Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 18, 2016

Singapore's short sellers rush for cover

Singaporean shares saw a surge in short interest in the midst of the volatility seen in the first quarter, but the STI index's recent calm has seen appetite to short shrink.

- STI average short interest down by a quarter from the recent yearly highs

- All ten of the most shorted companies during February's highs have seen covering

- Real estate bucks the trend as Acentas and City Development have large rises in short interest

Short sellers have been actively covering their positions in Singaporean blue chip stocks in the wake of the recent market rebound.

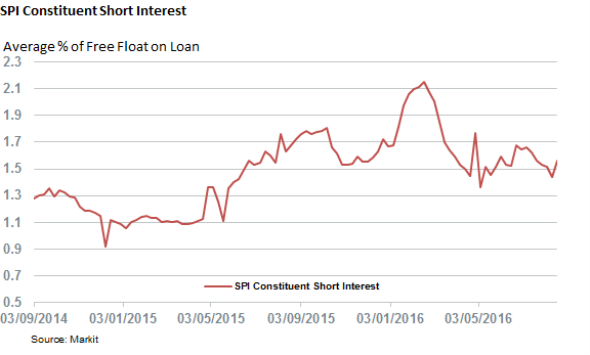

The shares which make up the STI index, which was down by more than 10% in February, had seen their average short interest jump to a multiyear high during the worst of the recent sell-off. The selloff proved relatively short lived however as the index has managed to get back on an even peg for the year which has in turn seen short sellers lose their appetite for Singaporean shares. The current constituents of the SPI index now see 1.6% of their free float shorted on average which represents a 27% fall from the average short interest seen during the height of February's bear raid.

Covering universal

The covering has been pretty much universal across the index as all ten of the firms seeing the worst short interest during the worst of February's volatility have seen demand to borrow their shares fall.

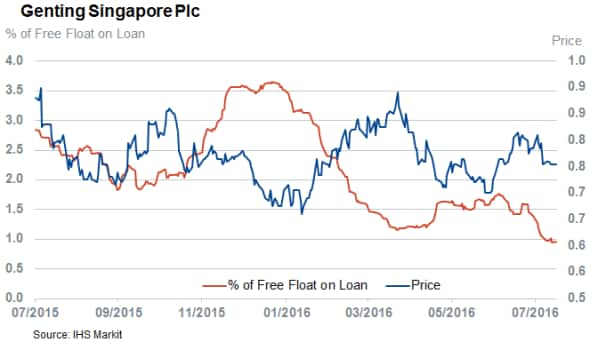

Gaming operator Genting has led the short covering in the last six months as the proportion of its free float out on loan to short sellers has fallen by a massive 70%. Genting's short covering comes despite the fact that the company continues to suffer from a lackluster gambling environment which has seen the firm post a 17% fall in revenue in its June second quarter earnings release, driven in large part by falling gambling volumes. But these results haven't reignited short seller's appetite as Genting's current short interest is the lowest in nearly two years.

Singapore Press Holdings, a long time target of short sellers, also sees a multi-year low in short interest in light of the recent covering. Its current short interest is a third lower than at its height in February when over 10% of its free float was shorted.

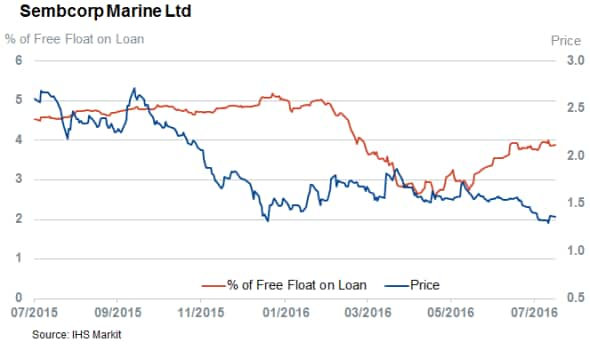

The covering does seem to have lost some steam in recent weeks however as demand to borrow STI shares has been relatively flat since June; driven by a couple of names seeing a resurgence in short interest. The one standout firm is Sembcorp Marine whose short interest has increased by more than 60% in recent weeks. While its current short interest is still some way off the highs set back in February, its most recent earnings showed that the island nation was still very much exposed to developments overseas as profits fell by over 90% due to a sharp drop in oil rig orders.

Real estate bucks the trend

Another sector which has failed to shake off short sellers has been the real estate sector which is struggling with a falling asset prices and mounting debt piles. The two favorite short targets in the sector are Ascendas and City Development which have both seen short interest surge by 68% and 119% respectively in the six months since short interest hit its peak across the STI index.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18082016-Equities-Singapore-s-short-sellers-rush-for-cover.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18082016-Equities-Singapore-s-short-sellers-rush-for-cover.html&text=Singapore%27s+short+sellers+rush+for+cover","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18082016-Equities-Singapore-s-short-sellers-rush-for-cover.html","enabled":true},{"name":"email","url":"?subject=Singapore's short sellers rush for cover&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18082016-Equities-Singapore-s-short-sellers-rush-for-cover.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore%27s+short+sellers+rush+for+cover http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18082016-Equities-Singapore-s-short-sellers-rush-for-cover.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}