period. This contrasted with the acceleration in overall services new business growth.

Detailed sector PMI data revealed that growth in services export business was led by insurance, media and software & services in October.

On the other hand, the worst performing export sectors were dominated by manufacturers including forestry & paper products, basic resources, and technology equipment. Real estate was the worst performing services sector.

Fall in export orders driven by weakness in developed markets

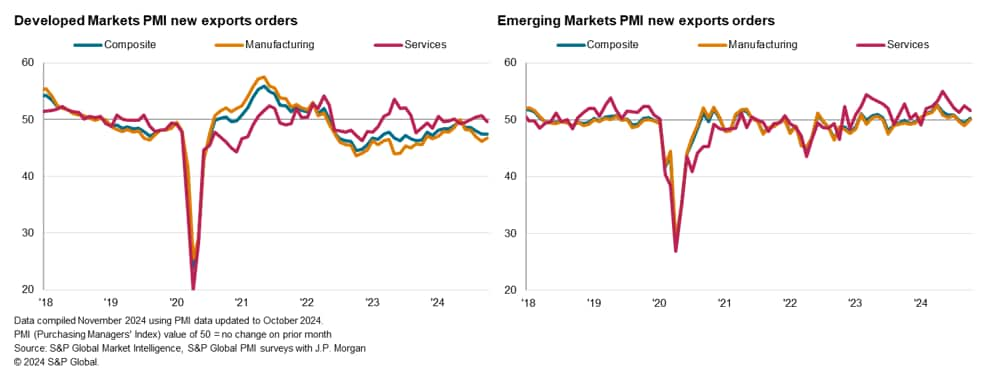

While the reduction in export orders had accelerated across both developed and emerging markets in September, some improvements were observed in October with emerging market trade returning to growth. Emerging market goods export volumes were unchanged at the start of the fourth quarter after falling for two consecutive months, thereby showing signs of stabilisation. This enabled overall export business to return to marginal expansion, supported by improvements in the service sector (even though the rate of services export business growth eased from September).

Concurrently, the downturn in developed markets held steady in the latest survey period. After accelerating for two straight months, the pace at which developed market export orders declined stalled in October. That said, the rate of reduction was nevertheless the joint-sharpest in the year-to-date, with services export business joining manufacturing in contraction.

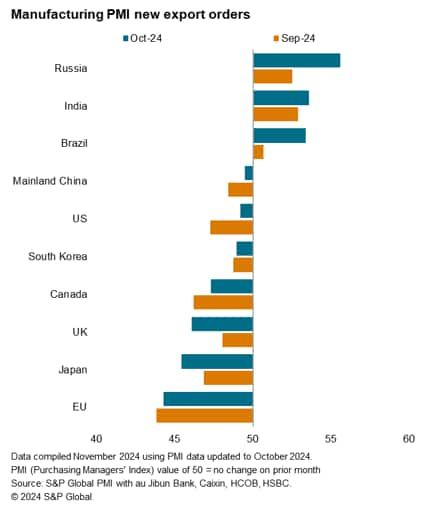

Russia overtakes India to lead goods export growth in October

Only three of the top ten trading economies recorded higher goods export orders in October, though with variations in ranking observed in the latest survey period. Russia dethroned India for the first time in 20 months by recording the fastest rate of growth among the top ten trading economies. The speed at which goods exports rose was the sharpest since January 2008 amid stronger demand from customers in nearby countries.

India came in second place in the export rankings, having seen the rate of export growth accelerate from the one-and-a-half-year low in September. Panellists cited higher demand stemming from Asia, Europe, Latin America and the US. Finally, Brazil also recorded solid expansions in goods trade, reporting the most pronounced in nearly four years in October.

Mainland China, the US and South Korea came in next, all witnessing their rates of goods trade contraction easing to marginal levels in October. Specifically for mainland China, the softening of the goods trade decline took place against a wider backdrop of renewed manufacturing sector expansion in October post the announcement of supportive government policies.

The EU meanwhile recorded the strongest rate of contraction in the top ten. The rate of decline was sharp even as it eased from September. The UK also saw a solid reduction in goods export orders, thereby underscoring the weakness of manufacturing sector performance in Europe. Notably, the trend in Japan was worrying as the export-oriented economy saw the sharpest downturn in goods trade since March, with panellists emphasizing weak demand from both the US and mainland China ahead of the US Presidential Election.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-remains-in-contraction-at-start-of-fourth-quarter-Nov24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-remains-in-contraction-at-start-of-fourth-quarter-Nov24.html&text=Global+trade+remains+in+contraction+at+start+of+fourth+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-remains-in-contraction-at-start-of-fourth-quarter-Nov24.html","enabled":true},{"name":"email","url":"?subject=Global trade remains in contraction at start of fourth quarter | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-remains-in-contraction-at-start-of-fourth-quarter-Nov24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+remains+in+contraction+at+start+of+fourth+quarter+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-remains-in-contraction-at-start-of-fourth-quarter-Nov24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}