Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 18, 2016

Distressed bond numbers fall but defaults accelerate

The number of distressed bonds in the US HY bond market has fallen considerably since February's peak, but the aftershocks are being felt through a number of defaults so far this month.

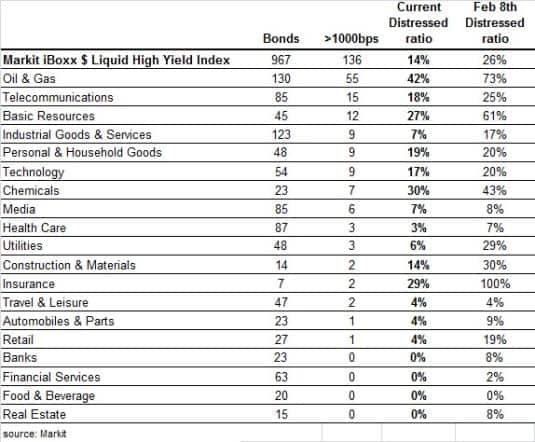

- Ratio of distressed bonds in the Markit iBoxx $ Liquid High Yield Index stands at 14%

- 42% of HY Oil & Gas bonds trade at spread greater than 1,000bps, down from 73% in February

- In "HY, the distressed ratio stands at 7%, similar to the level seen at the start of the year

A brighter outlook for risky assets over the past two months has seen perceived risk in the US high yield (HY) bond market fall, reducing the number of bonds trading at ''distressed'' levels (bonds that have a spread of 1000bps over US treasuries).

Distressed levels turn corner

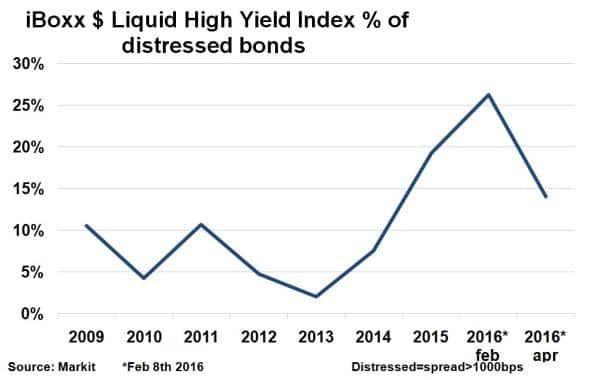

The spread on the Markit iBoxx $ Liquid High Yield Index, serving as a proxy for the US HY bond market, currently stands at 581bps; 194bps tighter than the year to date high seen in February.

February's data showed 26% of the constituents in the index were distressed - the highest level post 2009. But as risk sentiment turned positive, the number of distressed bonds has fallen back to levels seen last year. 136 bonds out of the 967 constituent Markit iBoxx $ Liquid High Yield Index currently trades at a distressed level (14%). While this represents a drastic fall from February's figures, and remains lower than the levels seen at the end of 2015 (19%), it is still markedly higher than levels seen in 2009-2014.

The lower distressed levels come as a relief just as the aftershocks of the high distressed levels seen at the start of the year are filtering through into the economy. Companies such as Peabody Energy and Energy XXI recently filed for bankruptcy, with defaults in the US HY sector reaching two year highs.

Distressed sector breakdown

Among distressed names, the main protagonists remain the Oil & Gas and Basic Materials sectors, which make up just under half of the distressed bonds in the Markit iBoxx $ Liquid High Yield Index. However, 42% of HY Oil & Gas bonds trade at a spread greater than 1,000bps, down from 73% in February.

In fact every sector across the board saw distressed levels fall from February's highs. The downside risk in commodity prices and lingering concerns around slowing global trade have dissipated, while central banks have further helped market participants by providing easy monetary conditions.

Utilities saw its distressed ratio fall to 6% from 29% in February, as investors returned to the defensive sector. The sectors that saw minimal change were Technology and Personal & Household goods.

European HY

European HY remained relatively isolated in terms of the number of distressed bonds, given its minimal exposure to the commodity sector and accommodative QE environment.

30 bonds in the 449 (around 7%) constituent iBoxx EUR Liquid High Yield Index are currently trading at distressed levels, down from 50/442 (11%) on February 8th. The current distressed ratio is now back to end of 2015 levels.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-Credit-Distressed-bond-numbers-fall-but-defaults-accelerate.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-Credit-Distressed-bond-numbers-fall-but-defaults-accelerate.html&text=Distressed+bond+numbers+fall+but+defaults+accelerate","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-Credit-Distressed-bond-numbers-fall-but-defaults-accelerate.html","enabled":true},{"name":"email","url":"?subject=Distressed bond numbers fall but defaults accelerate&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-Credit-Distressed-bond-numbers-fall-but-defaults-accelerate.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Distressed+bond+numbers+fall+but+defaults+accelerate http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18042016-Credit-Distressed-bond-numbers-fall-but-defaults-accelerate.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}