Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 18, 2015

Short sellers ride out European equity surge

Despite the swelling equity market, European short sellers have manages to successfully single out struggling shares, as the most expensive to borrow shares have underperformed the market so far this year.

- Most expensive to borrow shorts in Europe have underperformed the market by 3% YTD

- Lonmin and Opera have been the most profitable short positions so far this year

- Short sellers have started to trim their positions in energy names in the wake of oil's rally

At first glance, the recent strong run seen in European shares appears to offer unfertile ground for short sellers. The Stoxx 600 is up by over 14% year to date despite a recent selloff, and this type of strong bull market makes for slim picking for short sellers. This holds especially true given the fact that over 86% of constituents of the Markit Developed Europe universe have seen their shares rise year to date.

Despite the recent rally, short sellers have been able successfully pick out underperforming shares; no doubt bringing some solace to long short managers.

Short sellers pick out underperformers

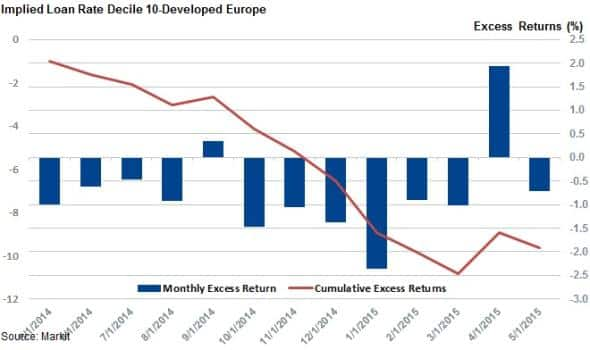

The shares which short sellers are the most willing to pay for, essentially those experiencing the most negative sentiment, have trailed the rest of the market in four of the last five months. This underperformance from the top targets for short sellers means that the most expensive to borrow stocks in the Markit Developed Europe universe have trailed the broader universe by a cumulative 3% since the start of January.

But this performance is only relative, as the top short selling targets are actually up by 12% since the start of the year; highlighting the main challenges faced by short sellers in the face of a rising market.

Lonmin and Opera most profitable

Despite the fact that just under 80% of the current most expensive to borrow shorts are up for the year, several of the current crop of top short selling targets have managed to provide absolute returns for the year to date.

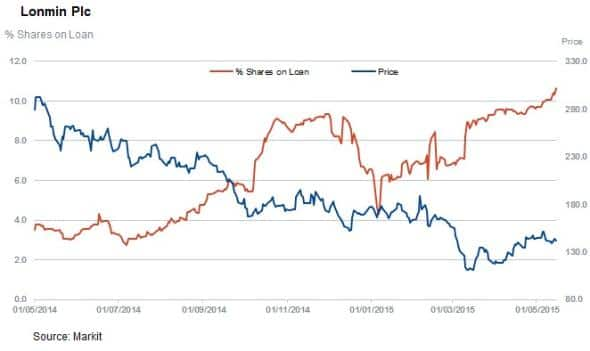

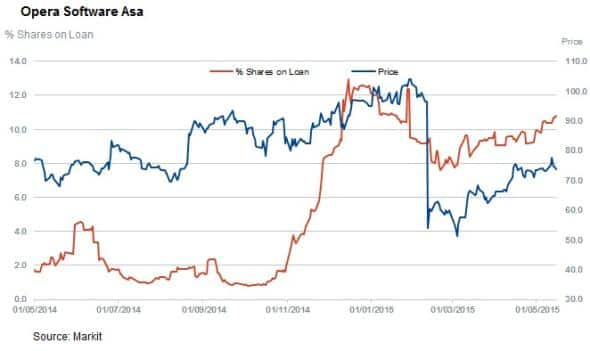

Norwegian software firm Opera and platinum miner Lonmin as currently leading the way as the current most profitable short positions in Europe, out of the firms seeing a large proportion of their shares out on loan.

Lonmin has featured among the most expensive to short firms since November last year and short sellers' convictions have been rewarded as Lonmin shares are down by over 20% for the year to date. Short sellers don't seem to be phased by the recent rebound as Lonmin's short interest has climbed to a new two and a half year high with over 10% of the company's shares now out on loan.

Opera has managed to edge out Lonmin in terms of profitability with after its shares fell by over 22% year to date. Much like in Lonmin, short sellers have also added to their positions in the wake of a rebound in Opera's share price.

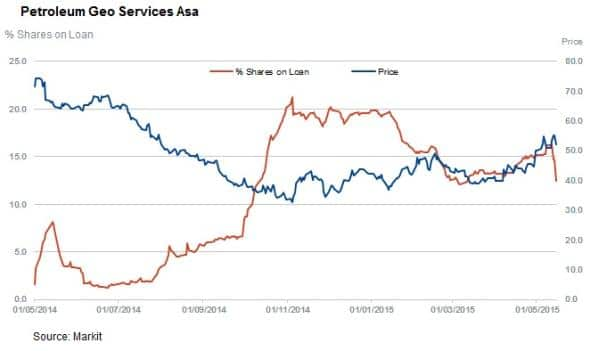

Less short selling in energy

While short sellers have been actively adding to their positions in two of their most successful positions year to date, the same hasn't been seen in energy names which have managed to rebound in the wake of the recent oil price stabilisation. Transocean and Petroleum Geo Services have seen short interest fall to yearly lows as a recent rebound means that their shares are now in positive territory for the year.

This recent covering means that the most expensive to borrow energy names now see a third less short interest on average than at the start of the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-equities-short-sellers-ride-out-european-equity-surge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-equities-short-sellers-ride-out-european-equity-surge.html&text=Short+sellers+ride+out+European+equity+surge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-equities-short-sellers-ride-out-european-equity-surge.html","enabled":true},{"name":"email","url":"?subject=Short sellers ride out European equity surge&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-equities-short-sellers-ride-out-european-equity-surge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+ride+out+European+equity+surge http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052015-equities-short-sellers-ride-out-european-equity-surge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}