Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 18, 2015

Market muted to week's top events

The Fed's decision to keep interest rates flat for the time being has lifted US bonds; but the reaction is far from earth shattering.

- Investment grade and treasury bonds jumped most in six weeks, yet high yield peers flat

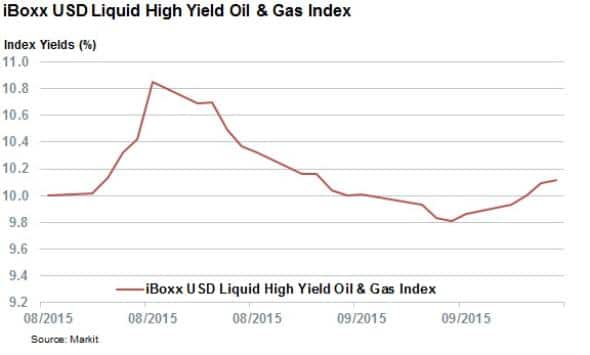

- Samson bankruptcy pushes Markit iBoxx USD Liquid High Yield Oil & Gas index yield back above 10%

- Japan CDS spreads flat despite being downgraded by ratings agency

Yesterday's long awaited September Fed decision saw the US rate setting committee hold interest rates steady for the time being on concerns regarding the recent global market volatility. The immediate market reaction to the deal was positive, but the movements were far from spectacular.

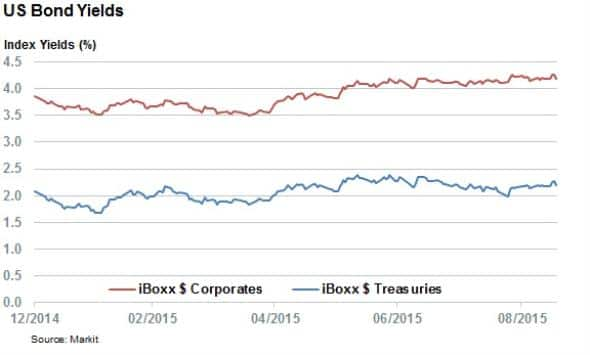

Treasuries tracked by the Markit iBoxx $ Treasury index returned 50bps on Thursday as its yield retreated by 8bps. This move was mirrored in investment grade bonds with the iBoxx $ Investment Grade index returning 60bps. While these returns will be welcomed by investors, the magnitude of the bounce was somewhat underwhelming given the anticipation in the run-up to the Fed's decision.

The fact that both indexes have seen their yields trade flat in the last three months highlights the state of limbo as the market looks for clear guidance going forward.

On the more speculative end of the bond market, high yield bonds tracked by the Markit iBoxx Liquid Investment Grade index fell slightly with a 9bps retreat on Fed decision day.

Samson hit energy bonds

The other large event to shape credit markets this week was the $4.2bn Samson Resources bankruptcy. This makes the shale driller one of the largest bankruptcies to hit the energy sector in the wake of the recent collapse in oil prices. This looks to have shaken energy bonds as the Markit iBoxx USD Liquid High Yield Oil & Gas index saw its yield move back above the 10% mark to close at 10.12% on Thursday.

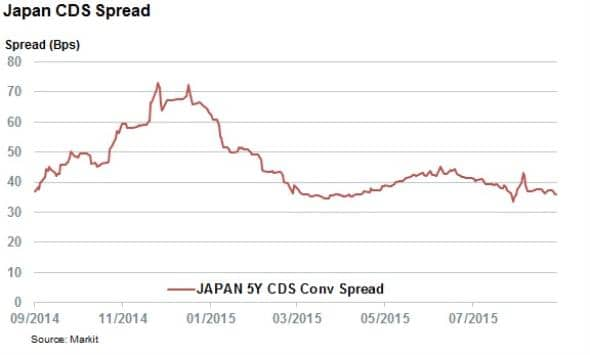

Japan CDS not moved by downgrade

One surprising area of calm this week was Japanese sovereign credit. The country's CDS spread traded relatively flat over the week despite the fact that Standard & Poor's cut its credit rating one notch to A+ over fears that the country's economic turnaround strategy will not do enough to bring down the country's growing debt.

Credit investors were little phased by the development as Japan's CDS spread is currently trading tighter despite the downgrade. The latest spread stands at 35bps, the tightest in a month. This divergence of opinions means that the CDS market is now treating Japanese government bonds with the same risk profile as AAA rated bonds, two notches above the current S&P rating for Japan.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Credit-Market-muted-to-week-s-top-events.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Credit-Market-muted-to-week-s-top-events.html&text=Market+muted+to+week%27s+top+events","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Credit-Market-muted-to-week-s-top-events.html","enabled":true},{"name":"email","url":"?subject=Market muted to week's top events&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Credit-Market-muted-to-week-s-top-events.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Market+muted+to+week%27s+top+events http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Credit-Market-muted-to-week-s-top-events.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}