Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 17, 2014

Weak consumer spending and falling oil prices push eurozone inflation to five-year low

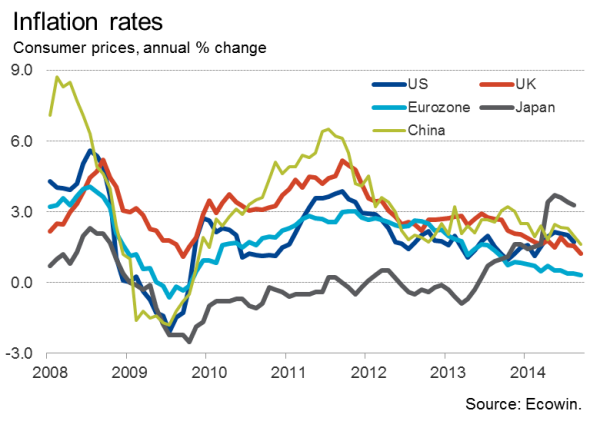

Inflation in the euro area is down to its lowest for five years. The annual rate of consumer price inflation fell to 0.3% in September, its lowest since October 2009, stoking fears that the single currency area is moving closer to deflation.

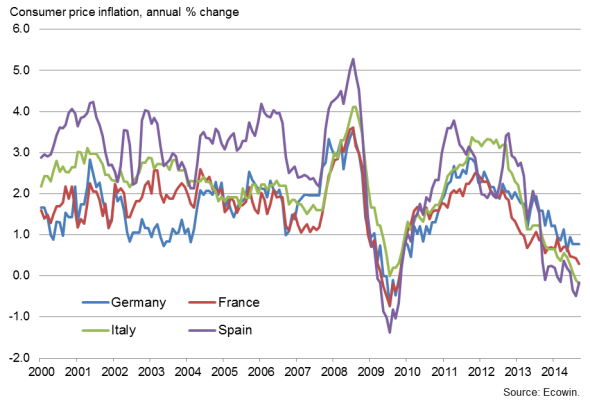

There are clearly growing signs of falling prices in the periphery, and inflation also remains worryingly weak in the core countries. Inflation in September was 0.8% in Germany and 0.4% in France, while year-on-year declines of 0.1% and 0.3% were seen in Italy and Spain respectively. Prices fell 1.1% on a year ago in Greece.

However, it's not just the eurozone where deflationary worries are present. Prices rose just 1.2% on a year ago in the UK, which was likewise the weakest seen for five years. China's inflation rate is a mere 1.6%, the lowest since 2010. In the US, the latest data (for August) showed only a 1.7% annual increase, a five-month low.

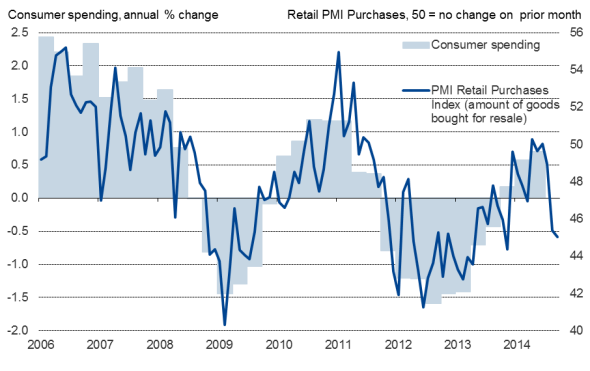

Falling retail sales adds to price gloom

The downturn in inflation is in part linked to consumer demand in the eurozone taking a turn for the worse again over the summer. Markit's Eurozone Retail PMI, which provides an advance guide to retail sales in the region, signalled the steepest drop in sales for almost a year-and-a-half in September. A slump in the amount of goods retailers bought for resale paints a particularly downbeat picture for consumer spending. The deterioration sits in stark contrast to the revival of consumer spending that had been signalled earlier in the year by both survey and official data. Rising retail sales had helped drive a 0.3% increase in consumer spending in the second quarter, the largest rise for three-and-a-half years.

Eurozone inflation

Eurozone consumer spending

Inflation in the four largest euro countries

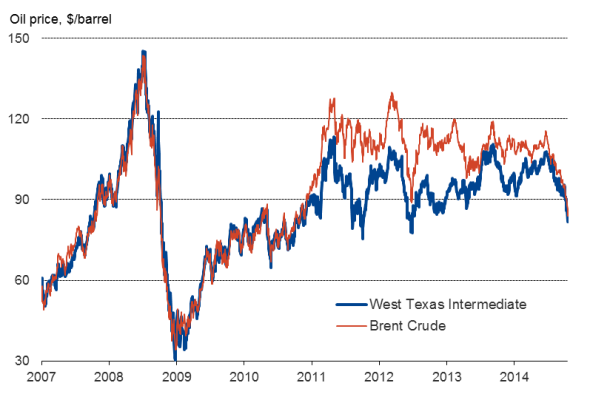

Lower oil prices

Another key cause of the downturn in inflation rates in the eurozone and elsewhere is the falling price of oil, which affects a wide variety of consumer prices. The price of oil not only governs how much we pay to fill up our cars with petrol and affects our utility bills, but also influences many chemical prices as well as the cost of packaging and transporting the goods that we buy. Very little is in fact not affected by the cost of oil in one way or another. The fact that Brent Crude oil prices are down 24% from their June peak has had a major bearing on consumer prices globally.

However, we also have to look at why oil prices are falling. Buoyant supply of oil is one reason, and in particular the increasing flow from the US, due to the shale revolution.

Weak demand is also to blame. Slower economic growth in the world's emerging markets, including all four BRIC economies, has severely dented demand for oil. Slower growth in the eurozone is of course also playing a role.

With no turnaround in global demand expected in coming months, and supply looking stable (after all, even recent geopolitical risks have failed to drive prices up), the outlook for oil prices is one of limited upside risk, meaning the inflation outlook also remains benign at best.

The combination of ongoing downward pressure on oil prices and a renewed weakening of demand at the retail level in the eurozone suggest deflation worries are more likely to intensify than to cool.

Oil prices

Source: Ecowin.

Inflation rates

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Economics-Weak-consumer-spending-and-falling-oil-prices-push-eurozone-inflation-to-five-year-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Economics-Weak-consumer-spending-and-falling-oil-prices-push-eurozone-inflation-to-five-year-low.html&text=Weak+consumer+spending+and+falling+oil+prices+push+eurozone+inflation+to+five-year+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Economics-Weak-consumer-spending-and-falling-oil-prices-push-eurozone-inflation-to-five-year-low.html","enabled":true},{"name":"email","url":"?subject=Weak consumer spending and falling oil prices push eurozone inflation to five-year low&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Economics-Weak-consumer-spending-and-falling-oil-prices-push-eurozone-inflation-to-five-year-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+consumer+spending+and+falling+oil+prices+push+eurozone+inflation+to+five-year+low http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Economics-Weak-consumer-spending-and-falling-oil-prices-push-eurozone-inflation-to-five-year-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}