Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 18, 2014

Boring stocks outperform in boring markets

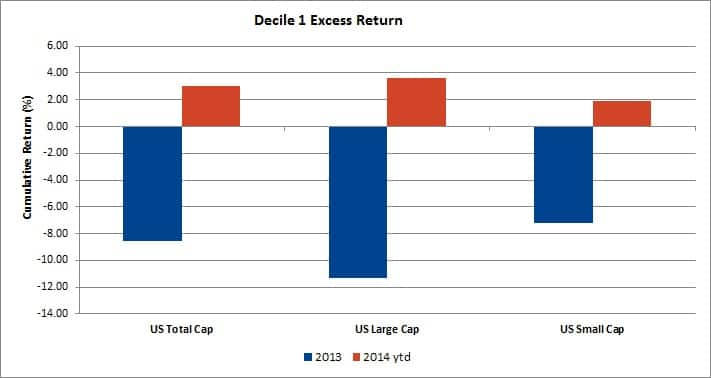

In a stark turnaround of last year’s results, shares with the lowest market adjusted volatility have outperformed their peers since the start of the year. This outperformance of low beta shares holds across both large and small cap shares.

- The lowest beta 10% of shares amongst the Markit US Total Cap index have outperformed the rest of the universe by 3.1% this year to date

- Large cap low beta shares have performed the best, outperforming their peers by 3.6%

- Underperforming, volatile cyclicals have dragged down the high beta group

The markets get set to enter their usual summer doldrums with an added sense of calm this year. Despite notching up new records on a regular basis this year, volatility expectations in the S&P 500, as measured by 90 day at the money volatility, stood at a five year low last week. As for the returns, last year’s blistering returns are long gone as the 5% year to date price appreciation is less than a third of the jump seen over the same period a year ago.

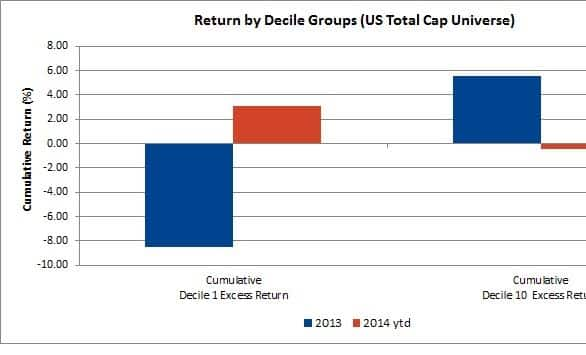

This begs the question of whether investors have been able to magnify these relatively flat returns by investing in shares which have a higher volatility than the rest of the market. Our review of the year to date returns by beta decile groups indicates that this has not played out since the start of the year. (More on the methodology in the footnotes)

High volatility shares outperform

So far this year, the 10% of shares with the highest volatility among the US Total Cap universe have underperformed the market by a cumulative 0.43% since the start of the year. This phenomenon represents a stark turnaround from what was seen last year when the most volatile shares outperformed the rest of the market by 5.6%.

Low beta rewards investors

In a reversal of last year’s market, low beta shares have proven a better investment in the current market than their more volatile peers. The 10% of shares in the US Total Cap index have outperformed the overall index by a cumulative 3.1% since the start of the year. This again represents an about turn from what was seen last year, as the market’s bullish mood saw the least volatile shares trail the market by 8.5%. This strong performance makes this group of shares the best performing out of the 10 decile groups.

While low beta shares have managed to outperform the market across both the large and small cap ends of the spectrum, as the least volatile decile group across these indexes has managed to pull in positive excess return over what was seen across the overall indexes. The low beta shares in the large cap end of the market have managed to perform the best over the last five and a half months. These shares have outperformed by 4.08%; more than half a percent above the total cap universe’s performance.

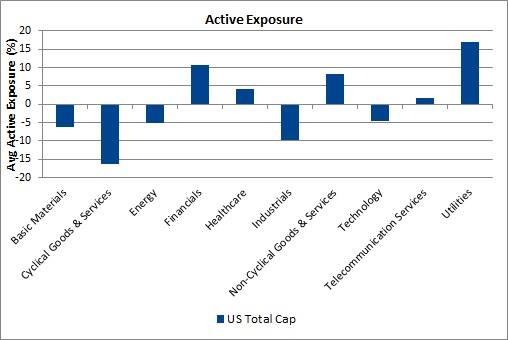

Utilities generate returns

As ever, ranking shares by factors such as volatility sees certain sectors disproportionally represented amongst certain decile groups. In the case of the beta analysis, the performance of the low beta group was helped by a large exposure to utilities, which has been the second best performing sector in the US total cap universe. Nearly half of all utilities are represented in the low beta group with the likes of Pepco, Exelon and Entergy all posting strong results.

At the opposite end of the spectrum are cyclical goods and services firms, which have fallen by 1% year to date, dragging down the returns of the highly volatile decile, as these firms make up a quarter of the group. Underperformers in this group include Quicksilver, American Apparel and Hovanian Enterprises.

Methodology

Our review of beta volatility uses the Markit Research Signal 60-Month Beta factor which ranks shares based on their historical return return covariance with the S&P 500 index return. The factor assigns an unattractive rank to shares with the highest volatility.

Performance results are based on the Markit US Large Cap and US Small Cap universes which represent 90% (approximately 1000 names) and the subsequent 91% - 98% (approximately 2000 names) cumulative market cap, respectively.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062014120000-boring-stocks-outperform-in-boring-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062014120000-boring-stocks-outperform-in-boring-markets.html&text=Boring+stocks+outperform+in+boring+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062014120000-boring-stocks-outperform-in-boring-markets.html","enabled":true},{"name":"email","url":"?subject=Boring stocks outperform in boring markets&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062014120000-boring-stocks-outperform-in-boring-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Boring+stocks+outperform+in+boring+markets http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062014120000-boring-stocks-outperform-in-boring-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}