Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 18, 2015

Most shorted heading into 2016

Our final commentary note of the year looks at the companies which see the highest amount of short interest heading into 2016.

- The current 20 most shorted companies have seen shorts increase by 50% over the year

- Gamestop is the most shorted company globally with 47% of its shares out on loan

- Capital goods and energy firms make up a third of the most shorted companies globally

Our final look at what has been an active, and fruitful year for short sellers, both in the US and overseas, focuses on the firms across the world which see the most proportion of their shares out on loan heading into the new year.

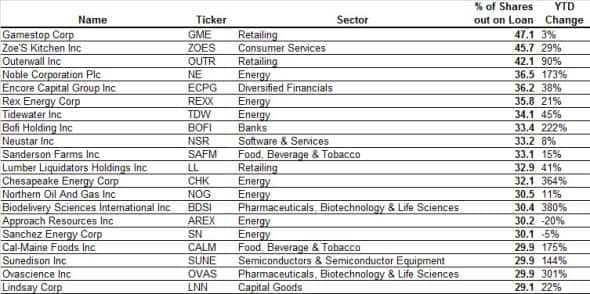

Americas most shorted

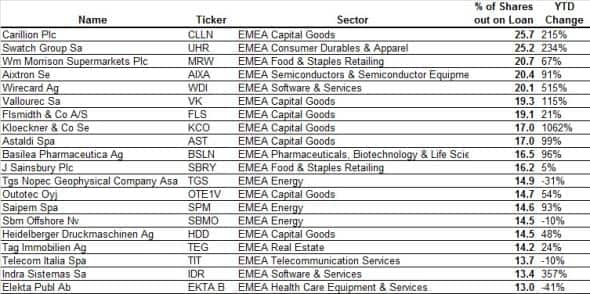

Europe most shorted

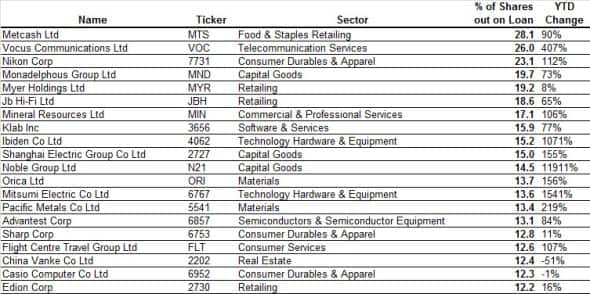

Asia most shorted

At first glance, the 20 favourite short targets in the US, Europe and Asia sees that most of the firms on the list have seen their short interest surge over the course of the year. The 60 most shorted companies across the world had an average of 14% of their shares out on loan at the start of the year, a number which has subsequently climbed by over 50% to 22.6%. This demonstrates how short sellers have been actively shifting their positions in the last 12 months in reaction to shifting market circumstances.

On the short side, Noble Group saw the biggest proportional change in short interest over the year as its short interest jumped by 120 folds in the last 12 months. This massive jump makes the company the 11th most shorted in Asia with 14.5% of its shares now out on loan.

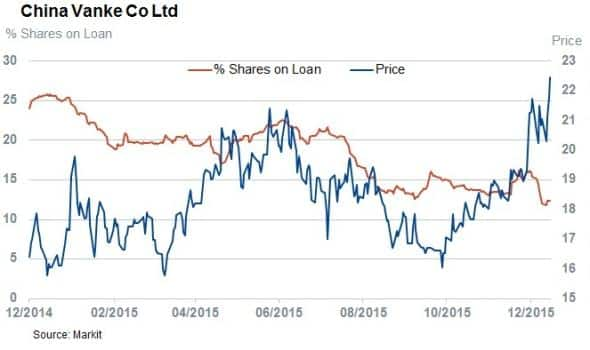

On the other side of the change in short interest, short sellers seem to have given up on real estate developer China Vanke group as its short interest has halved year to date. While the company still makes it on to the most shorted list, a growing number of short sellers look to be closing out their positions given that its shares have continued to climb in the last six months. China Vanke is still the exception to the norm however, as only seven of the 60 most shorted companies globally have seen short covering over 2015.

Interestingly, the most shorted firm globally, Game retailer Gamestop, has seen a relatively steady short interest in the last 12 months as demand to borrow its shares is only 3% higher than at the start of the year

Energy and capital goods most shorted

Sector wise, the favourite targets of short sellers heading into 2016 are clustered around the capital goods and energy firms as these two sectors make up a third of the 60 firms which see the most interest. While these sectors were no stranger to short sellers at the start of the year, the ongoing china slowdown and commodities headwinds have added to short sellers' resolve given that both sectors have seen a large jump in demand to borrow in the last 12 months.

On the energy side, the most shorted firm is Noble Group, Rex Energy and Tidewater while the favourite capital goods shorts are irrigation provider Lindsay Corp and construction firm Carillion.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-Equities-Most-shorted-heading-into-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-Equities-Most-shorted-heading-into-2016.html&text=Most+shorted+heading+into+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-Equities-Most-shorted-heading-into-2016.html","enabled":true},{"name":"email","url":"?subject=Most shorted heading into 2016&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-Equities-Most-shorted-heading-into-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+heading+into+2016 http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122015-Equities-Most-shorted-heading-into-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}