Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 18, 2015

Short sellers step out of firing line

Surging share prices have seen short sellers close out their positions in both lethal and non-lethal weapons manufacturers in the US.

- Short interest in Sturm Ruger down by over 60% so far this year

- Smith & Wesson's short interest is now the lowest in two and a half years

- Taser has seen short sellers close out most of their post-Ferguson momentum positions

The differing fortunes of US gun makers were highlighted this week as Colt International, the oldest US firearms manufacturer, filed for bankruptcy as it continued to struggle with a mounting debt pile. But Colt's issues look to be the exception to the norm as the industry has returned to growth after previously sinking following the post Sandy Hook surge in arms sales, when customers looked to get ahead of possible weapons sales restrictions.

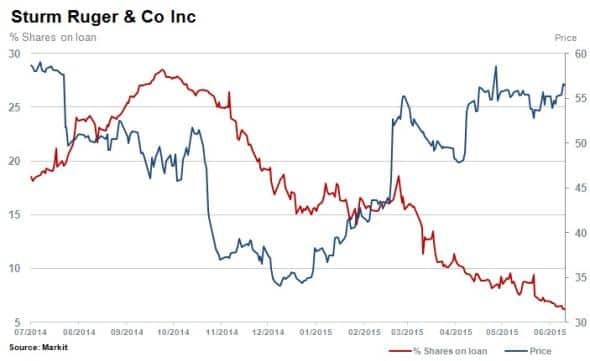

The two main listed gun manufacturers Sturm Ruger and Smith & Wesson, which were the targets of sustained short selling over the last 12 months, have now seen short sellers retreat in the face of rising share prices.

Sturm Ruger, the larger of the two US listed gun manufacturers, best exemplifies this trend as the company experienced an 11% jump in Q1 sales from the previous quarter; beating analyst estimates by a massive 16%. Sturm shares have also jumped, with a year to date appreciation north of 60%.

On the short interest front, short sellers have shown little appetite to stand in the way of the recent momentum, with the number of RGR shares out on loan now 60% lower than at the start of 2015.

Smith & Wesson

Sturm's competitor Smith & Wesson has also seen the similar growth, with its shares now up by two thirds for the year. On the short interest front, demand to borrow Smith & Wesson shares is down to the lowest level in over two and a half years with 8.4% of shares now out on loan as of latest count.

The company's results are also showing signs of the industry's return to growth with analysts now forecasting the firm to post its first year on year quarterly jump in sales when the company announces earnings today.

Non-lethal firms also see covering

The recent covering is not limited to the lethal sector as Taser, which manufactures both the ubiquitous stun guns that bear its name as well as a range of products aimed at filming and storing video evidence, has seen short sellers cover positions to reach new annual lows for the year.

Taser's shares have more than doubled in the second half of last year following a string of controversial police incidents in the US, which investors viewed as a potential tailwind for the company's lesser known body camera business. Short sellers were initially sceptical of the company's surging shares price as evidenced by the fact that demand to borrow jumped tenfold to 35% of shares outstanding in the wake of civil unrest in August.

Despite these apparent doubts, the company has been able to capitalise on the trend with sales of its evidence-gathering solution growing four fold as of its latest quarterly report. This has in turn seen short sellers cover all their positions from last year's high, with current demand to borrow hovering at the 17% mark. This move looks to have been well timed as Taser shares are now trading at an all-time high.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Equities-Short-sellers-step-out-of-firing-line.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Equities-Short-sellers-step-out-of-firing-line.html&text=Short+sellers+step+out+of+firing+line","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Equities-Short-sellers-step-out-of-firing-line.html","enabled":true},{"name":"email","url":"?subject=Short sellers step out of firing line&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Equities-Short-sellers-step-out-of-firing-line.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+step+out+of+firing+line http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Equities-Short-sellers-step-out-of-firing-line.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}