Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 18, 2016

Confidence in US housing being tested

Despite the continued record low mortgage rates and a resurgent economy, jitters in the US property market have resurfaced which has bolstered short sellers in housing related stocks.

- Homebuilder William Lyon Homes sees shorts gather as shares plummet in 2016

- SPDRS S&P Homebuilders ETF posts the largest price decline seen since 2008

- Housing related Tempur Sealy and Bed Bath & Beyond see rush of short sellers

Property bubbles

Property prices globally have performed well in the past 10 years, with some cities now in perpetual 'bubble' territory as cheap credit, low inventory and insatiable foreign demand continues to fuel asset price growth.

However, the US property market has taken time to recover after being the tinder of the financial crisis. House prices are almost at levels last seen in 2006 however, recent weakness in housing starts for January have seen doubts about the strength of the recovery resurface.

After reaching 'peak' housing starts in September 2015 of 1.2Mn, starts have declined to 1.09Mn in January. This coincided with a drop in confidence among builders to a nine month low in February. This decline in outlook is occurring while average rates on 30-year fixed mortgages remain near record lows and US job growth remains robust.

Shorts begin to build positions

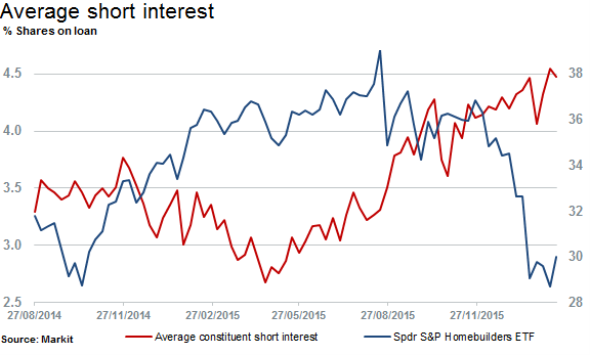

Naturally, homebuilders and related suppliers are t directly exposed to weakness in house prices and new housing demand. Short sellers have been quick to build positions in the sector, measured by average short interest of the SPDR S&P Homebuilders ETF (XHB).

Average short interest increased by 29% across constituents last year and the trend has continued in the new year as short interest across this group of shares is up 5% year to date to 4.5% of shares outstanding on loan.

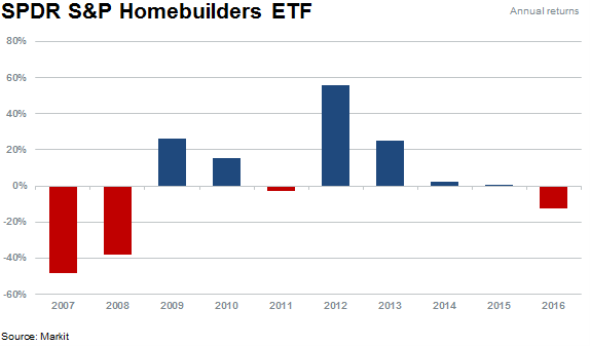

It seems short sentiment has been well timed as XHB stocks fully participated in the selloff seen across markets in the opening weeks of 2016. XHB constituents (37 companies) have fallen 12% on average year to date after falling 6% in December 2015 - in fact price returns for the ETF have been declining since 2012.

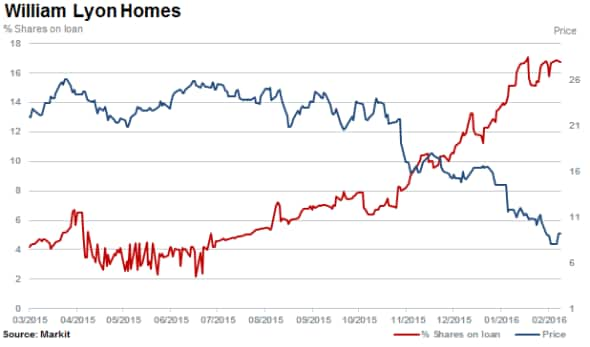

As well as being the most shorted constituent of the XHB, the constituent falling by the most year to date is William Lyon Homes down which is down 44%. The company is one of the largest Western US regional home builders and has seen short interest climb since July 2015, rising threefold to 17% of shares outstanding on loan. William Lyon is due to report earnings next week.

Shorts 2016 focus on furnishings

Sentiment has turned sour as well for the "world's largest bedding provider" Tempur Sealy International. Shares have fallen 32% from highs in 2015 with short sellers aggressively increasing positions in the stock year to date, up more than fourfold to 9% of shares outstanding on loan.

Shares in the bedmaker have been on a downward trajectory, falling just shy of a third since the end of November 2016.

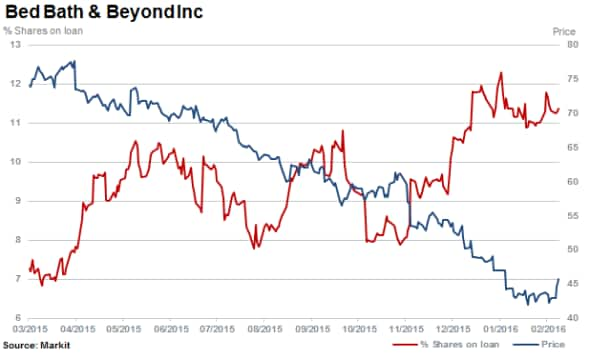

Posting almost linear declines over the last 12 months falling by 40% is Bed Bath & Beyond. The home retailing business has attracted short sellers with 11.3% in shares currently outstanding on loan.

Relte Stephen Schutte, Analyst at Markit

Posted 18 February 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-equities-confidence-in-us-housing-being-tested.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-equities-confidence-in-us-housing-being-tested.html&text=Confidence+in+US+housing+being+tested","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-equities-confidence-in-us-housing-being-tested.html","enabled":true},{"name":"email","url":"?subject=Confidence in US housing being tested&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-equities-confidence-in-us-housing-being-tested.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Confidence+in+US+housing+being+tested http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18022016-equities-confidence-in-us-housing-being-tested.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}