Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 17, 2014

Studying student housing REITs

Education exposed REITs have underperformed the rest of the REIT market over the last four weeks. We reveal the factors driving the returns in this niche sector.

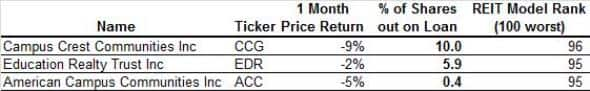

- All three US listed student housing REITs have seen their shares retreat in the last month

- Short interest in the three firms is up by 41% year to date

- The student housing REITS score badly in the Markit Research Signal REIT model

The quest for yield in these low rate times has forced investors to turn to increasingly exotic corners of the financial world in order to secure the levels of yield that were previously provided by conventional assets. One such niche are the relatively high yielding student housing REITs where companies build and then lease multi-family units to college students.

With the total US college population increasing by nearly a third in the decade to 2012 (the most recent statistics available from the US National Centre for Education Statistics), universities have increasingly turned to these firms to help house their growing attendees. Investors on the other hand have been eager to help, given the relatively high yields that these units command in their captive markets.

All has not been smooth sailing for these companies as recent speculation of an impending rate rise has seen all major US listed student housing REITs fall by a greater proportion than the rest of the REIT universe in the last month.

Student REITs suffer setbacks

The three listed student housing REITs have seen their shares retreat in the last four weeks. Despite preforming broadly in line with the rest of the REIT market since the start of the year, the recent selloff seen in the REIT world seems to have hit student housing REITs harder than the rest of the universe. Over the last four weeks this small corner of the REIT universe has fallen by 5.4% on average, 46% more than the 3.7% price fall seen by the Markit Research Signals REIT universe.

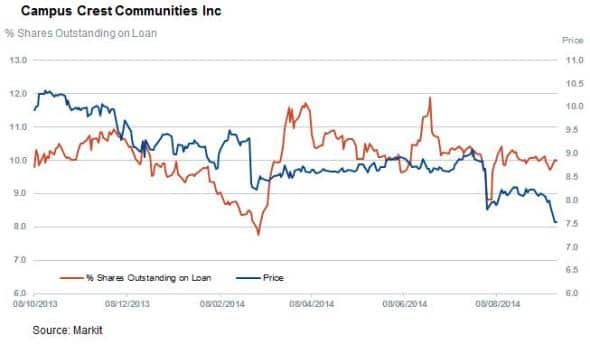

Leading the price decline has been Campus Crest Communities which has fallen by just under 9% to the lowest level since its 2010 IPO. The company which operates over 43,000 beds in 80 campuses nationwide recently announced that it was scaling back its purchase of competitor Copper Beach after failing to agree merger terms.

American Campus Communities, the largest of the three firms, has also fallen by a greater proportion than the rest of the universe with a 5.5% decline.

Shorts circle

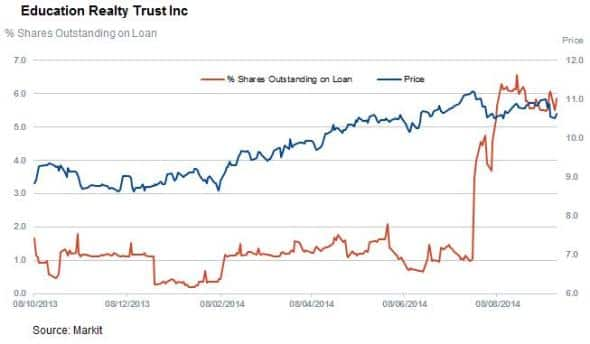

This recent bout of bearish stock performance has seen shorts circle in the sector since the start of the year. The average demand to borrow shares in the three student housing REITs has climbed by over 40% in the nine months since the start of the year, with current demand to borrow standing a nearly two and a half times the industry average.

This surge in shorting activity was led by Educational Reality Trust which has saw the proportion of its shares out on loan jump six-fold at the end of July to 6%. The company, which offers such amenities as lazy rivers and saunas in order to attract students in increasingly competitive markets, has seen its shares hold up relatively well in the recent selloff, but has shown signs of buckling in recent weeks after its shares fell by 5% in the last week.

Underwhelming REIT model scores

Interestingly, although these firms have performed relatively in line with the rest of the REIT universe in the months leading up to the recent dip, all three have been consistently scored in the worst ranked group of the Markit REIT model.

This model ranks REITs through criteria such as balance sheet strength, operational strategy and price momentum, has seen the worst ranked 20% of the REIT universe underperform the rest of their peers by over 25% in the last five years.

The largest drag on the ranks of the three student housing REITs were their diverse geographic locations as well as their relatively weak capital structure ranks.

While both CCG and EDR have consistently scored in the worst ranked group, industry leader ACC has recently seen its score dip to join its two smaller rivals. While the firm scores relatively well in the liquidity scores and earnings momentum, the firm's score is dragged down by its current Premium to NAV.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-studying-student-housing-reits-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-studying-student-housing-reits-.html&text=Studying+student+housing+REITs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-studying-student-housing-reits-.html","enabled":true},{"name":"email","url":"?subject=Studying student housing REITs&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-studying-student-housing-reits-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Studying+student+housing+REITs http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17092014-studying-student-housing-reits-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}